Switch

& Save

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

overhead title

Detail

overhead title

Detail

overhead title

Detail

overhead title

Detail

Context & problem statement

Context

A large majority of users carry over balances on their credit cards, often paying high interests on this debt.

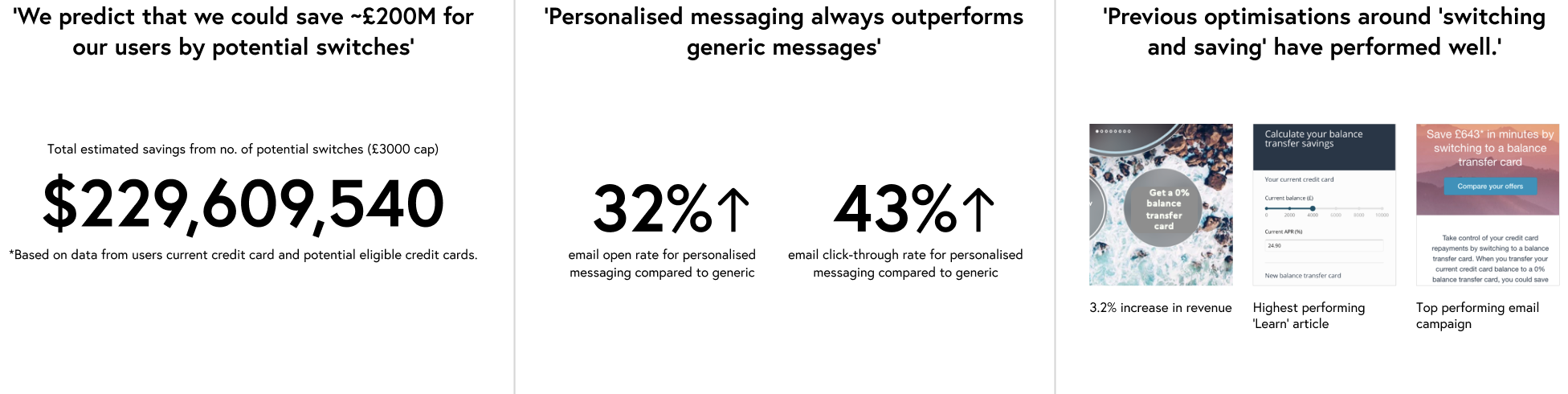

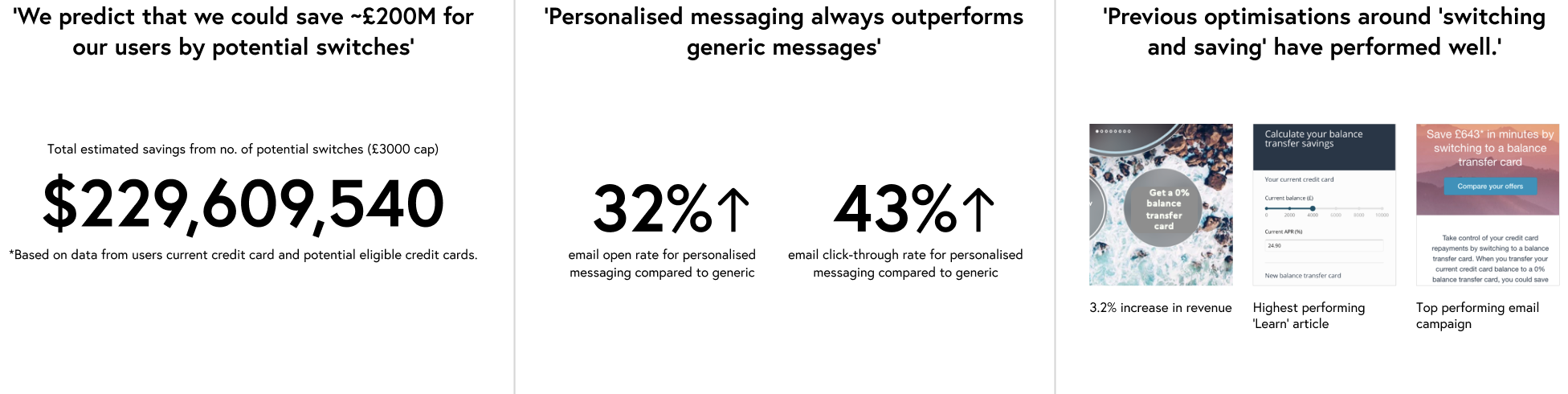

We’ve calculated that we could help save ~£200M across our users if they switched their credit cards to balance transfer cards available in our marketplace.

Users don’t currently know how much they could save with a balance transfer card and so are less motivated to switch.

‘Assumed’ user problem

Users with outstanding credit card balances often pay high interest without realising they could save by switching to balance transfer cards.

This leads to missed savings and low motivation to switch while managing their debt.

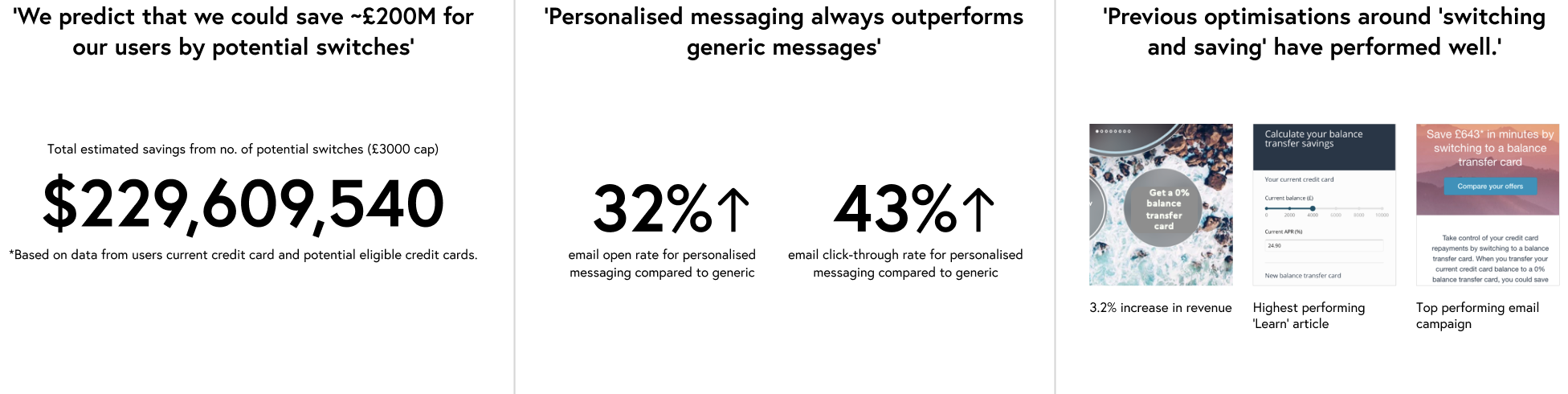

Existing relevant insights

- Over 231,000 users could save £576 on average by switching to a balance transfer card.

- Previous optimisations around ‘switching and saving’ have performed well.

- Personalised messaging always outperforms generic messages

Goals & Objectives

User value goals

- Delivering real savings by helping users reduce interest payments.

- Educate users on balance transfer benefits.

- Highlight personalised savings for users.

Business value goals

- Increasing card conversions from the marketplace.

- Boost engagement with balance transfer offers.

Success metrics

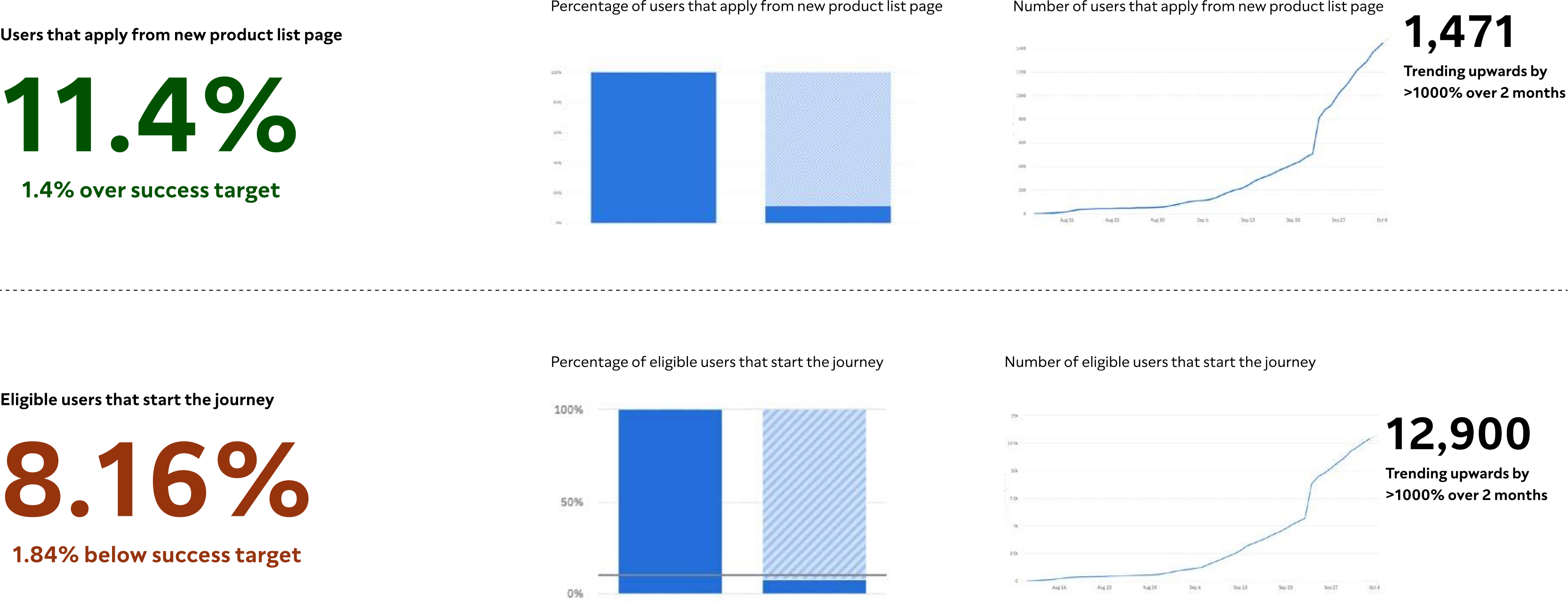

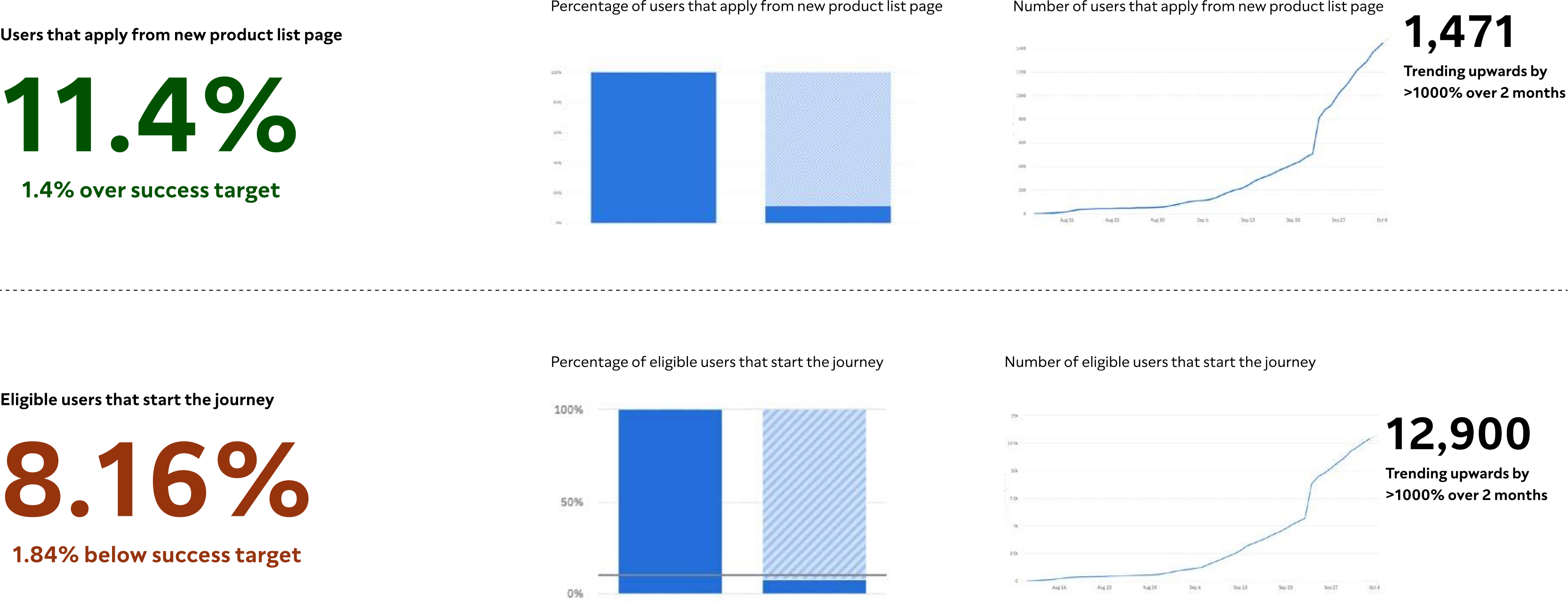

Metrics are measured against analytics from the live app.

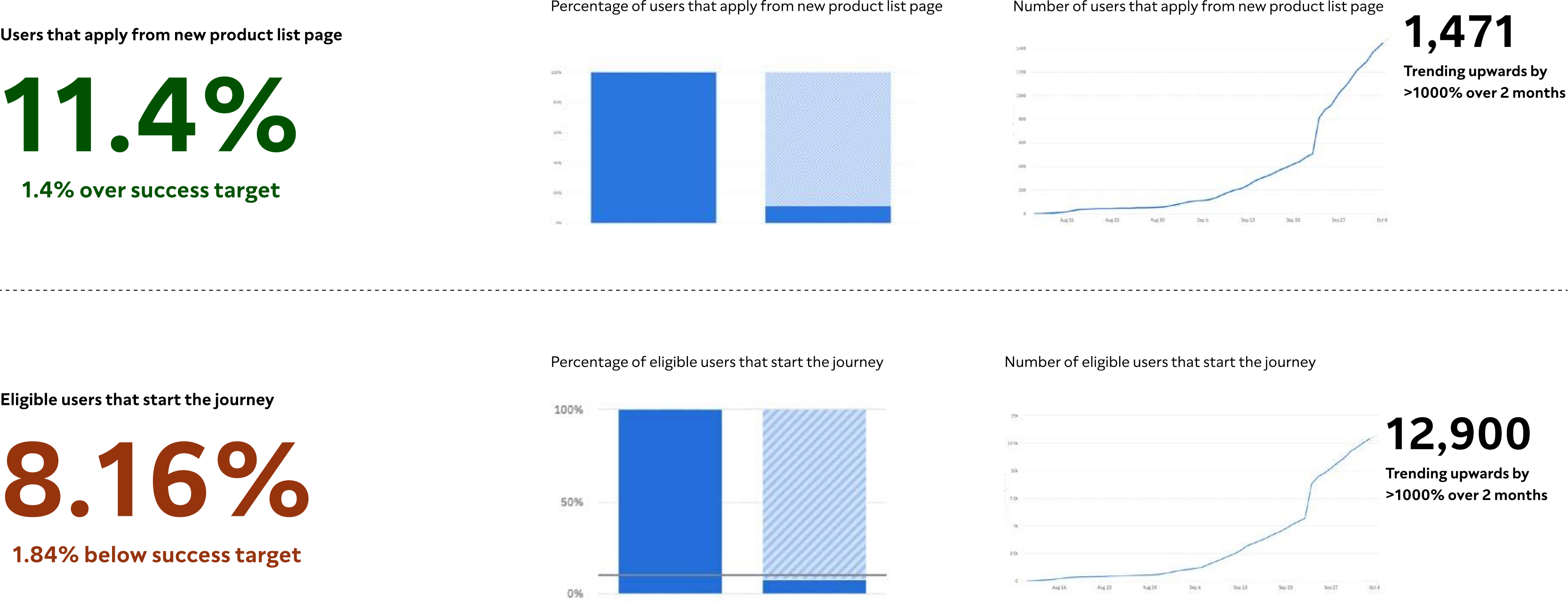

Percentage of users that apply from the new product list page

Success

> 10%

Ok

7-10%

Fail

< 7%

Percentage of eligible users that start the new journey

Success

> 10%

Ok

7-10%

Fail

< 7%

Target Audience

Requirements

- Users we predict can save above £100 by switching to a balance transfer card.

- Users with at least a 70% chance of approval for the balance transfer card.

- Users that have revolved a balance for the last 3 months.

- Active & semi-active users (logged in within the last 6 months)

- Users who are not flagged to be on a 0% promotional rate

- Users with credit score above 300.

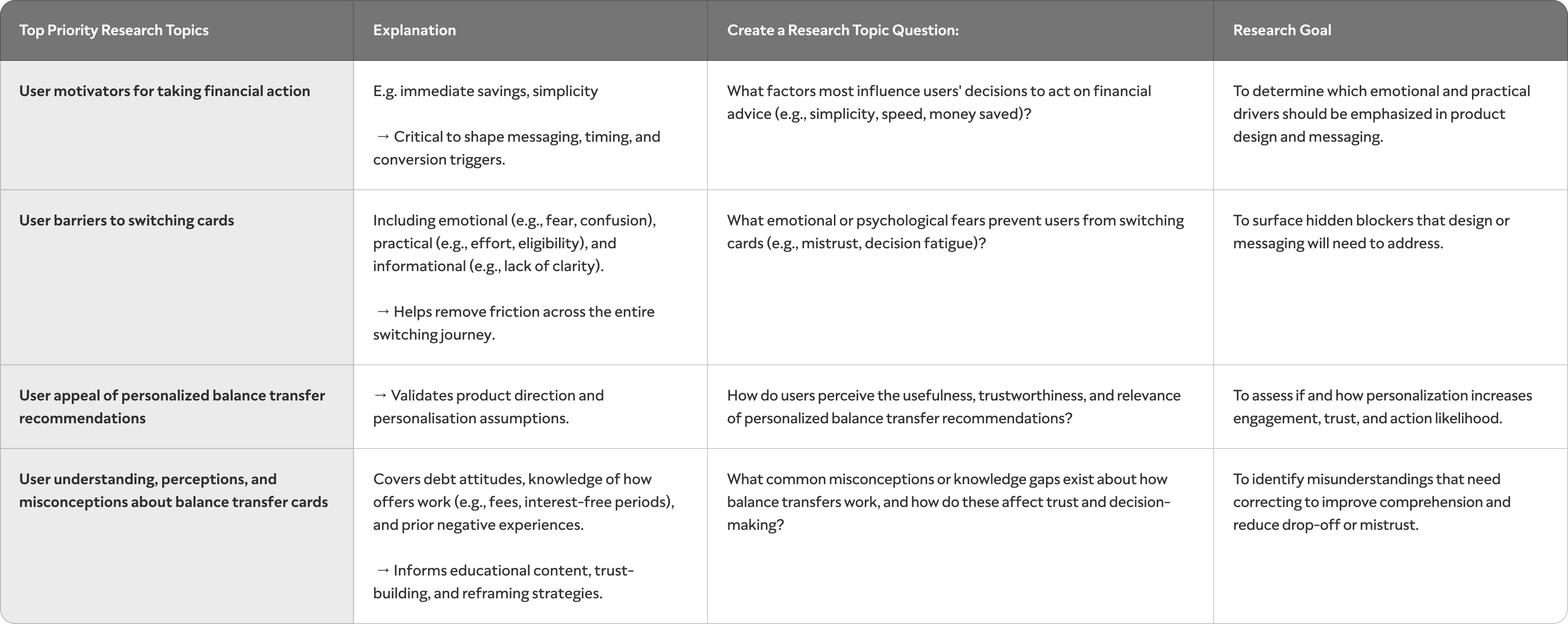

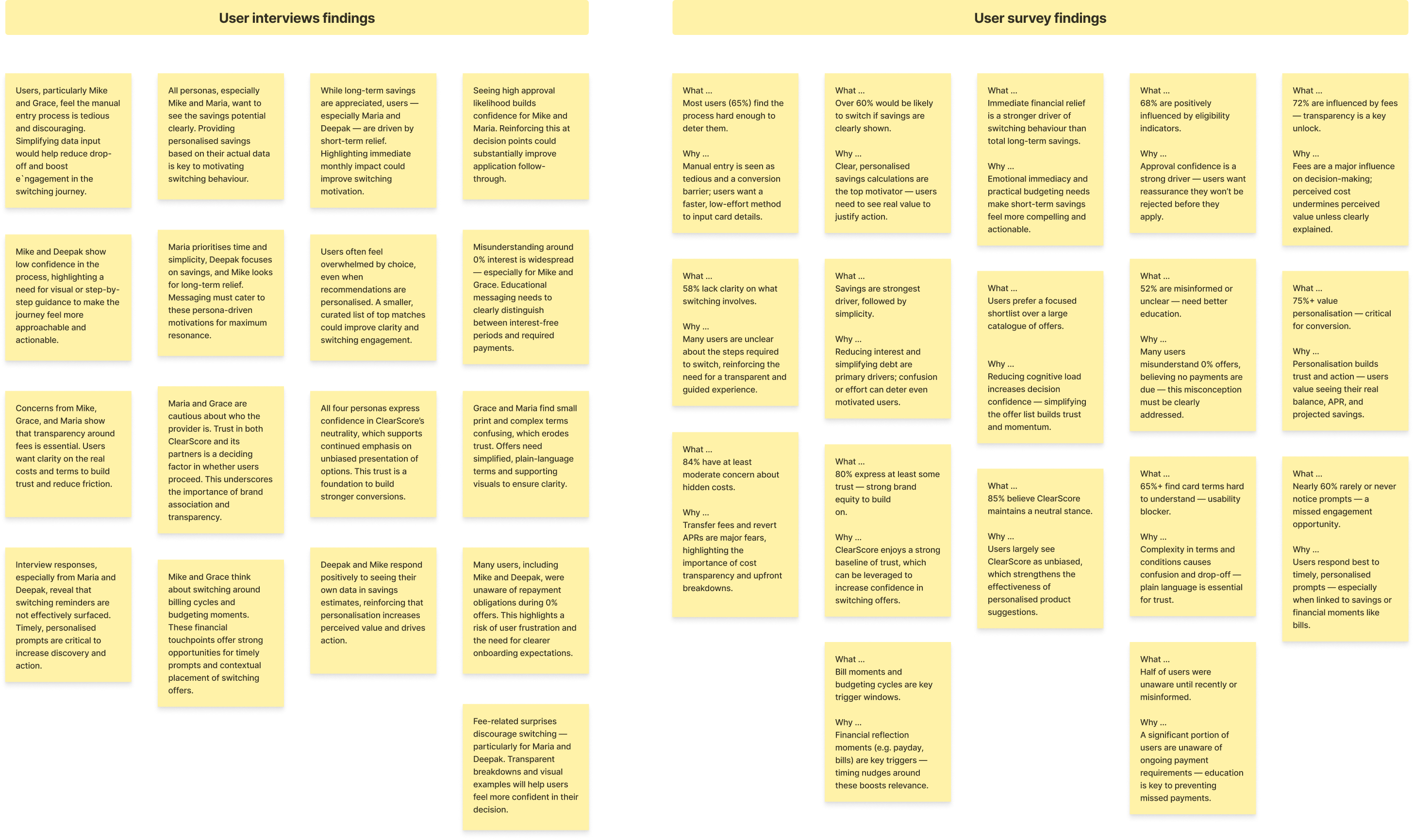

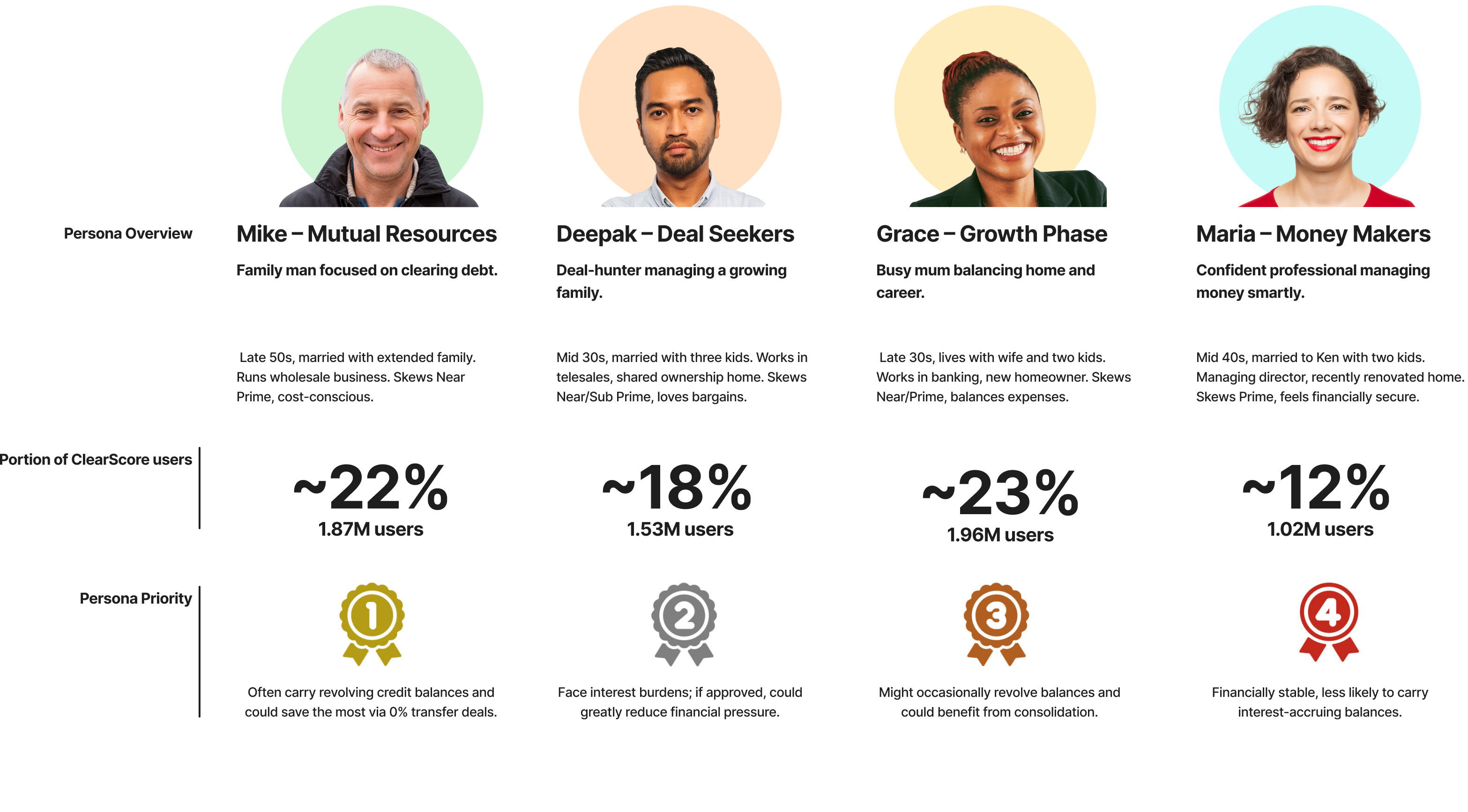

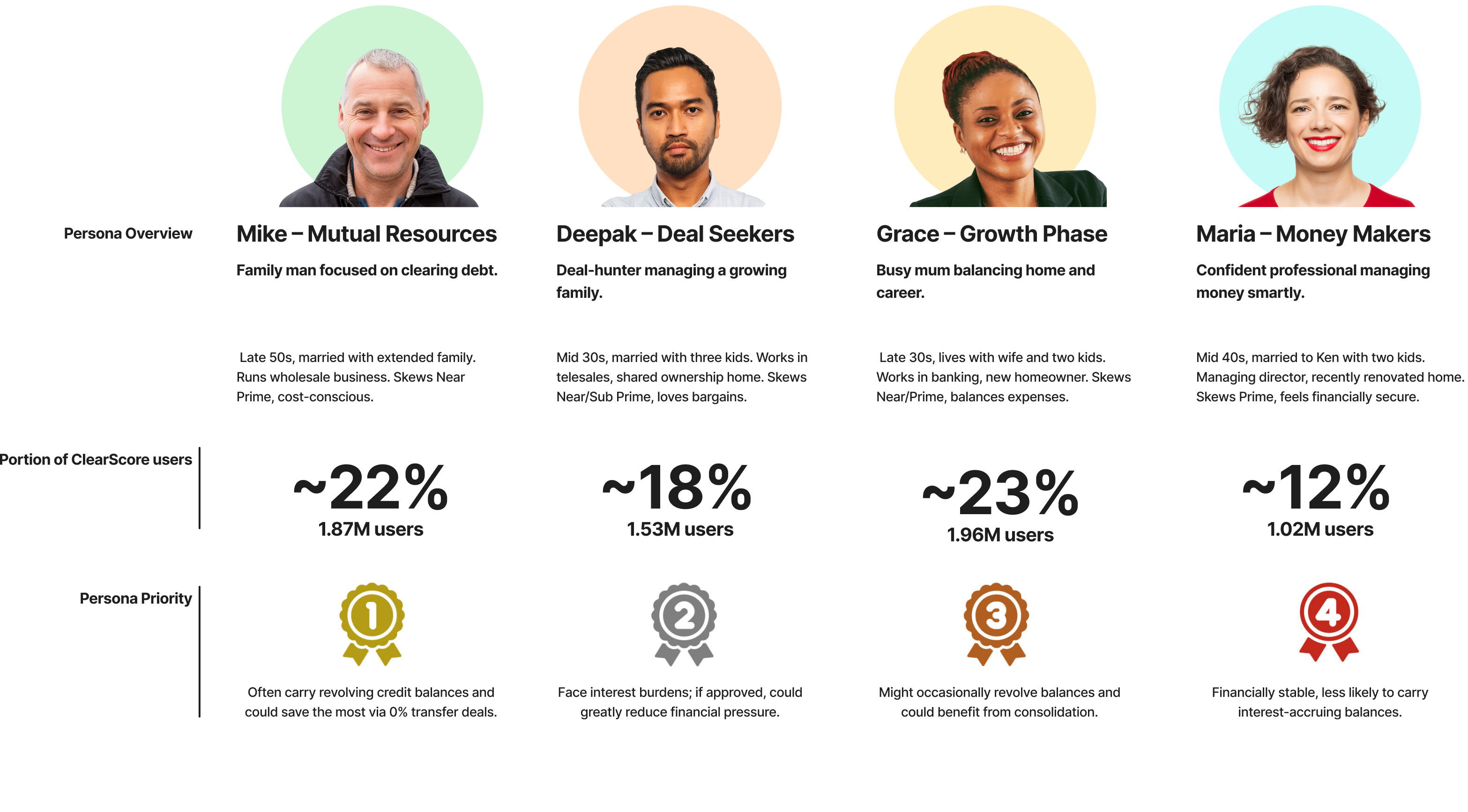

Personas

ClearScore has 6 personas — 4 of these are a target audience for this project and described below:

Money Maker - Maria

High earner with strong credit, rarely uses ClearScore.

Growth Phase - Grace

Busy working mum, tech-savvy and credit confident.

Mutual Resources - Mike

Older self-employed user, focused on clearing debt, uses ClearScore occasionally.

Deal Seeker - Deepak

Budget-savvy dad, always hunting for savings, uses ClearScore often.

Design Requirements

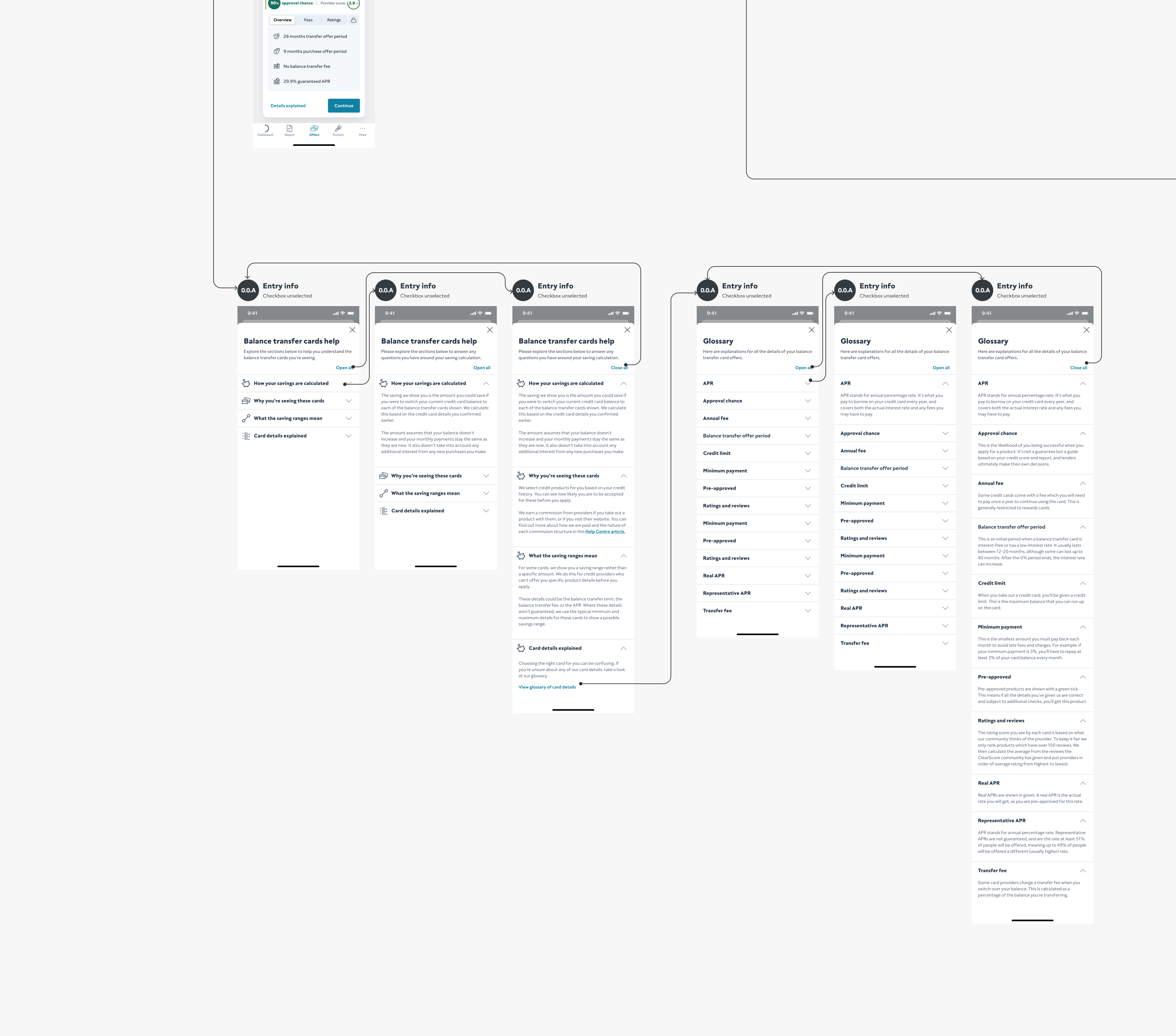

- Savings Calculation

• Show real-time savings using actual card data (APR, balance, payment).• Only calculate after eligible cards are returned.

- API Integration UX

• Trigger panel search via partner APIs. • Handle delays with smooth loading/progress indicators.

- Pre-condition Logic

• Require Offers flow completion (30-day + credit card). • Integrate into journey as needed.

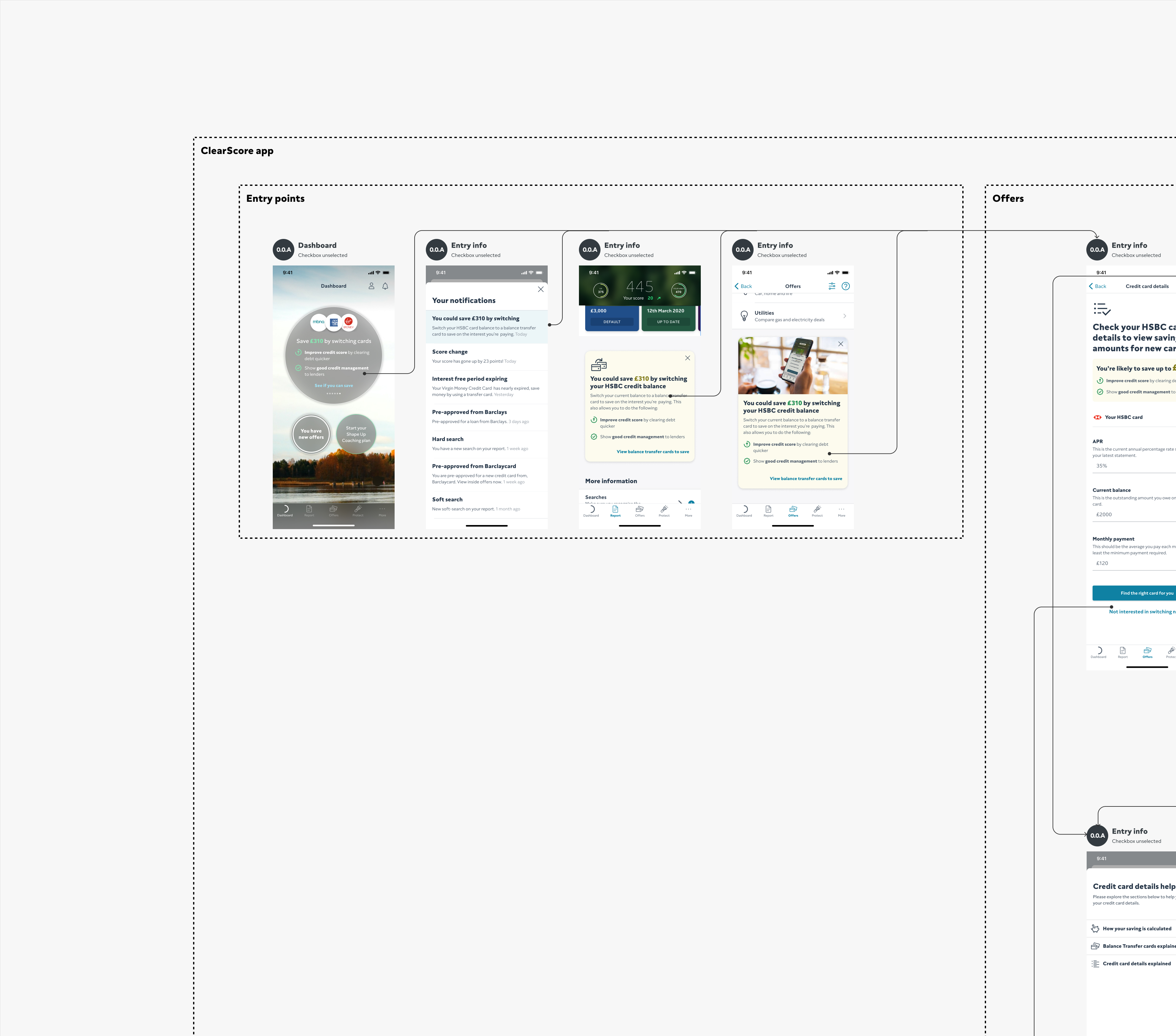

- In-App Entry Points

• Add entry points from dashboard, cards tab, or credit report. • Target users with card debt or interest.

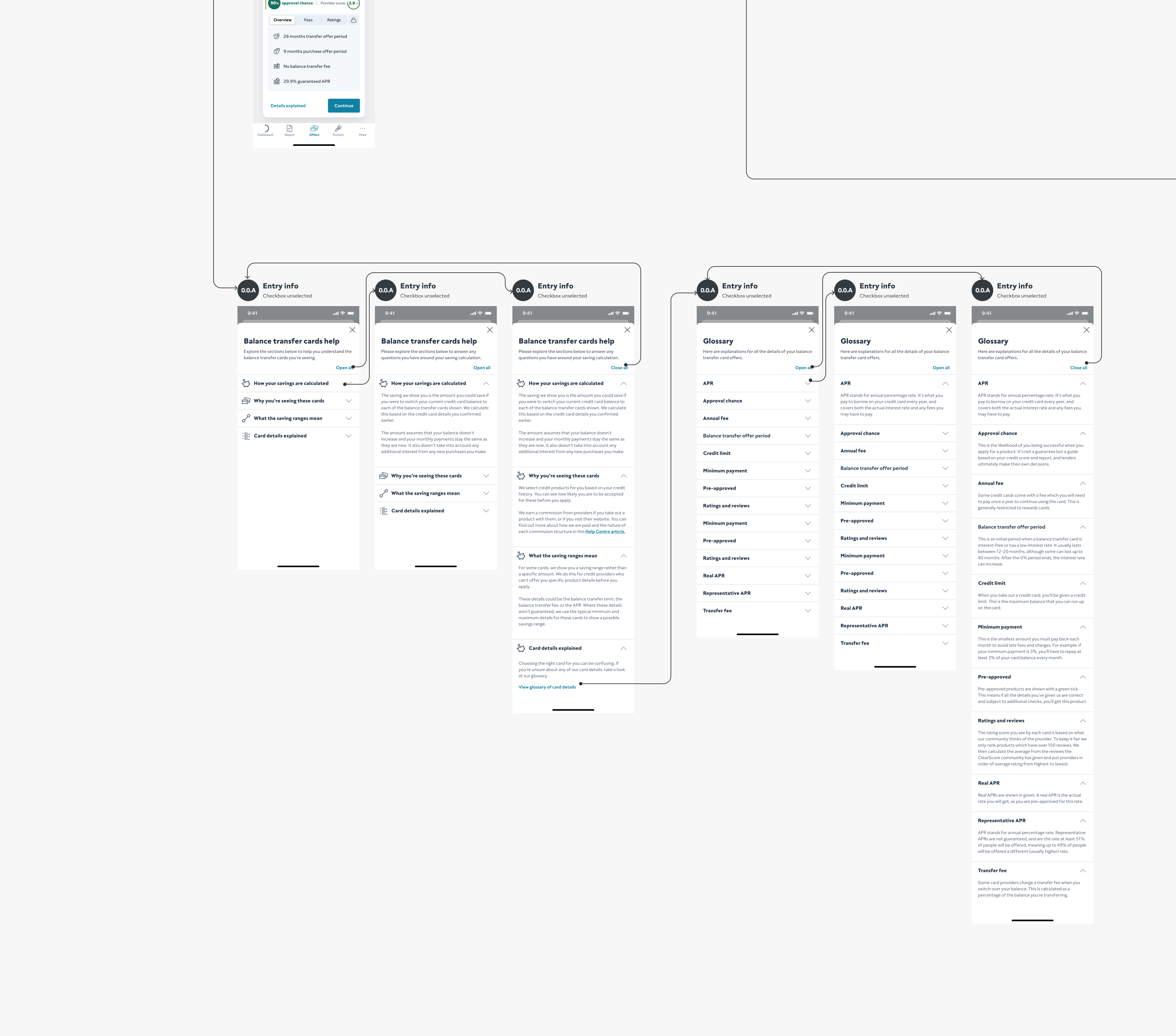

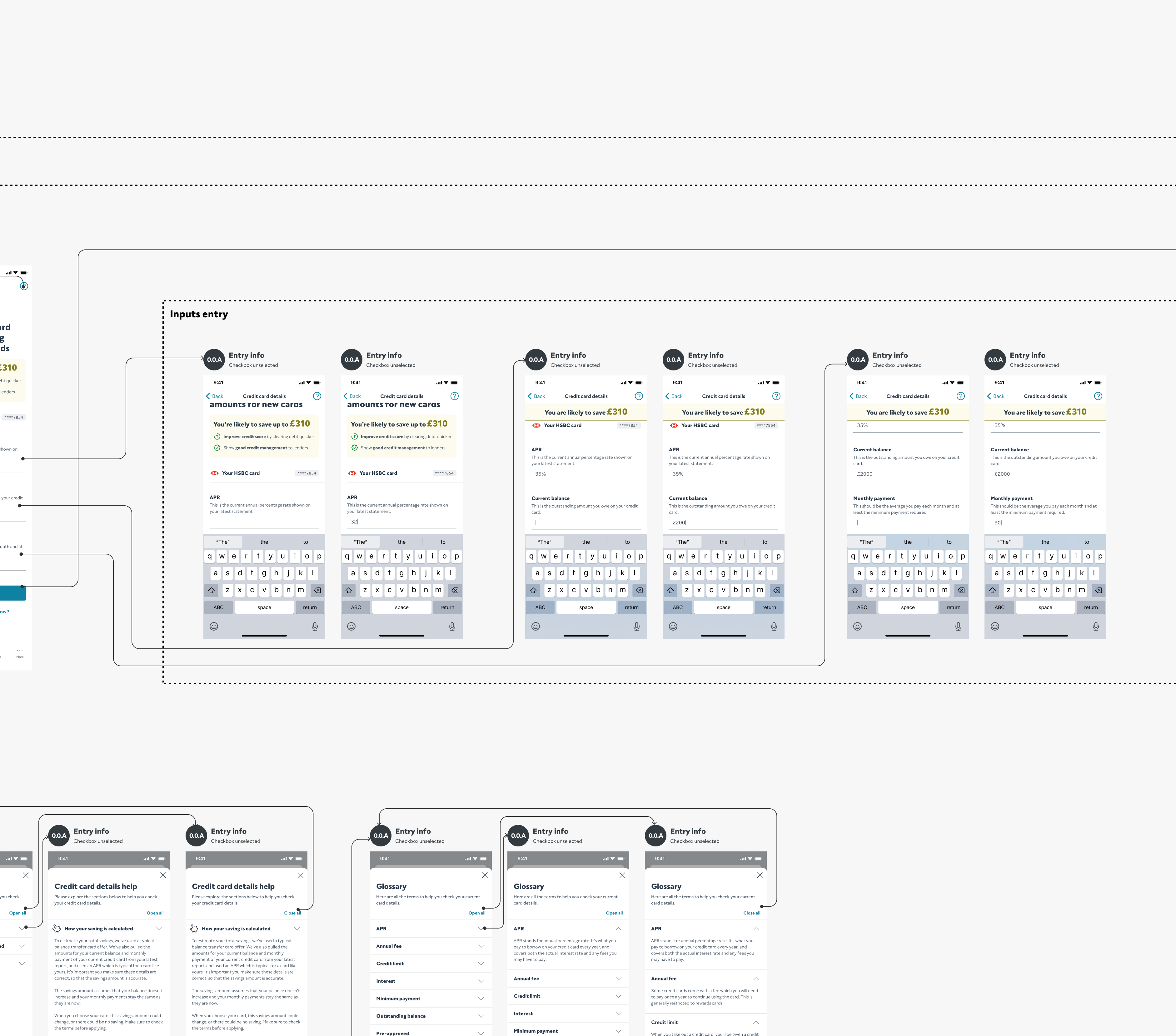

- Existing credit card input

• Allow editing of card details (APR, balance, payment).

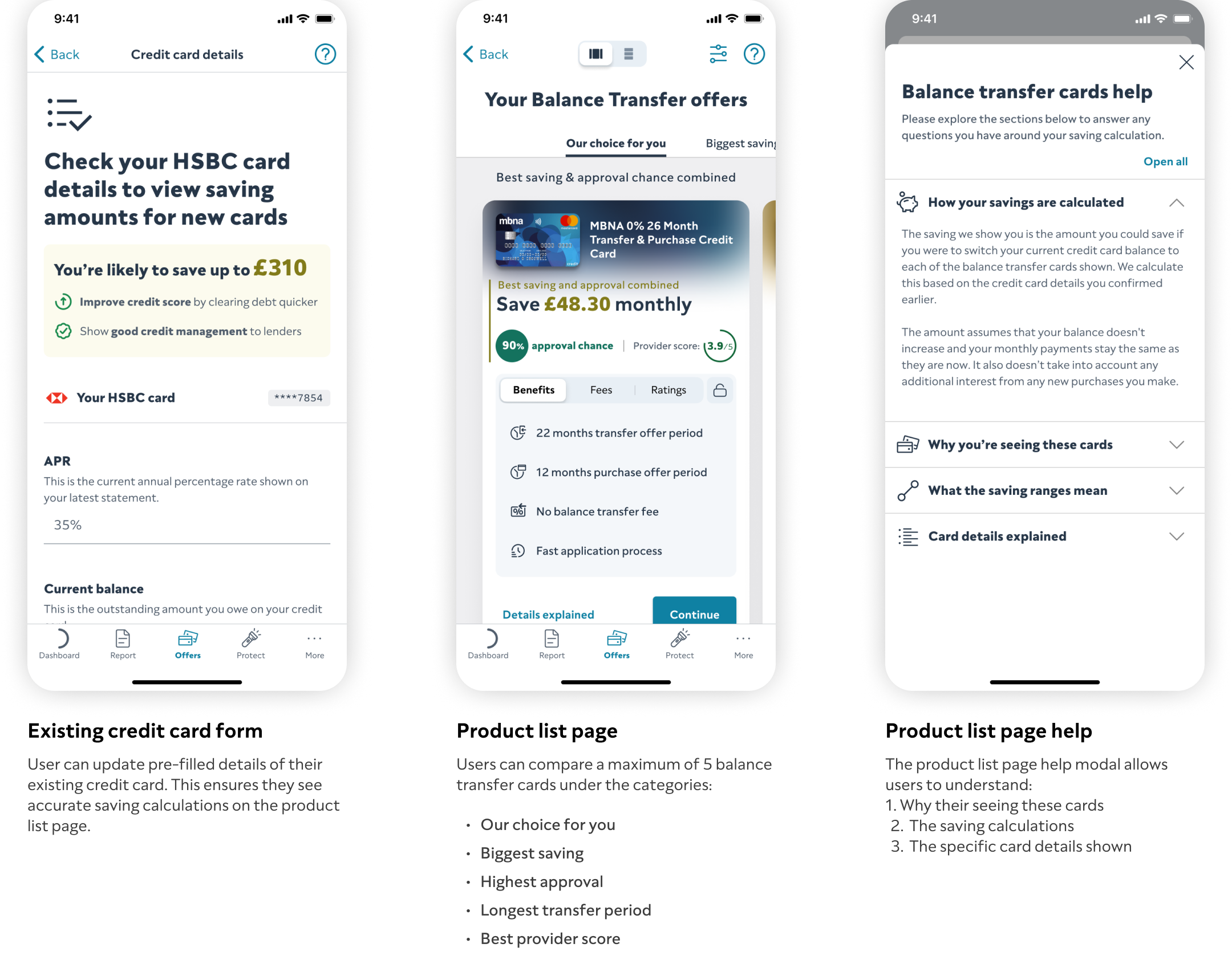

- Results Presentation

• Show savings for top 1, 3, or all eligible cards. • Include APR, terms, eligibility, example. • Link to product pages.

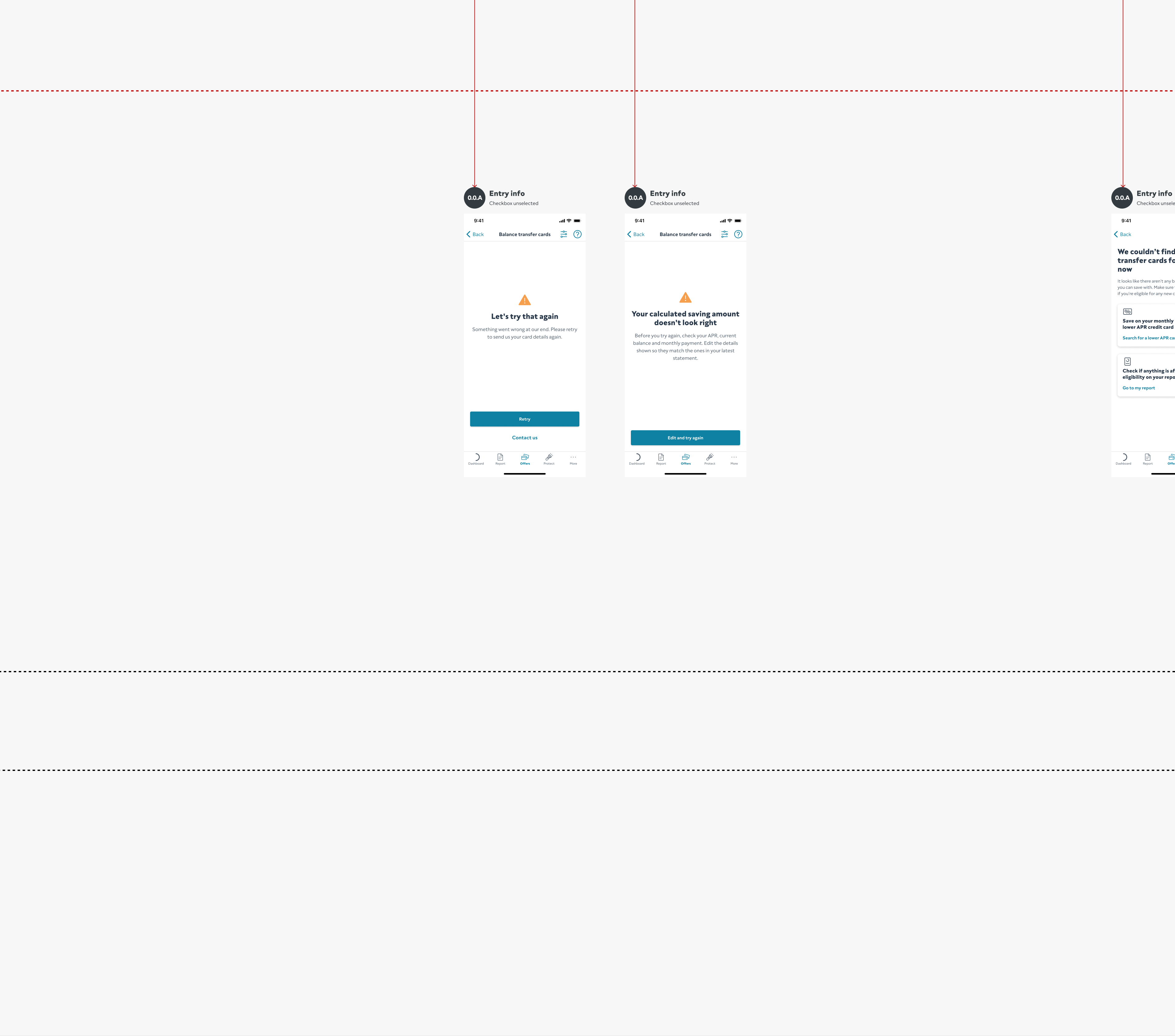

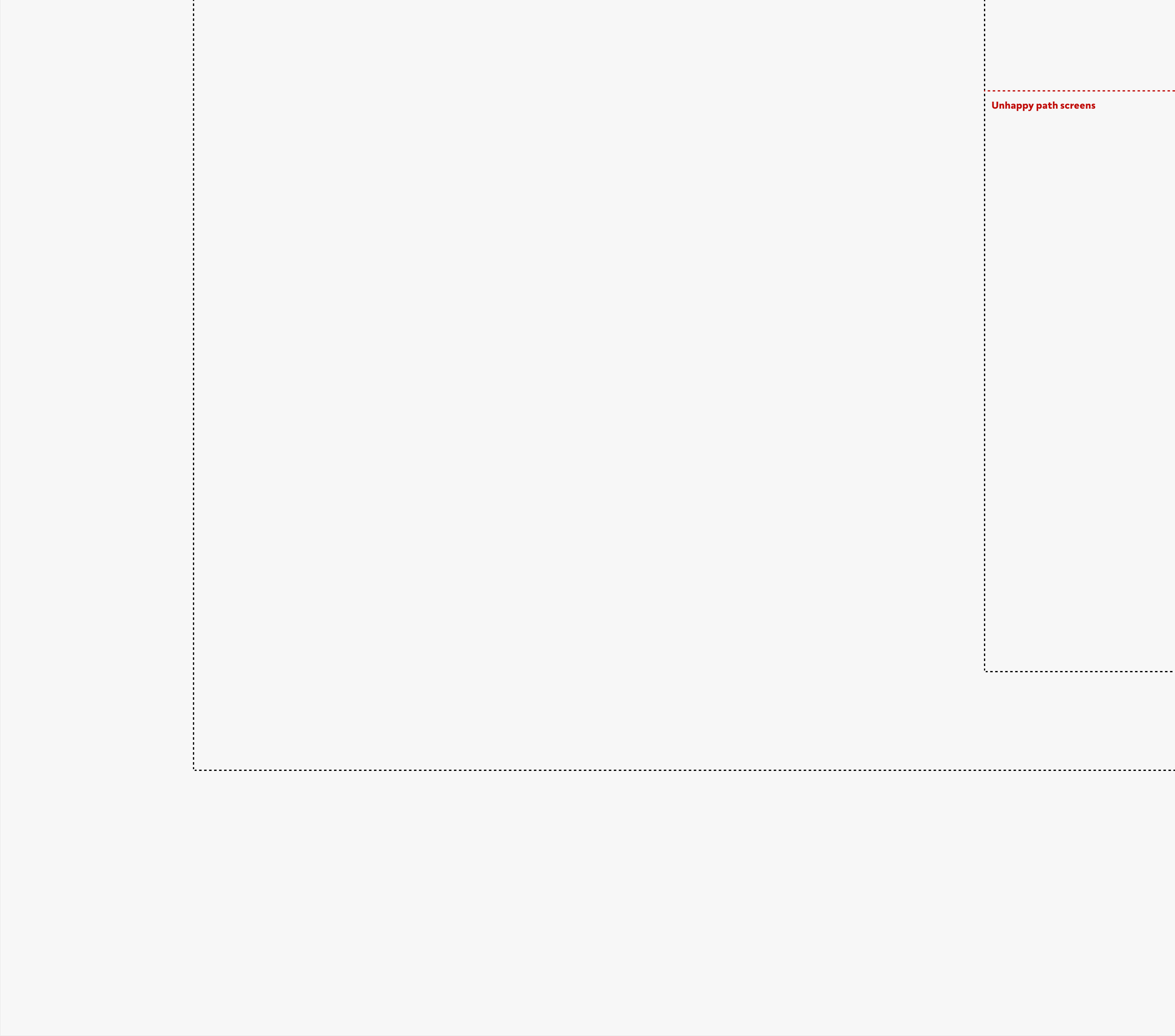

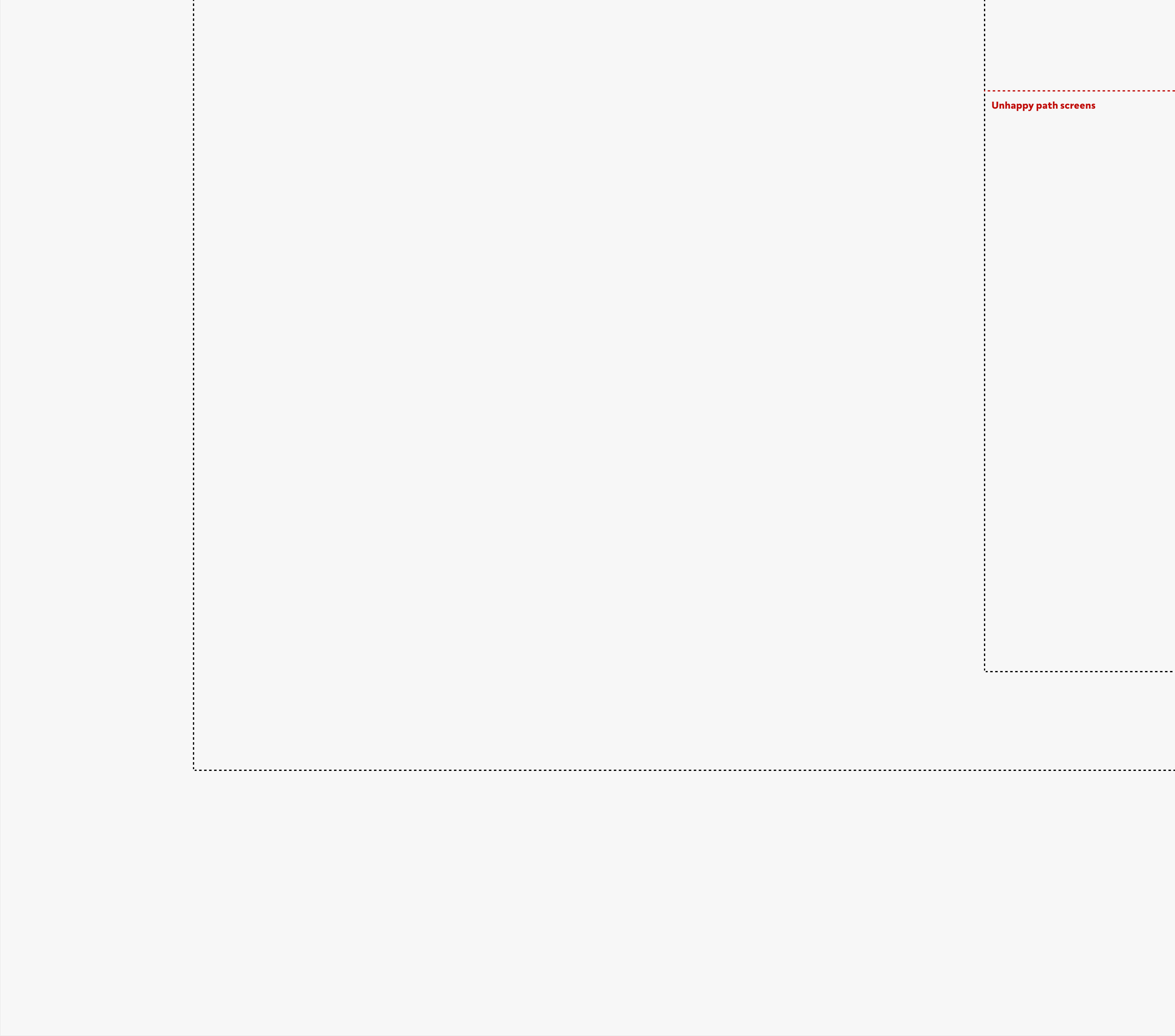

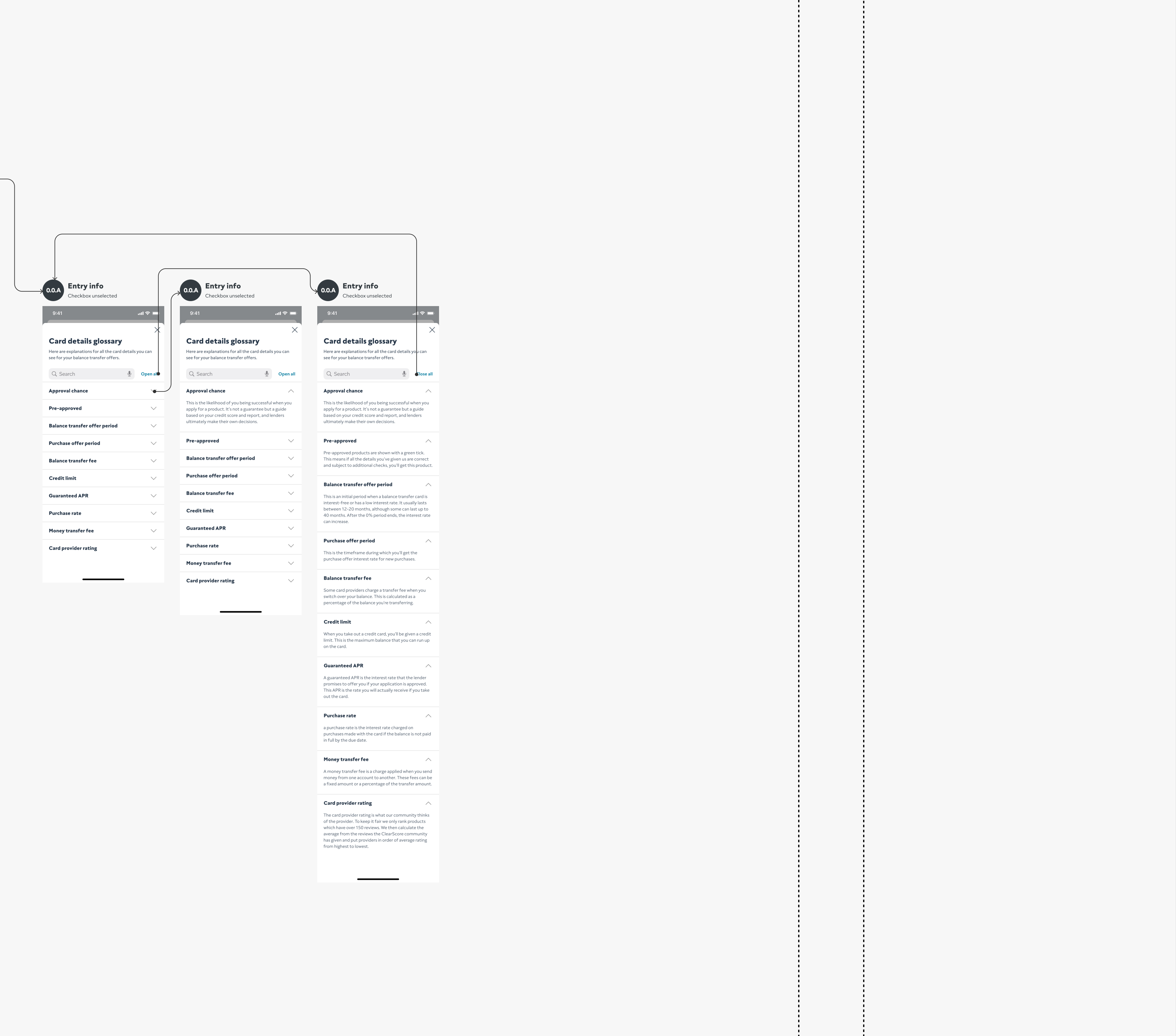

- Unhappy Path

• Fallback if no savings or BT cards. • Suggest next steps or alternatives.

Design stage 1 OF 4

Discover

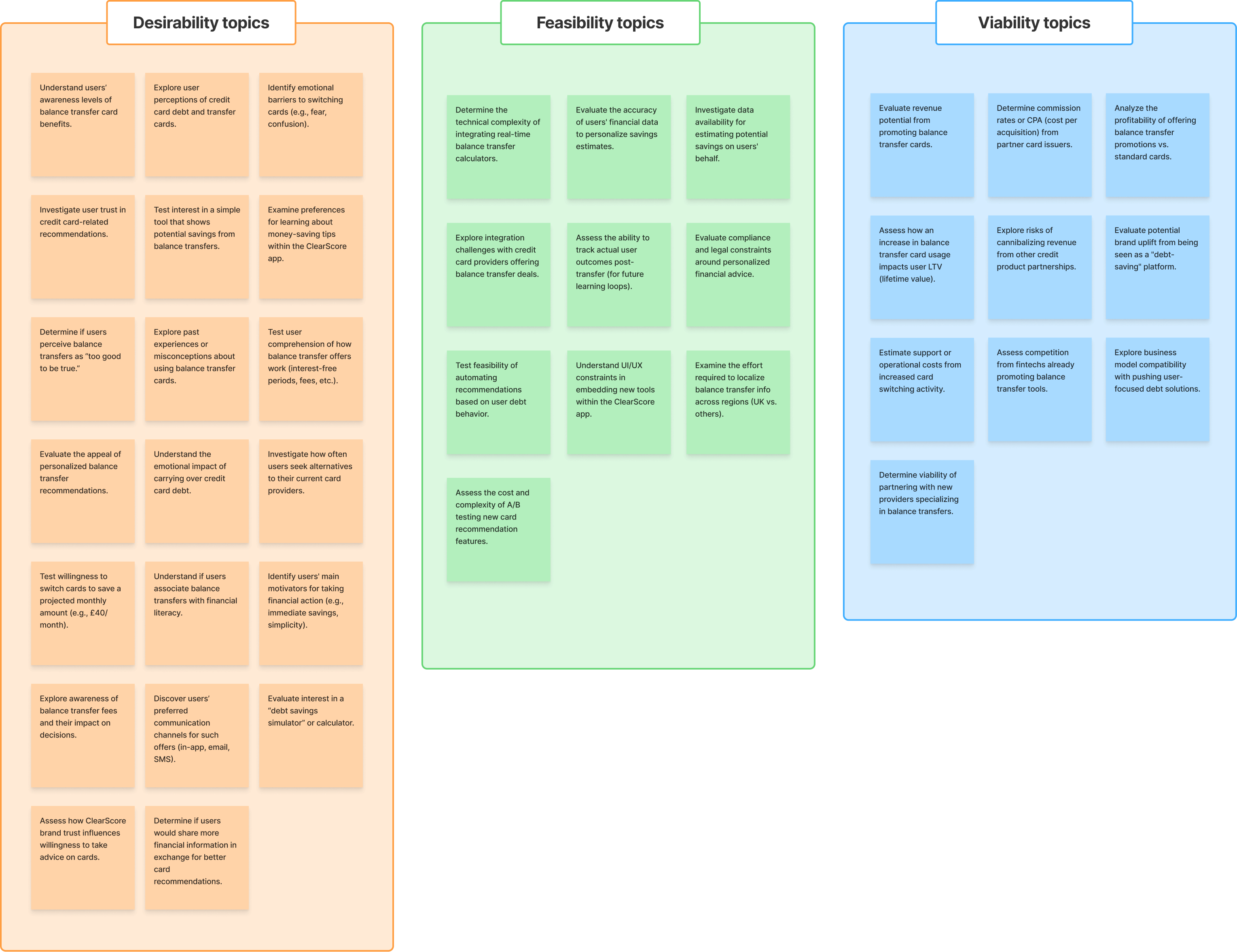

Our initial problem statement was based on the saving calculation and success of related optimisations. So needed to know users thoughts about switching or why users are not saving on their interest payments.

Assumed Problem Insights

DISCOVER

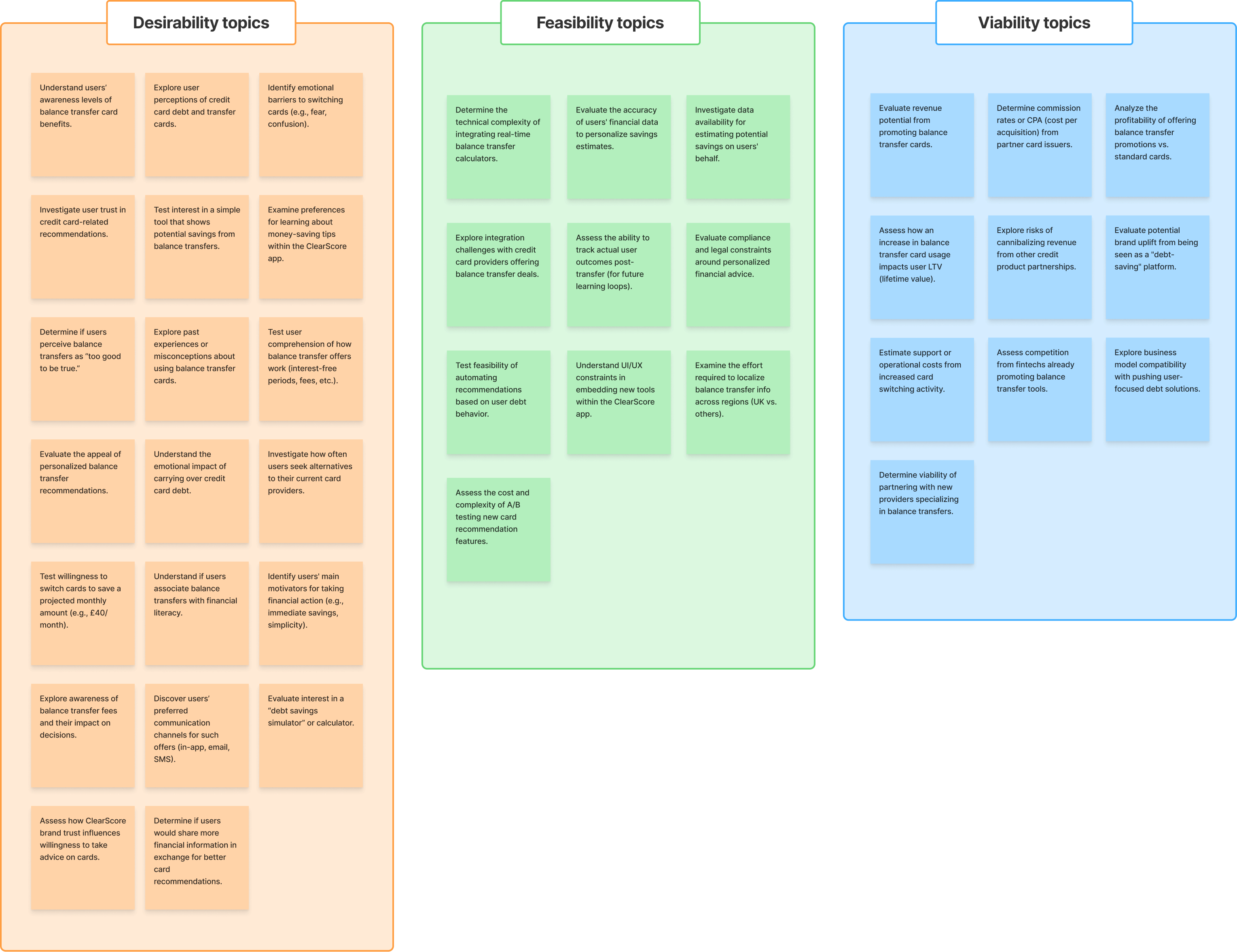

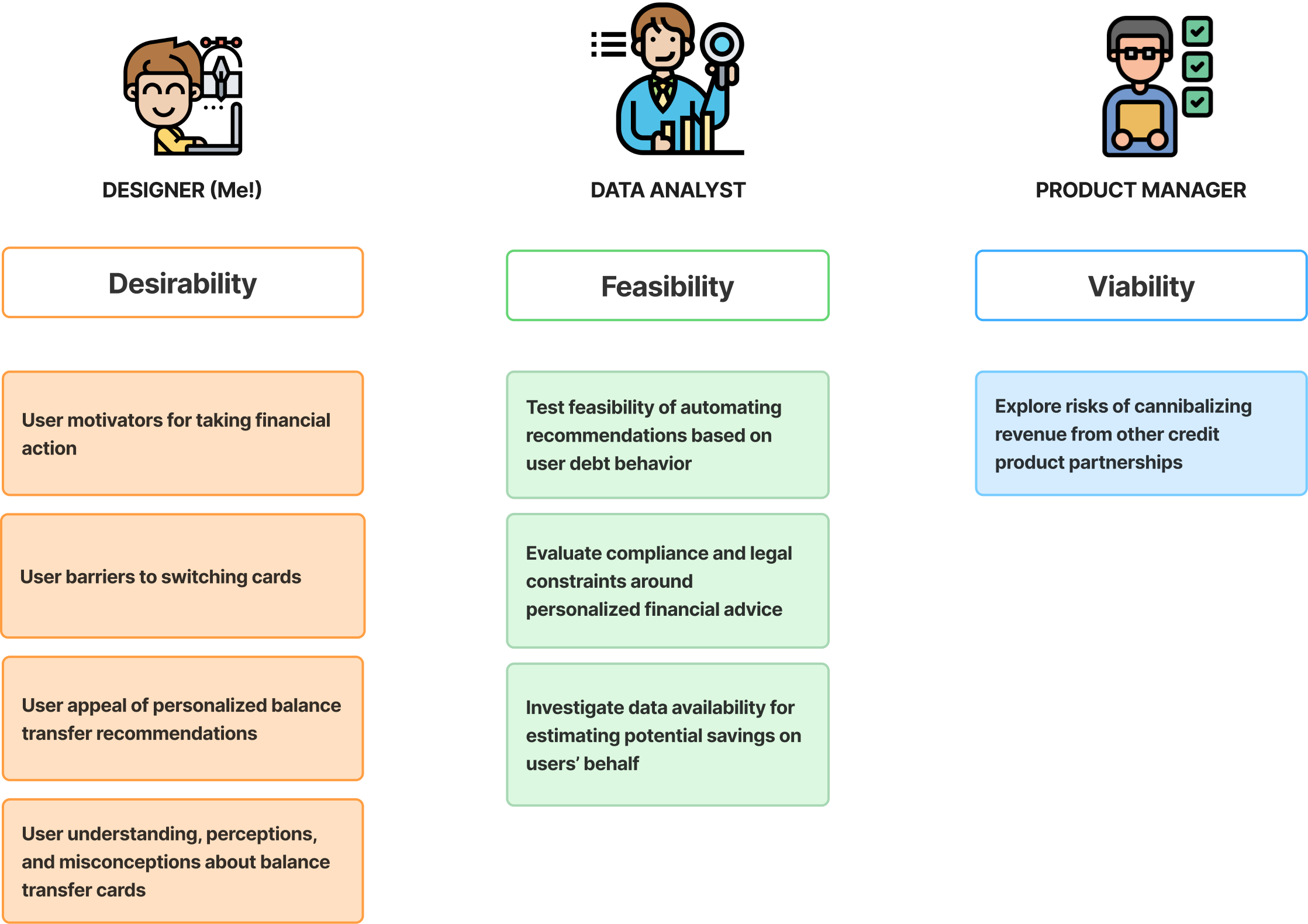

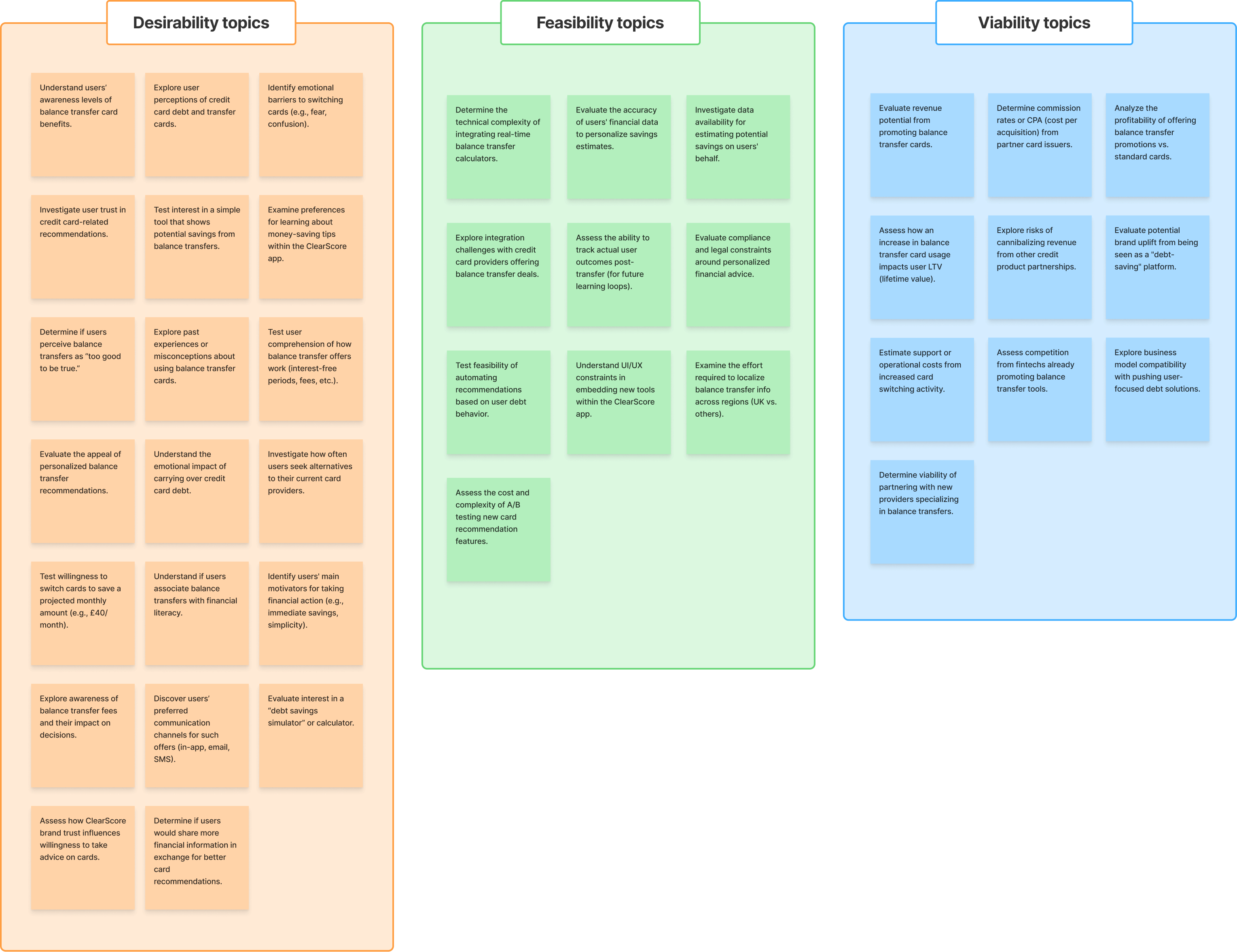

Research Topics Gathering

DISCOVER

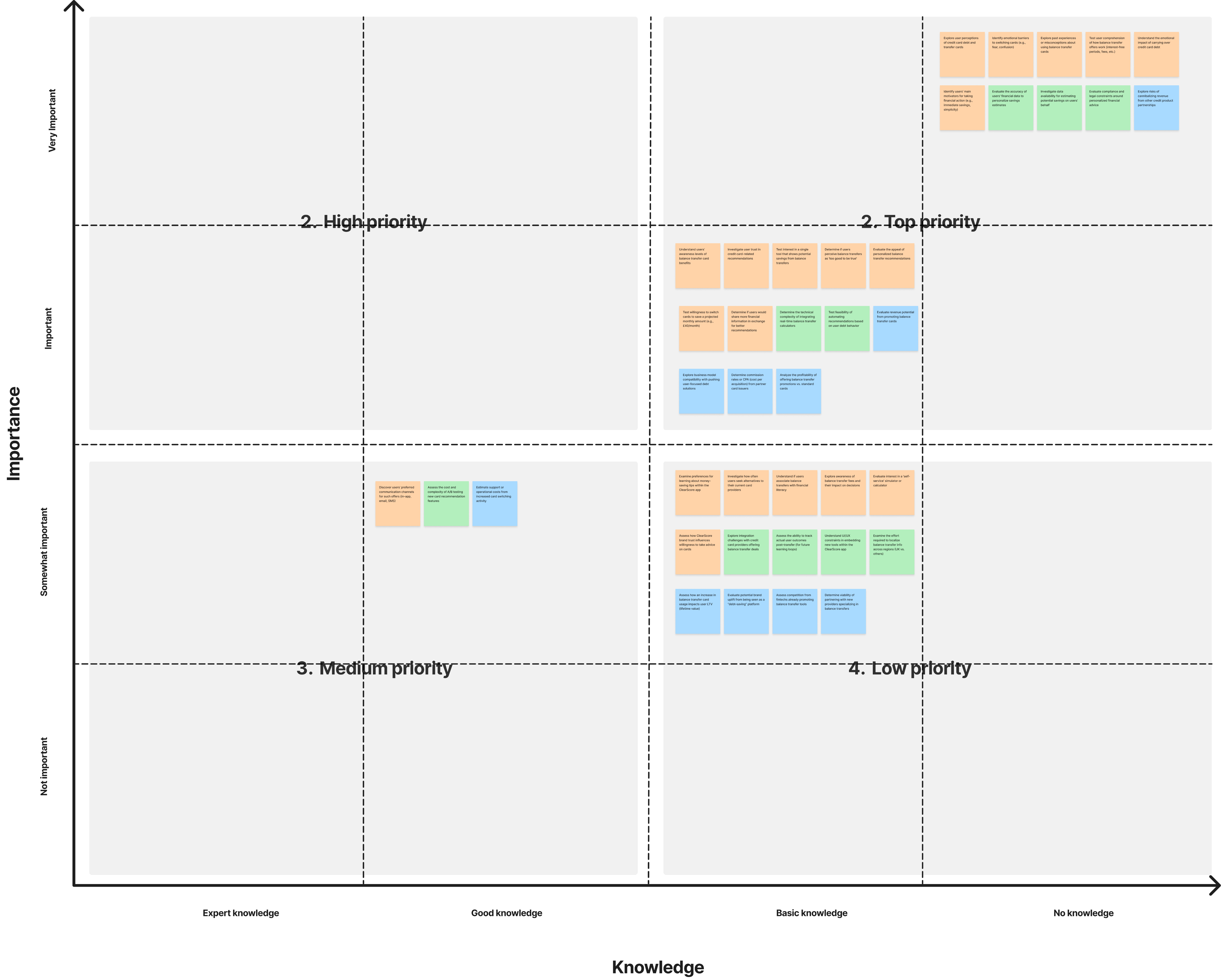

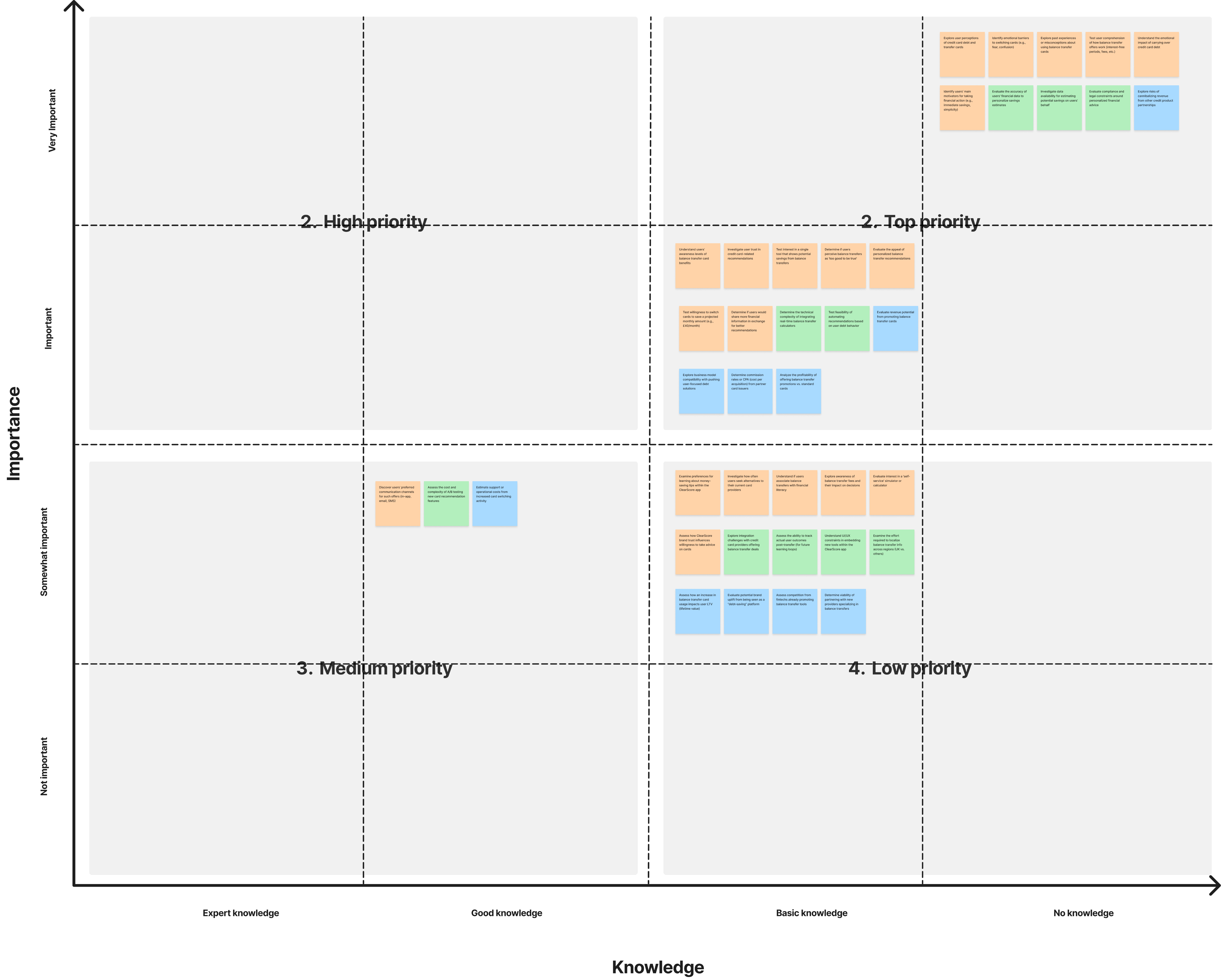

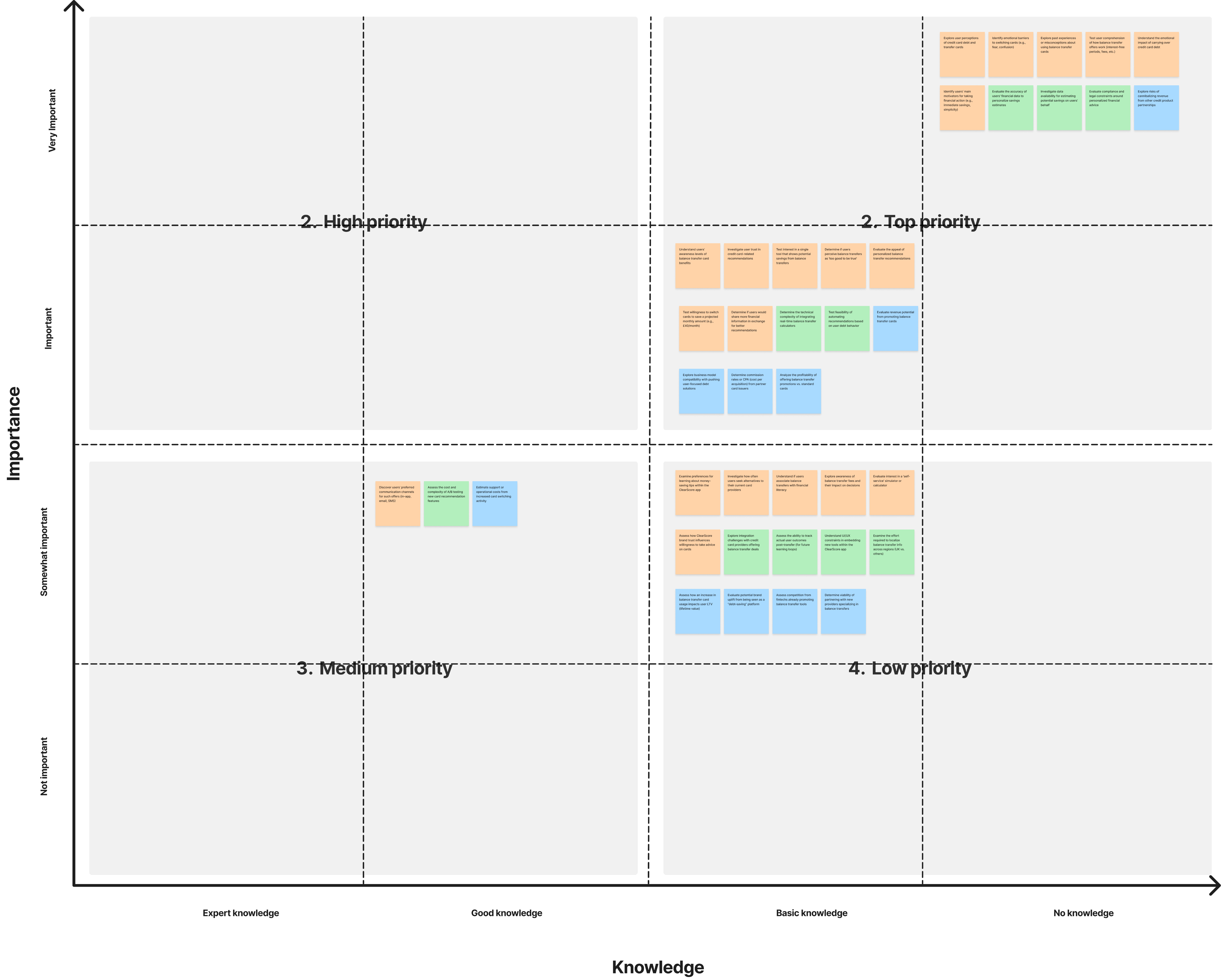

Research Prioritisation

Importance knowledge matrix

DISCOVER

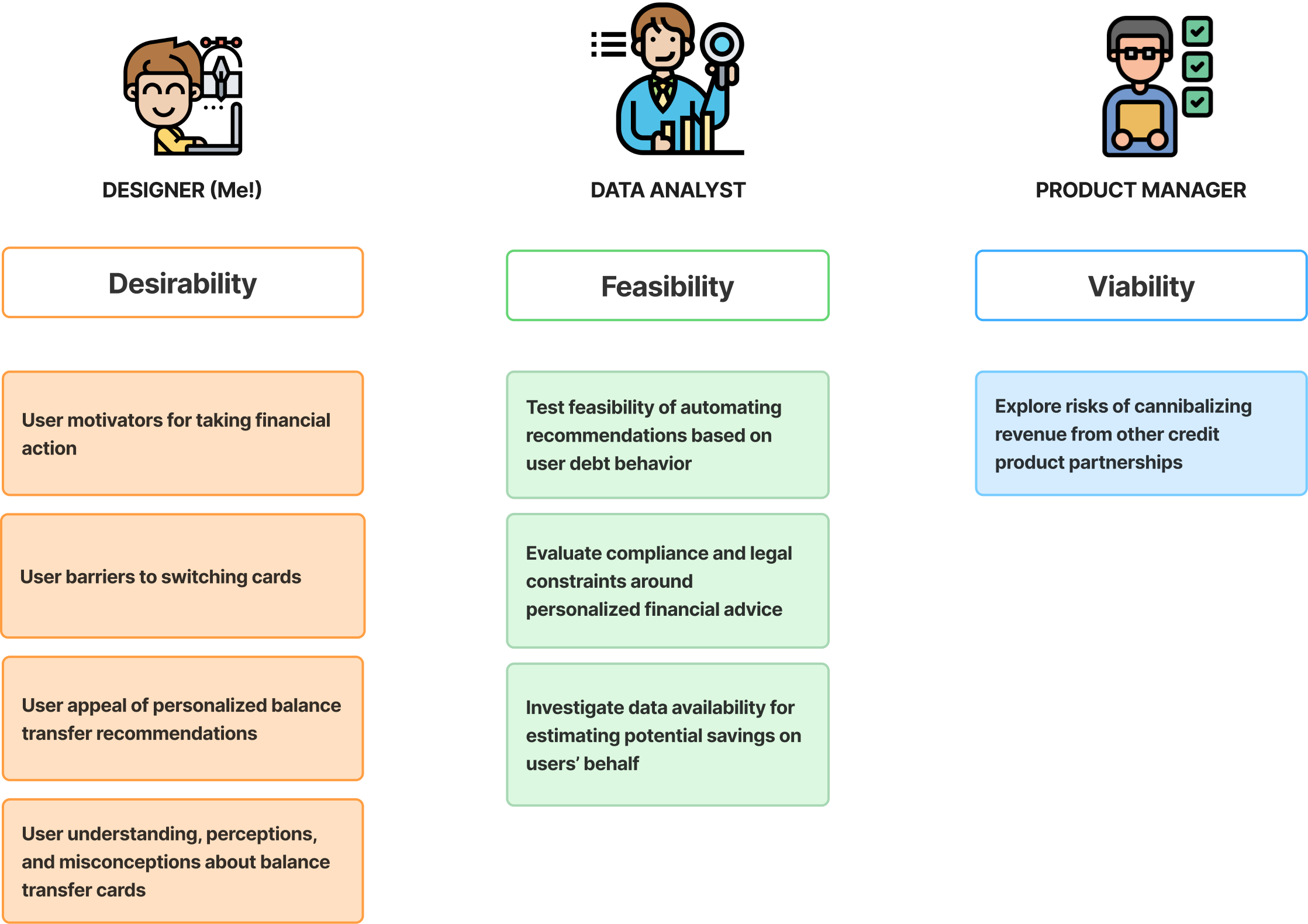

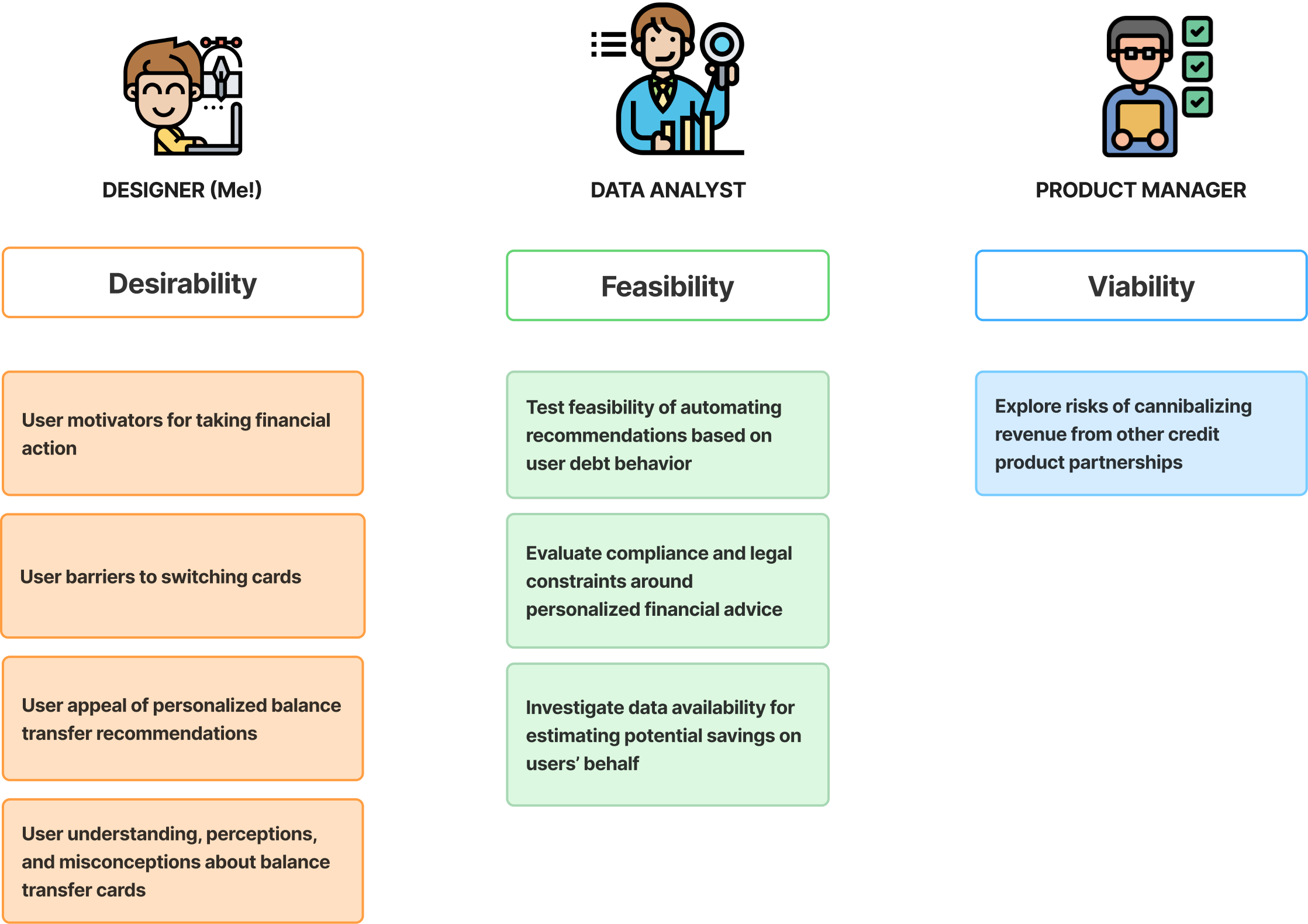

Top Priority Research Delegation

DISCOVER

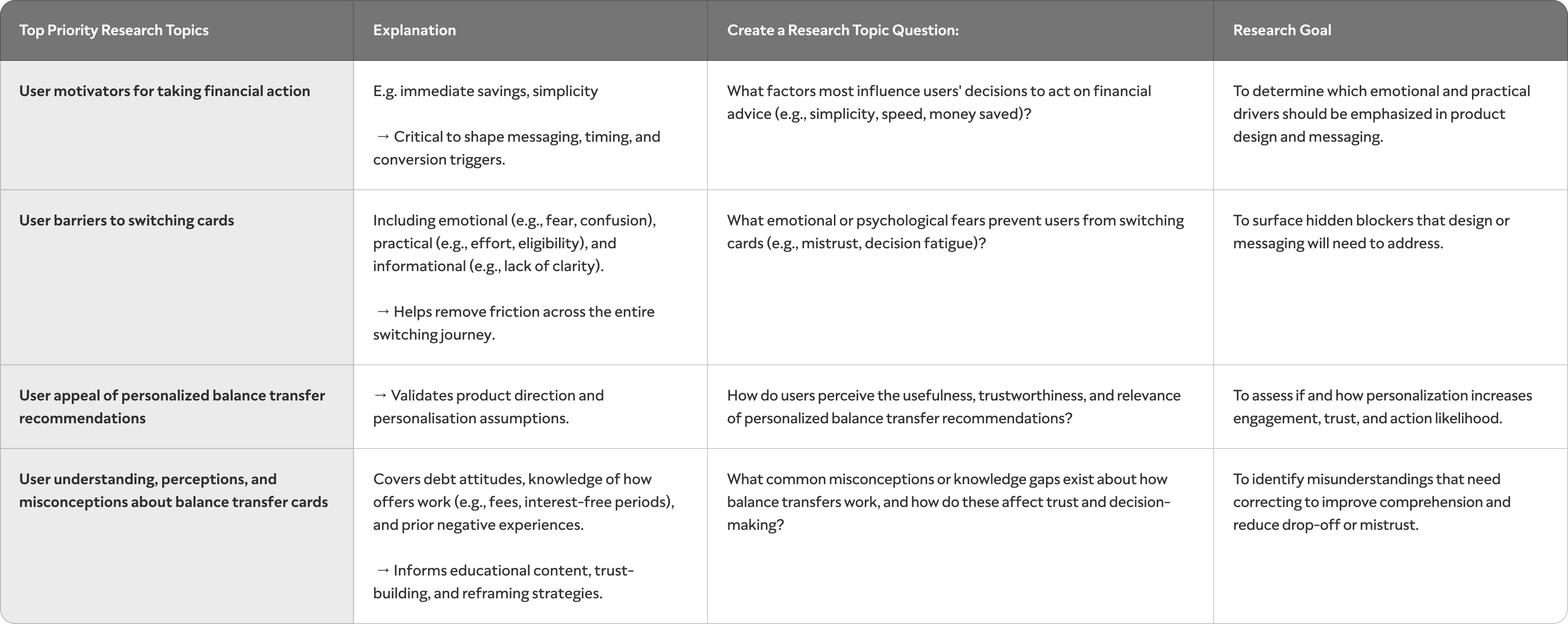

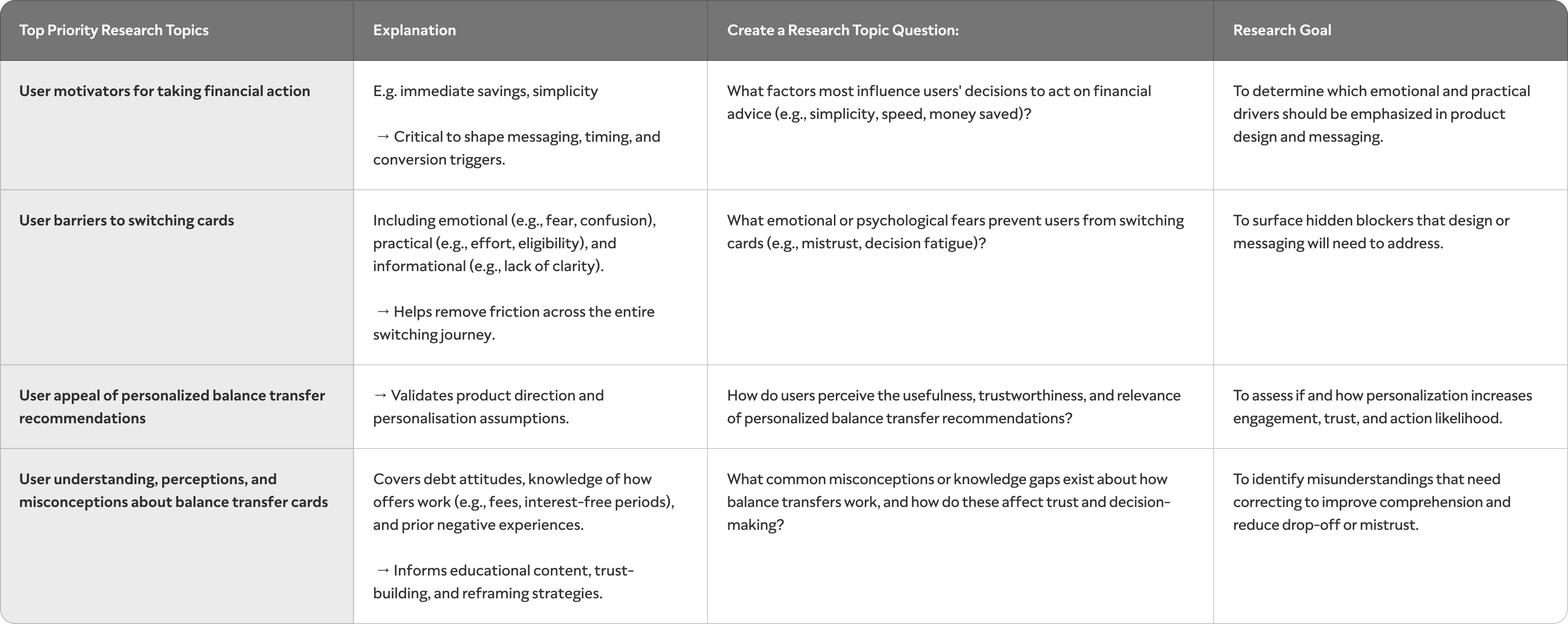

Top Priority Research Topics

DISCOVER

Top Priority Research Topics

DISCOVER

Design stage 2 OF 4

Define

We needed to refine the numerous research findings into the most relevant insights and a thorough problem definition to start ideating from.

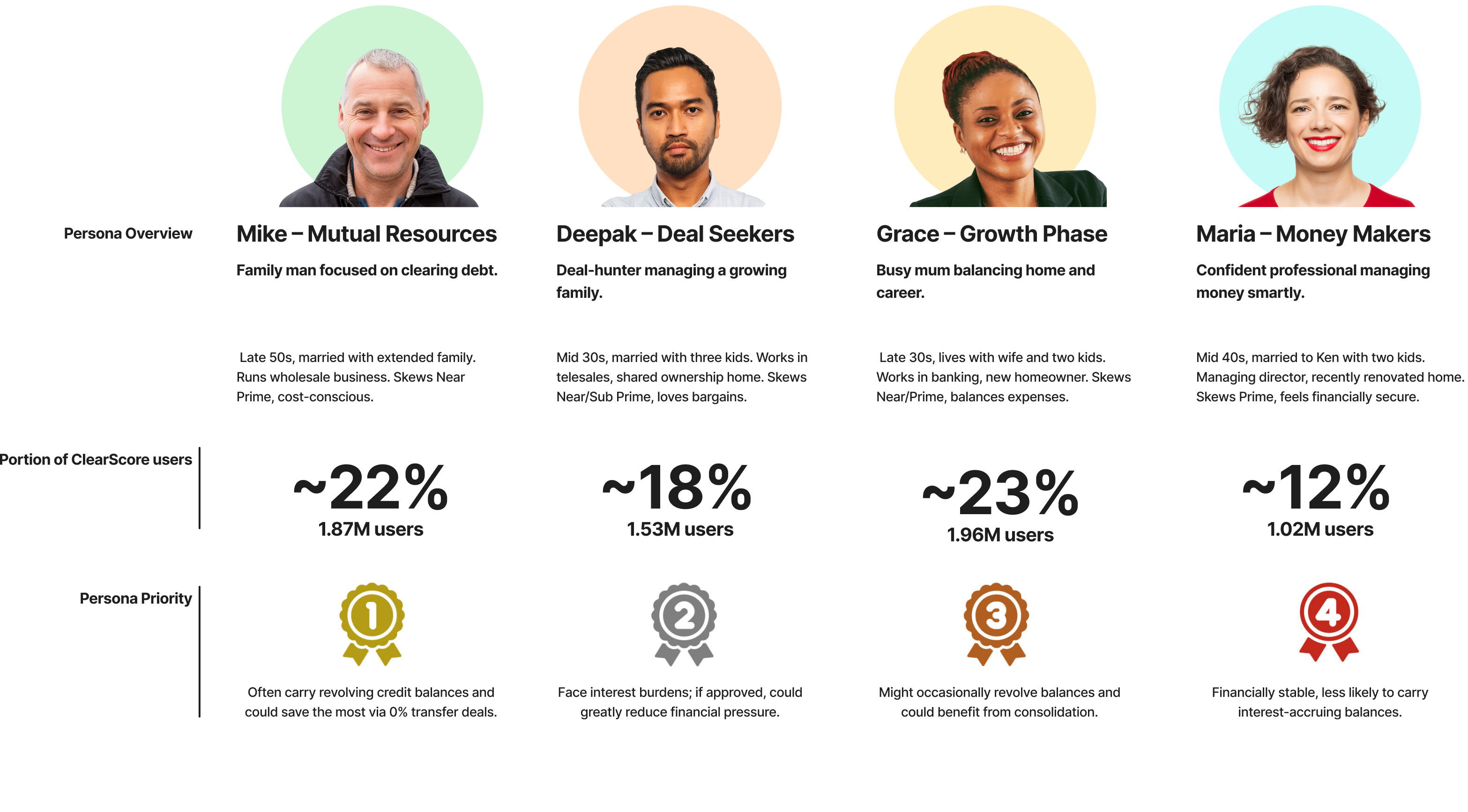

Unstructured Research Findings

DISCOVER

Findings Themes

DISCOVER

Key Research Insights

Insight 1

Personalised savings must be made clear and tangible

Users are more likely to switch when they clearly see how much they personally will save, presented at the moment they’re comparing options, rather than generic or abstract savings claims.

Insight 2

Educational gaps undermine switching confidence

When users don’t understand switching steps or terminology early in the journey, uncertainty builds and even motivated users hesitate or drop off.

Insight 3

Too many card options lead to decision paralysis

Large lists of similar offers overwhelm users during comparison, making it harder to choose and increasing indecision and abandonment.

Insight 4

Confidence in eligibility drives switching action

Users are more willing to apply when they feel confident they’ll be approved; fear of rejection or credit impact causes them to avoid offers, even when eligible.

‘Researched’ user problem

ClearScore users with credit card debt who are open to switching often feel uncertain and overwhelmed when exploring options in the app.

Unclear savings, a confusing process, and low confidence in approval prevent them from switching, even when it could reduce costs and interest payments.

Design stage 3 OF 4

Develop

With key insights identified and the problem defined, I started developing solutions – from the user flow through to conceptual UI.

Themes Problem Statements

DISCOVER

Themes Problem Statements

DISCOVER

Themes Problem Statements

DISCOVER

Themes Problem Statements

DISCOVER

Themes Problem Statements

DISCOVER

Design stage 4 OF 4

Deliver

Now the chosen solution was brought to life by building, testing, and refining it to ensure it works for our users and the business.

Themes Problem Statements

DISCOVER

Themes Problem Statements

DISCOVER

Themes Problem Statements

DISCOVER

Insights Problem Statements

DISCOVER

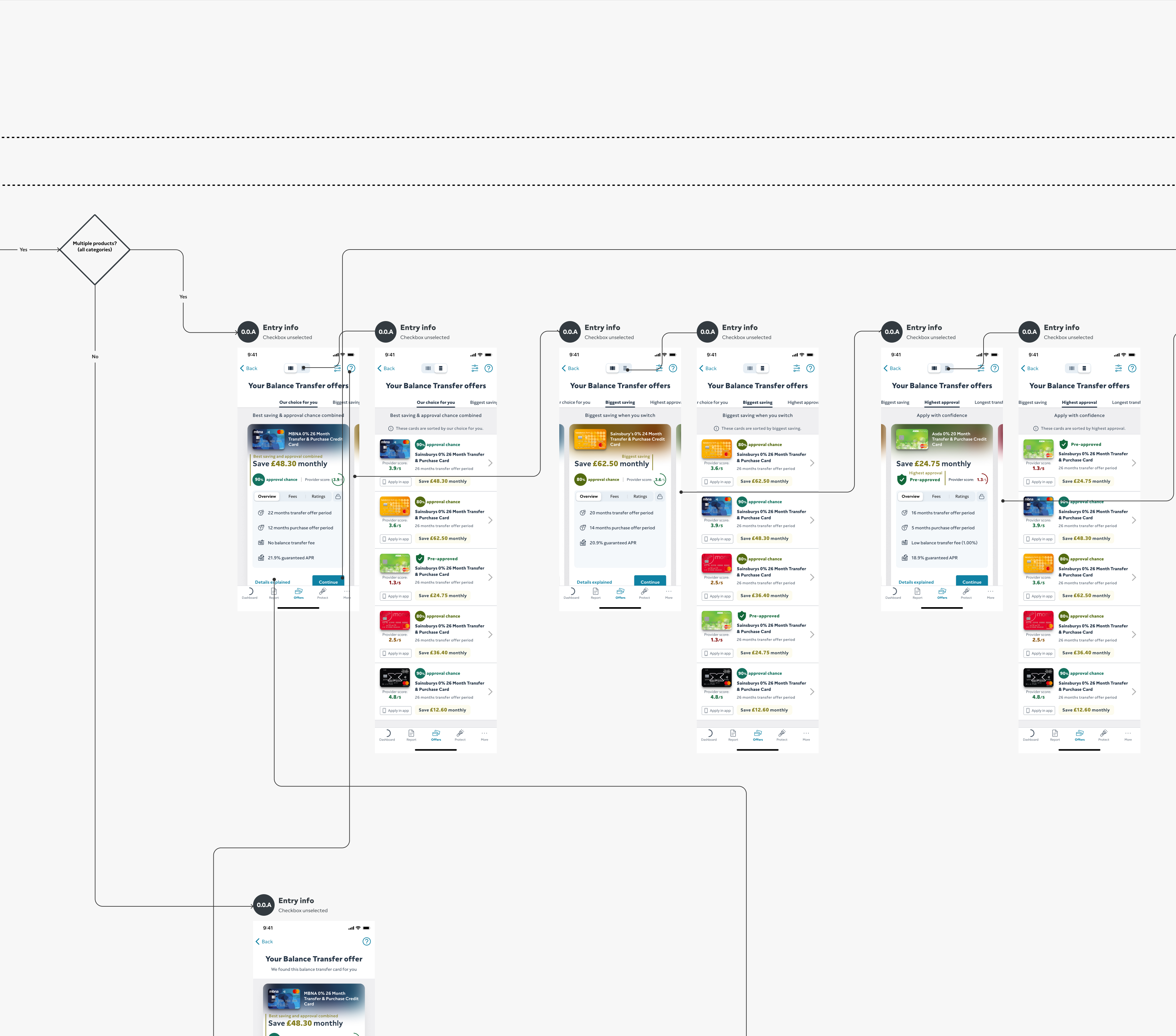

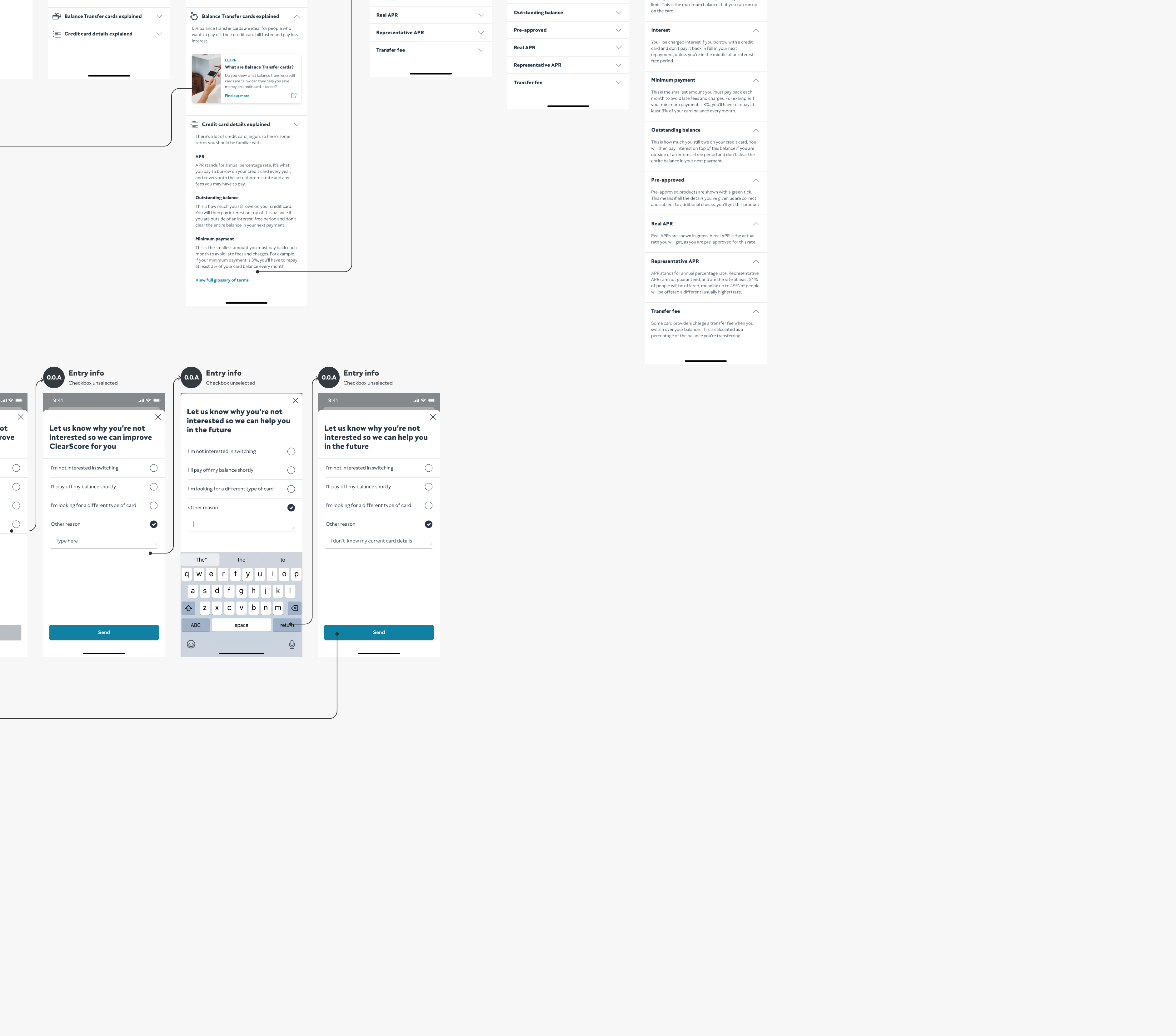

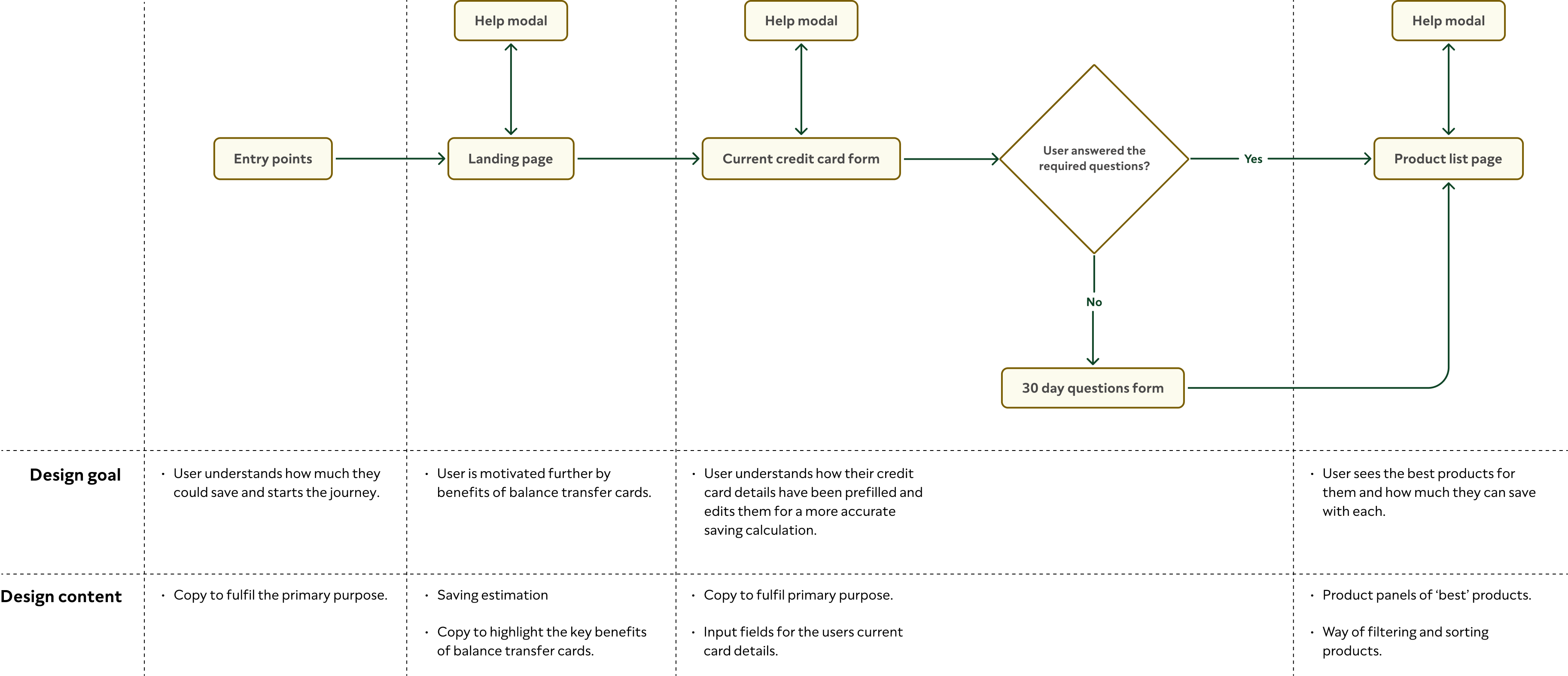

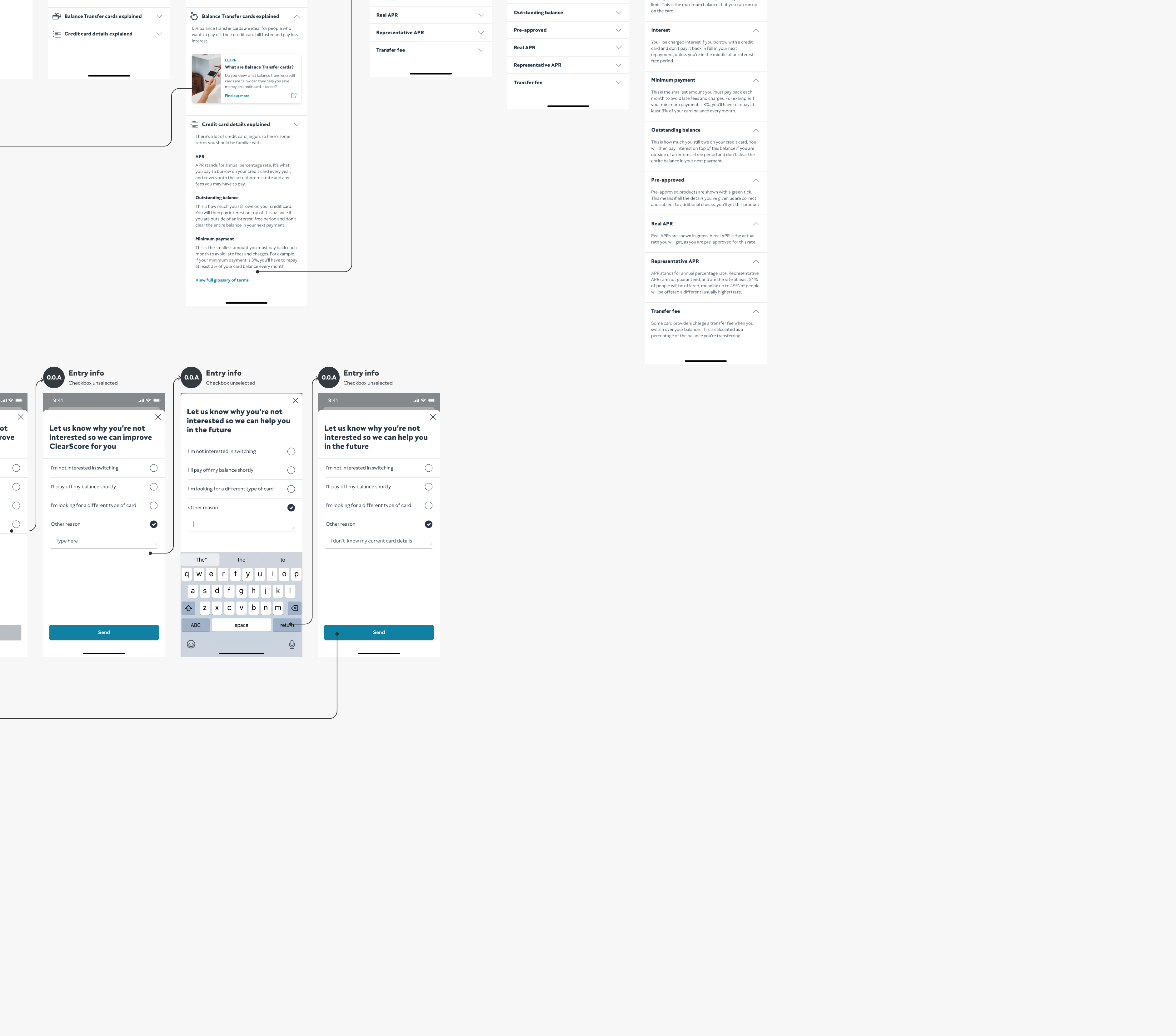

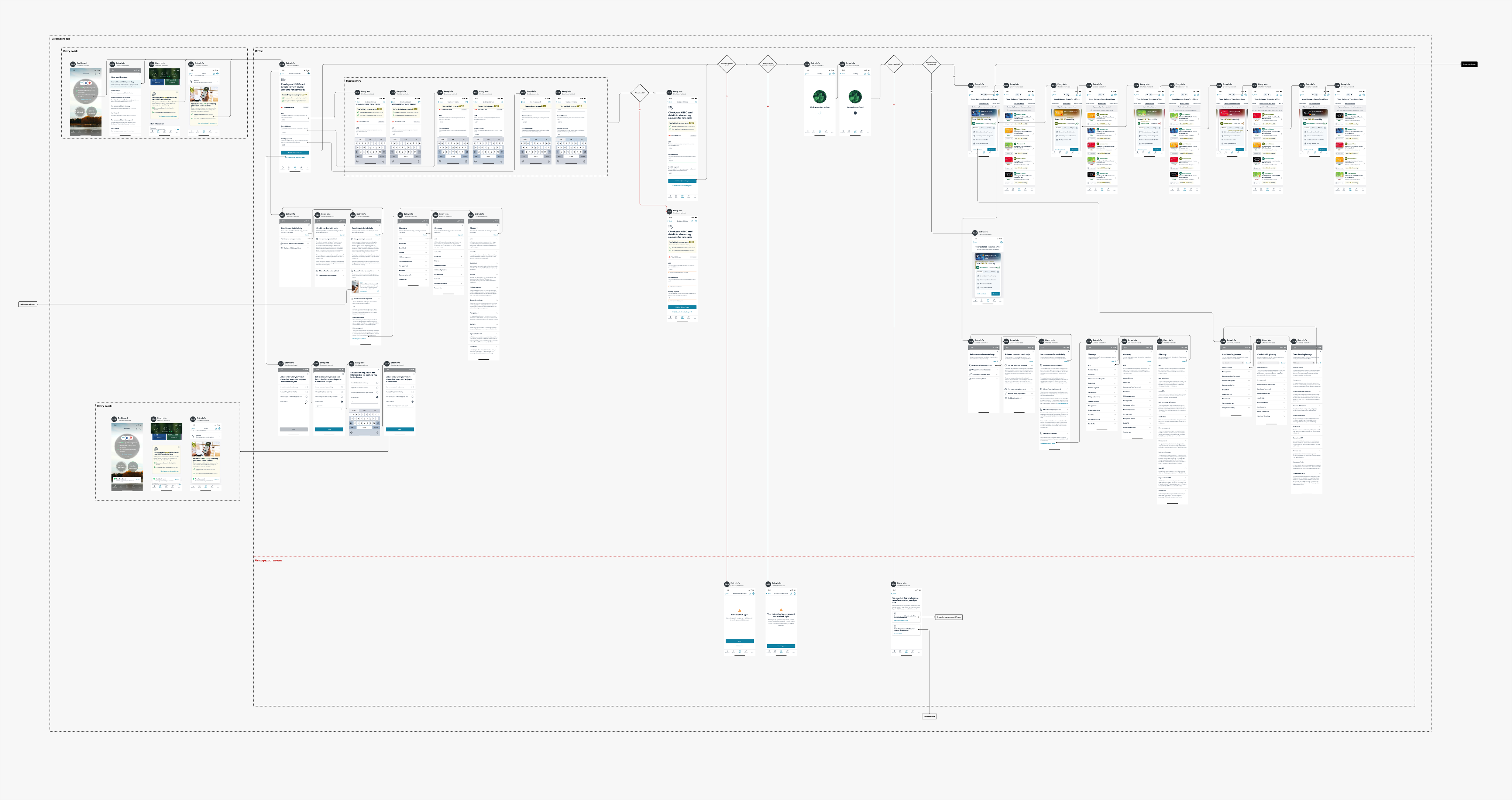

Screen Flow Diagram

deliver

Themes Problem Statements

DISCOVER

Themes Problem Statements

DISCOVER

Themes Problem Statements

DISCOVER

Themes Problem Statements

Sub title

DISCOVER

Themes Problem Statements

DISCOVER

Total number of user to apply through switch & save (in first 54 days)

1,471

Average calculated saving per apply click (in first 54 days)

£1,137

Estimated Total saving made for our users

(in first 54 days)

£1,672,527

If you like what you see

— Don’t be a stranger! ...

o.hardisty@me.com

Switch

& Save

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

overhead title

Detail

overhead title

Detail

overhead title

Detail

overhead title

Detail

Context & problem statement

Context

A large majority of users carry over balances on their credit cards, often paying high interests on this debt.

We’ve calculated that we could help save ~£200M across our users if they switched their credit cards to balance transfer cards available in our marketplace.

Users don’t currently know how much they could save with a balance transfer card and so are less motivated to switch.

‘Assumed’ user problem

Users with outstanding credit card balances often pay high interest without realising they could save by switching to balance transfer cards.

This leads to missed savings and low motivation to switch while managing their debt.

Existing relevant insights

- Over 231,000 users could save £576 on average by switching to a balance transfer card.

- Previous optimisations around ‘switching and saving’ have performed well.

- Personalised messaging always outperforms generic messages

Goals & Objectives

User value goals

- Delivering real savings by helping users reduce interest payments.

- Educate users on balance transfer benefits.

- Highlight personalised savings for users.

Business value goals

- Increasing card conversions from the marketplace.

- Boost engagement with balance transfer offers.

Success metrics

Metrics are measured against analytics from the live app.

Success

Ok

Fail

Percentage of users that apply from the new product list page

> 10%

7-10%

< 7%

Percentage of eligible users that start the new journey

> 10%

7-10%

< 7%

Target Audience

Requirements

- Users we predict can save above £100 by switching to a balance transfer card.

- Users with at least a 70% chance of approval for the balance transfer card.

- Users that have revolved a balance for the last 3 months.

- Active & semi-active users (logged in within the last 6 months)

- Users who are not flagged to be on a 0% promotional rate

- Users with credit score above 300.

Personas

ClearScore has 6 personas — 4 of these are a target audience for this project and described below:

Money Maker - Maria

High earner with strong credit, rarely uses ClearScore.

Growth Phase - Grace

Busy working mum, tech-savvy and credit confident.

Mutual Resources - Mike

Older self-employed user, focused on clearing debt, uses ClearScore occasionally.

Deal Seeker - Deepak

Budget-savvy dad, always hunting for savings, uses ClearScore often.

Design Requirements

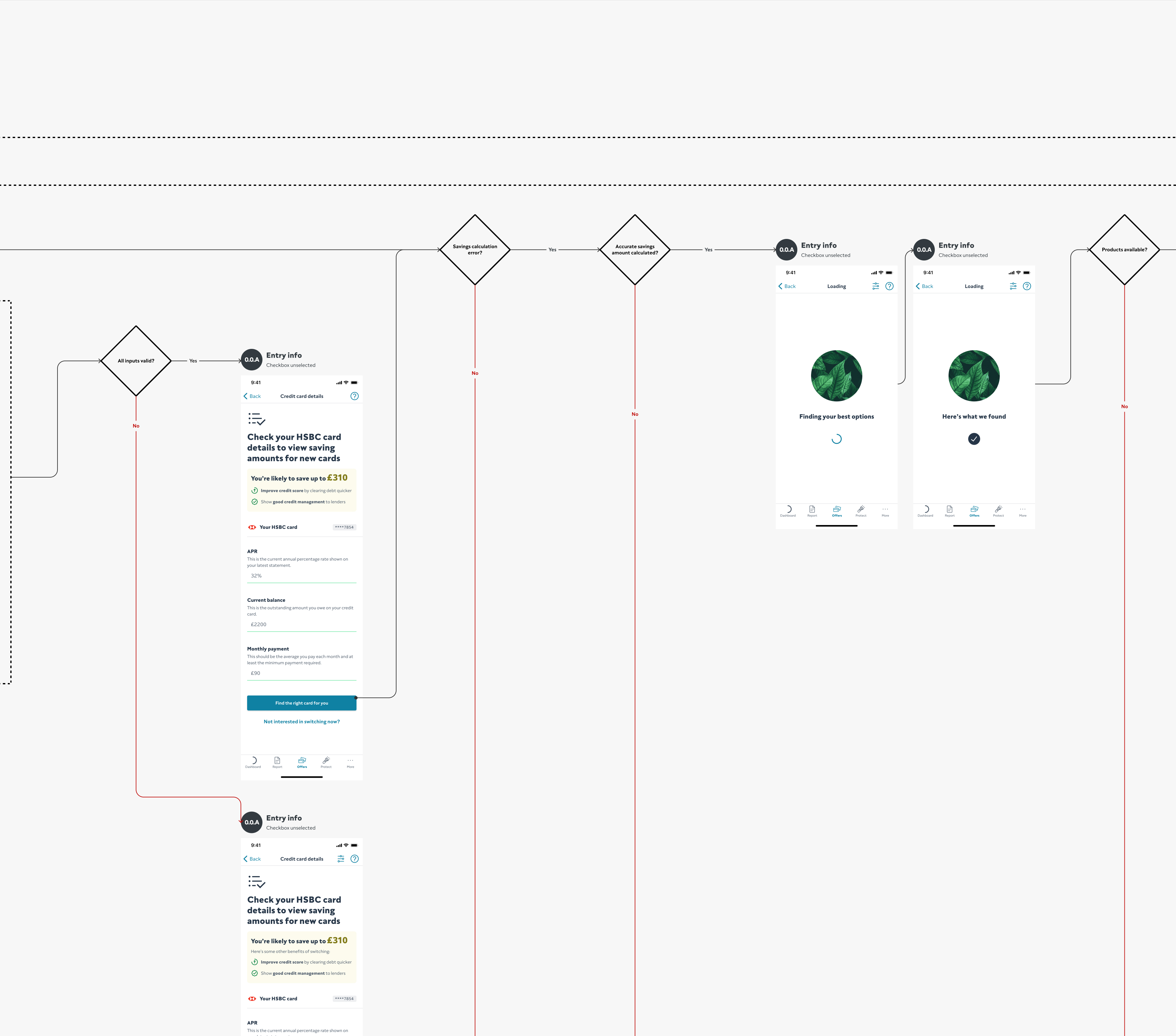

- Savings Calculation

• Show real-time savings using actual card data (APR, balance, payment).• Only calculate after eligible cards are returned.

- API Integration UX

• Trigger panel search via partner APIs. • Handle delays with smooth loading/progress indicators.

- Pre-condition Logic

• Require Offers flow completion (30-day + credit card). • Integrate into journey as needed.

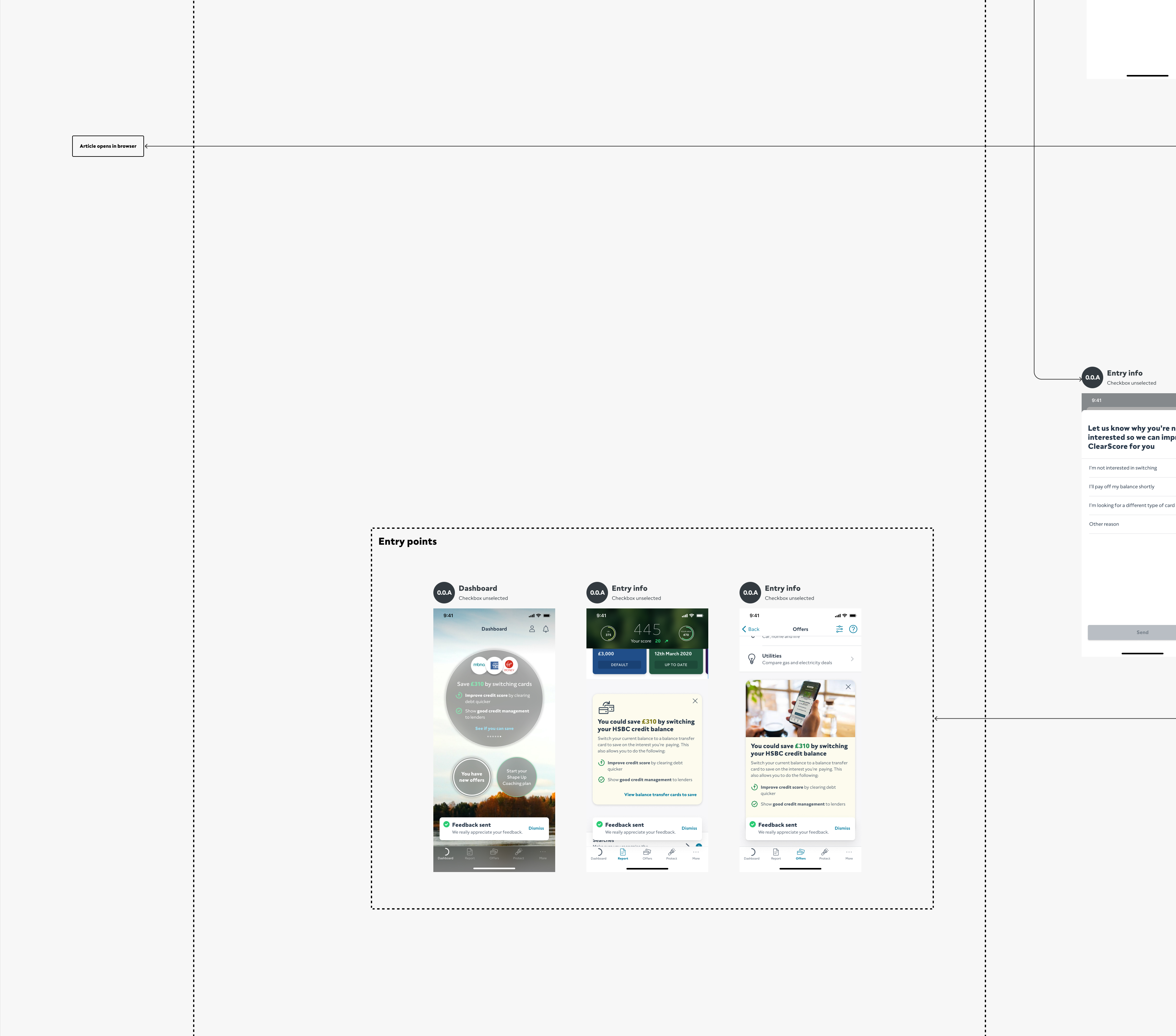

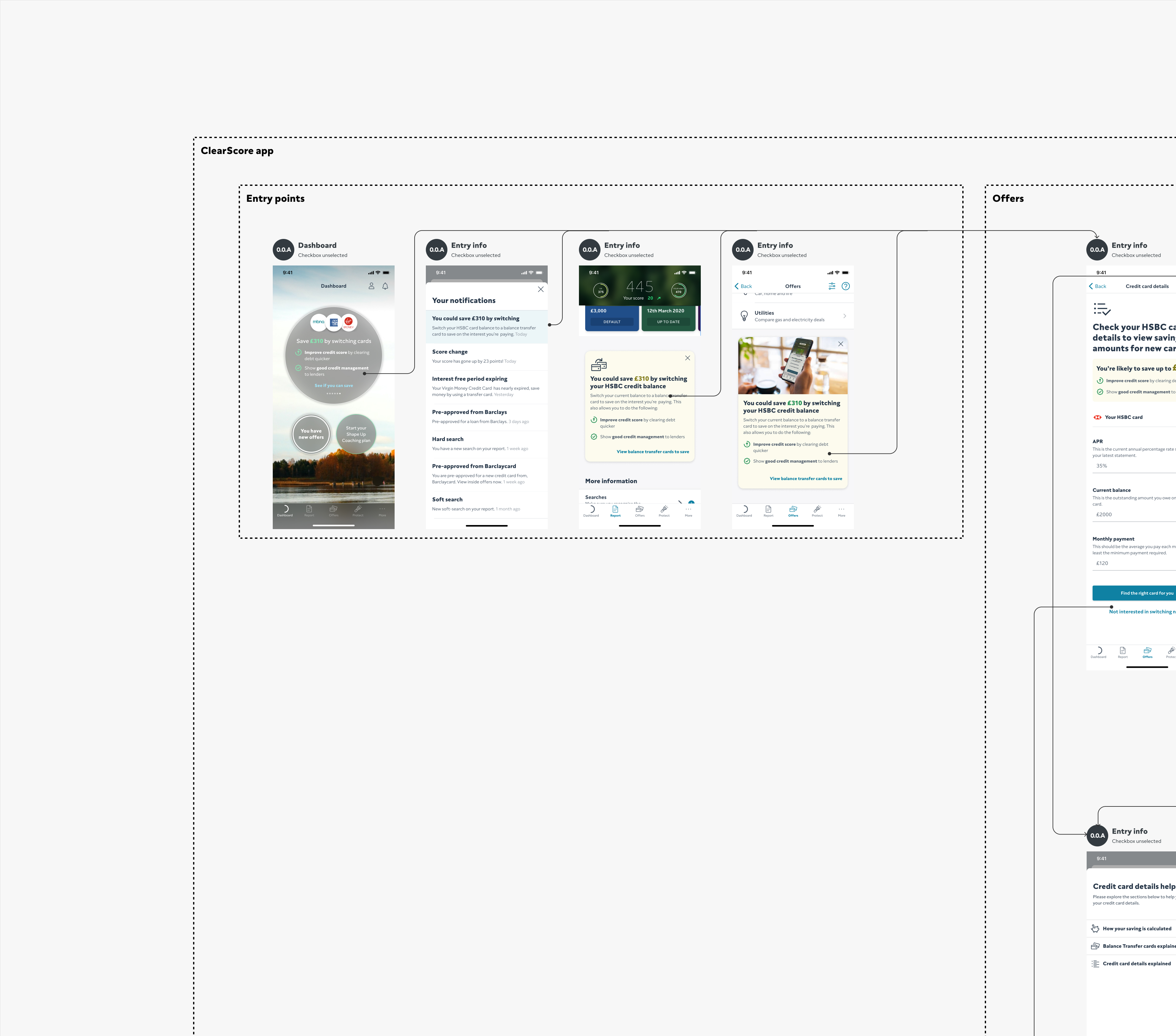

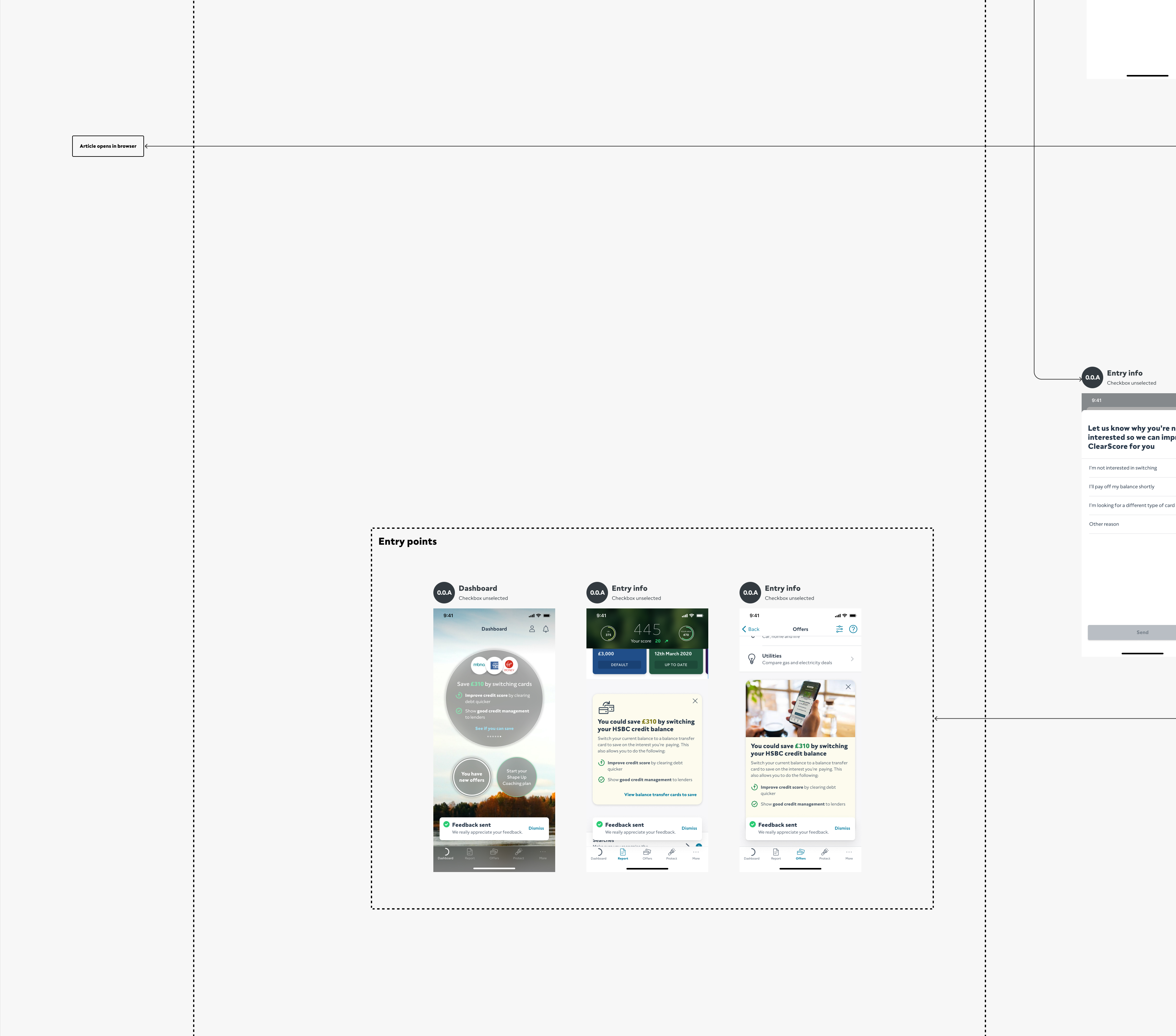

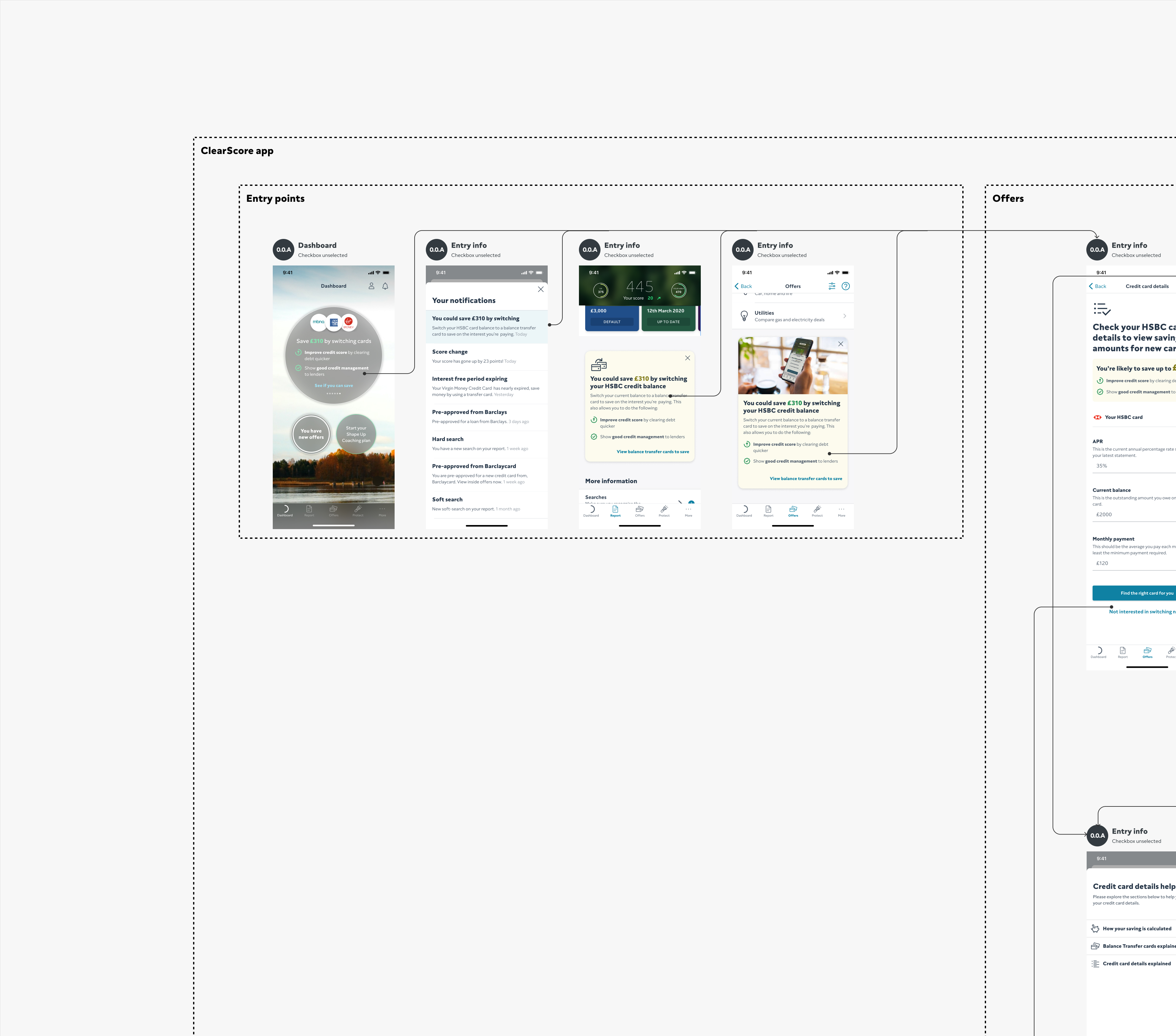

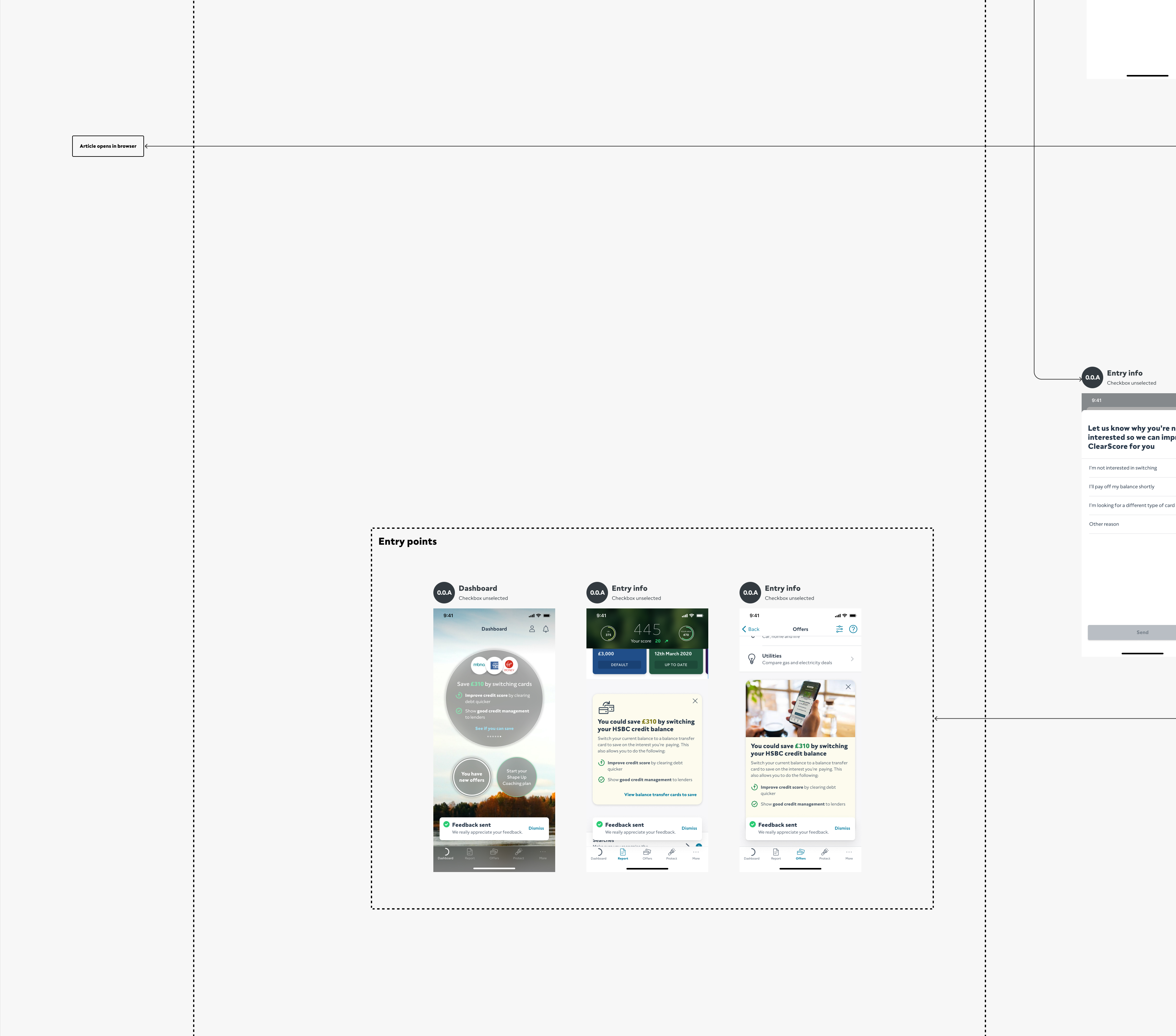

- In-App Entry Points

• Add entry points from dashboard, cards tab, or credit report. • Target users with card debt or interest.

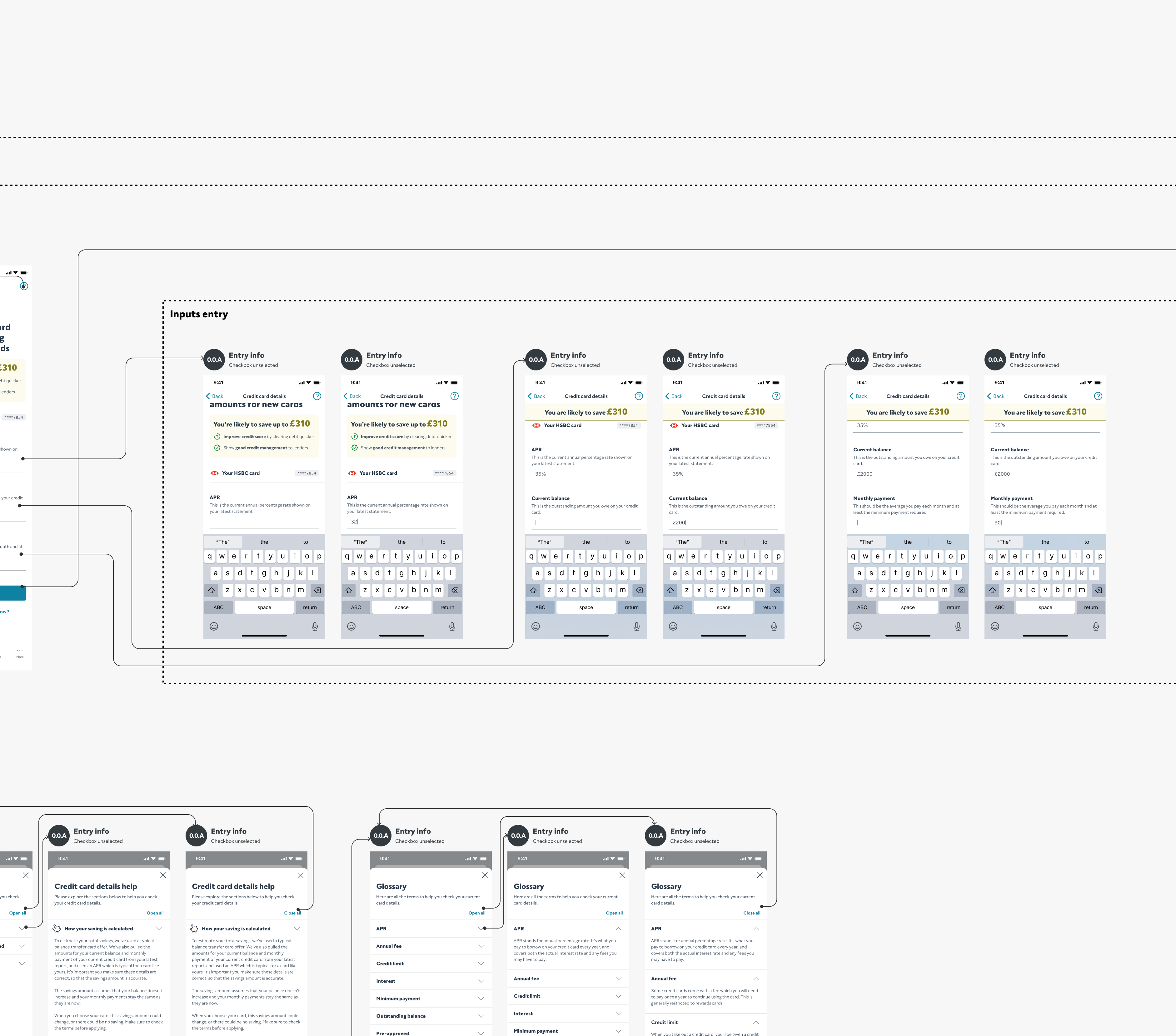

- Existing credit card input

• Allow editing of card details (APR, balance, payment).

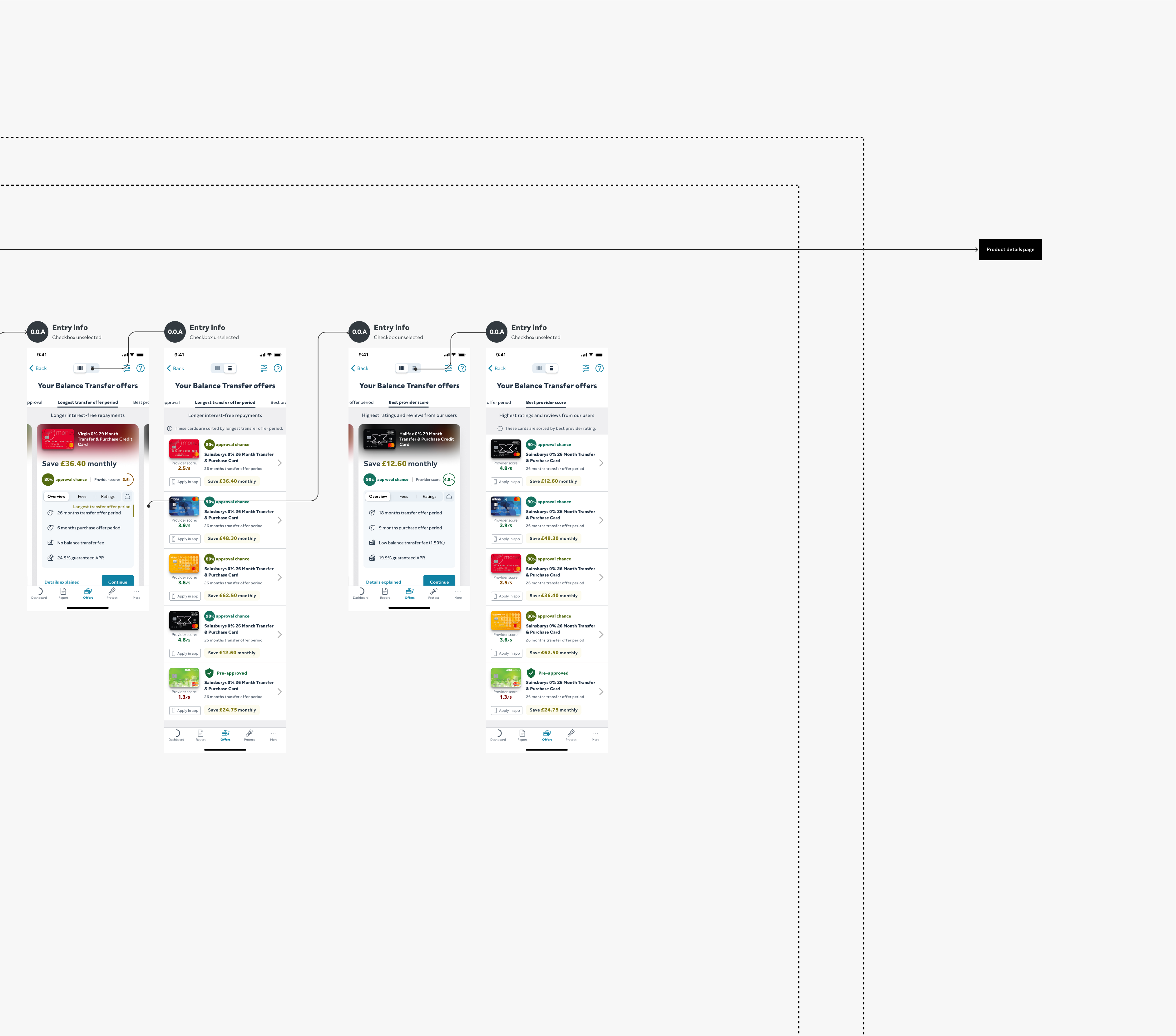

- Results Presentation

• Show savings for top 1, 3, or all eligible cards. • Include APR, terms, eligibility, example. • Link to product pages.

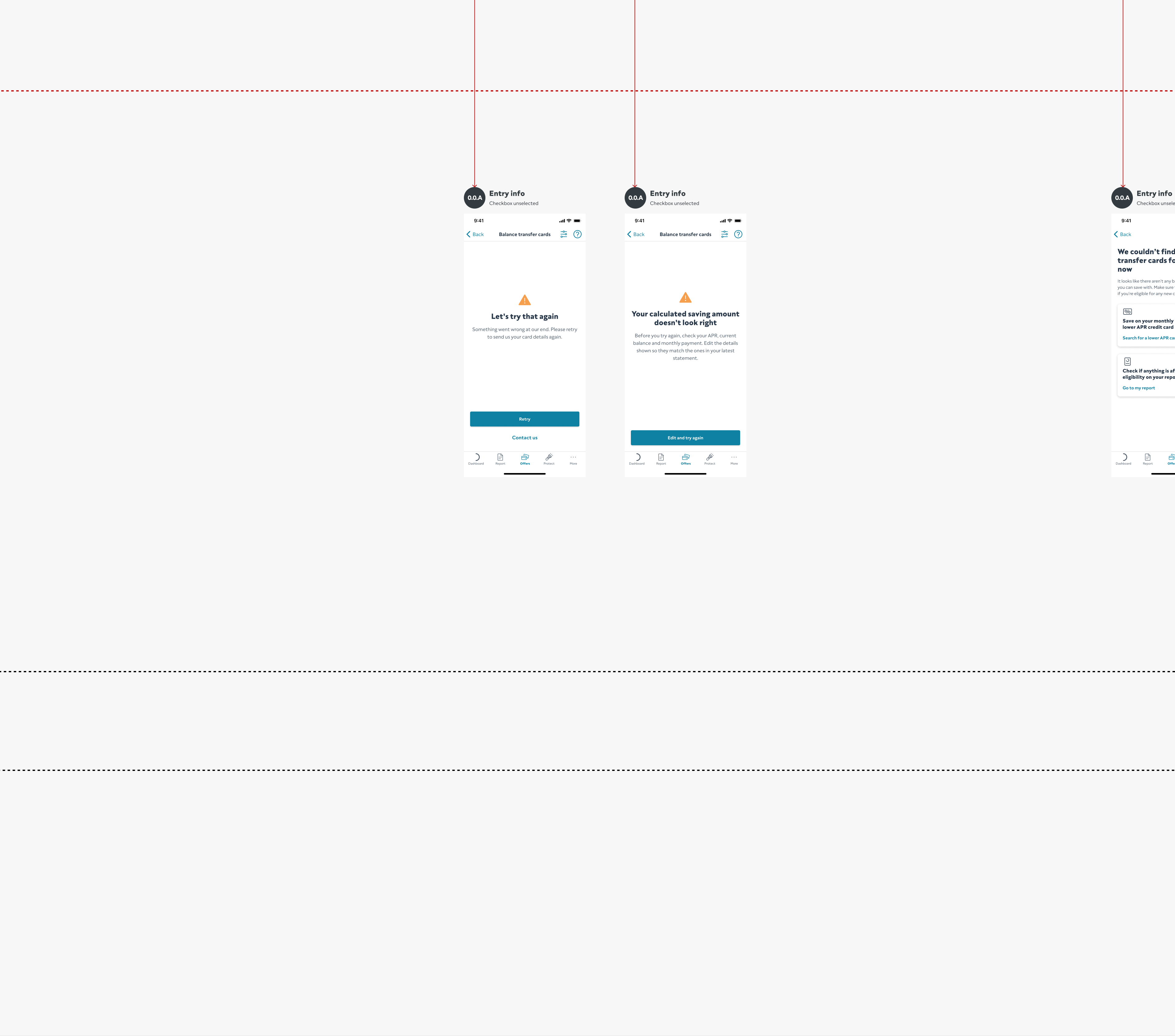

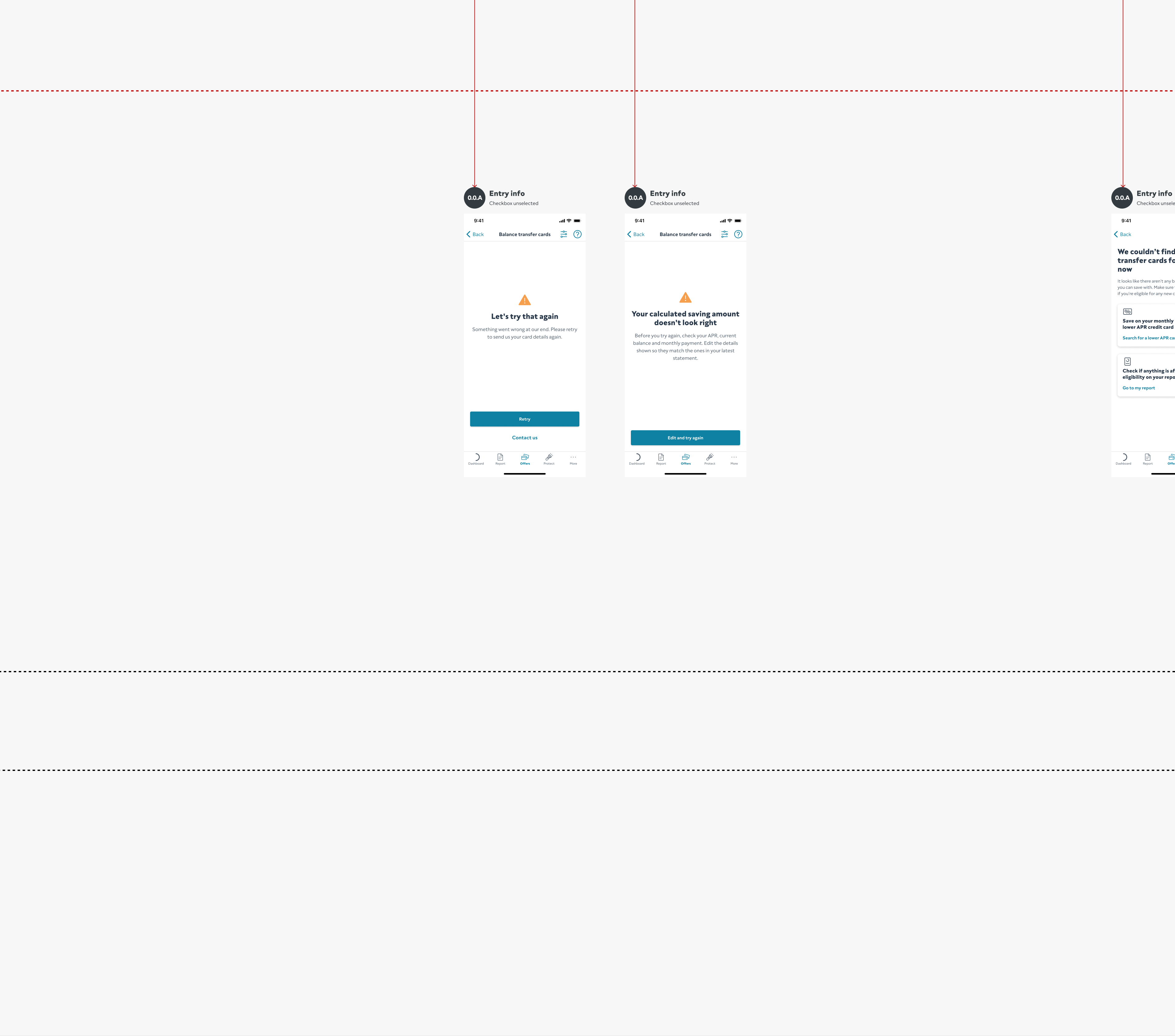

- Unhappy Path

• Fallback if no savings or BT cards. • Suggest next steps or alternatives.

Design stage 1 OF 4

Discover

Our initial problem statement was based on the saving calculation and success of related optimisations. So needed to know users thoughts about switching or why users are not saving on their interest payments.

Assumed Problem Insights

DISCOVER

Research Topics Gathering

DISCOVER

Research Prioritisation

Importance knowledge matrix

DISCOVER

Top Priority Research Delegation

DISCOVER

Research Questions & Goals

DISCOVER

Persona Prioritisation

DISCOVER

Design stage 2 OF 4

Define

We needed to refine the numerous research findings into the most relevant insights and a thorough problem definition to start ideating from.

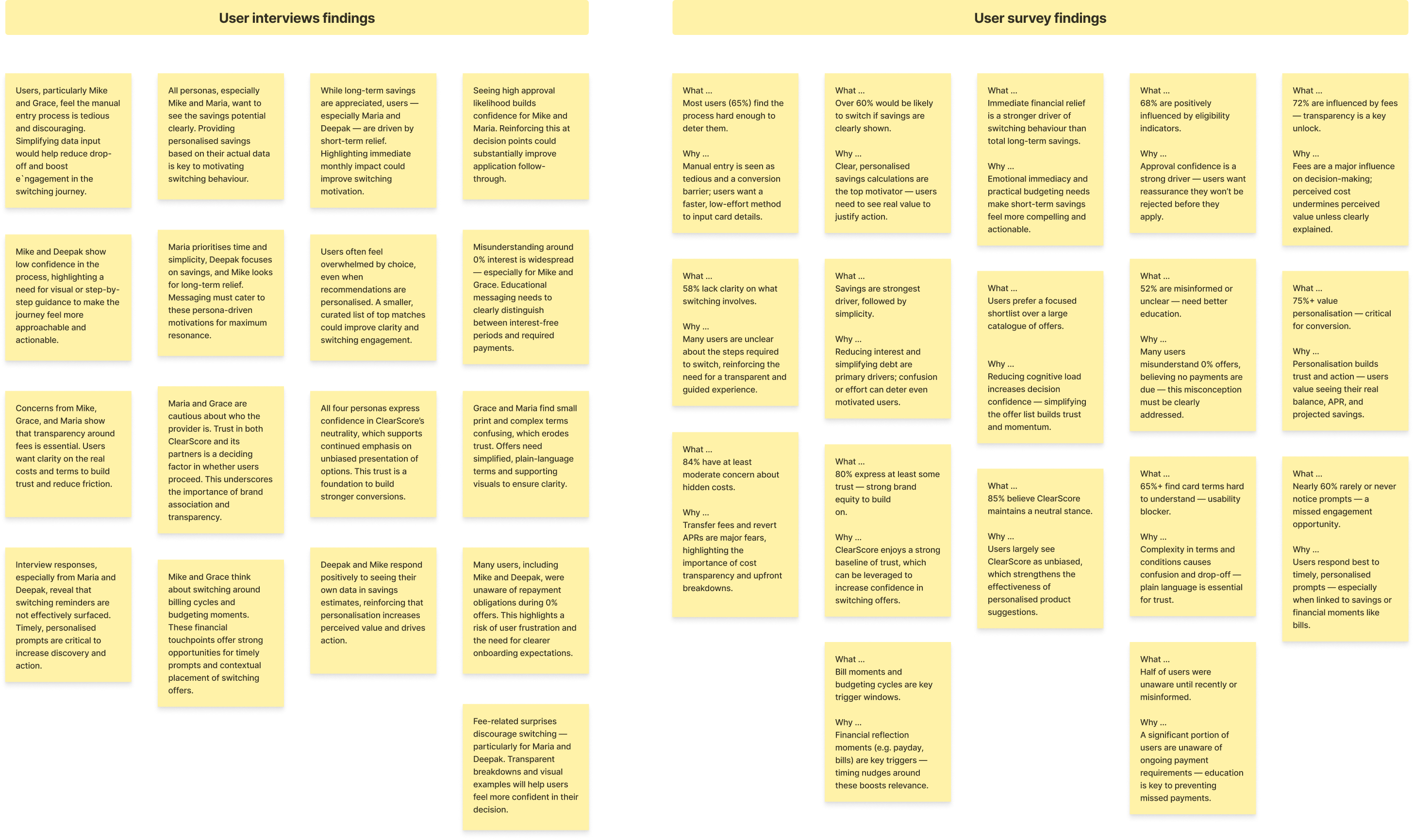

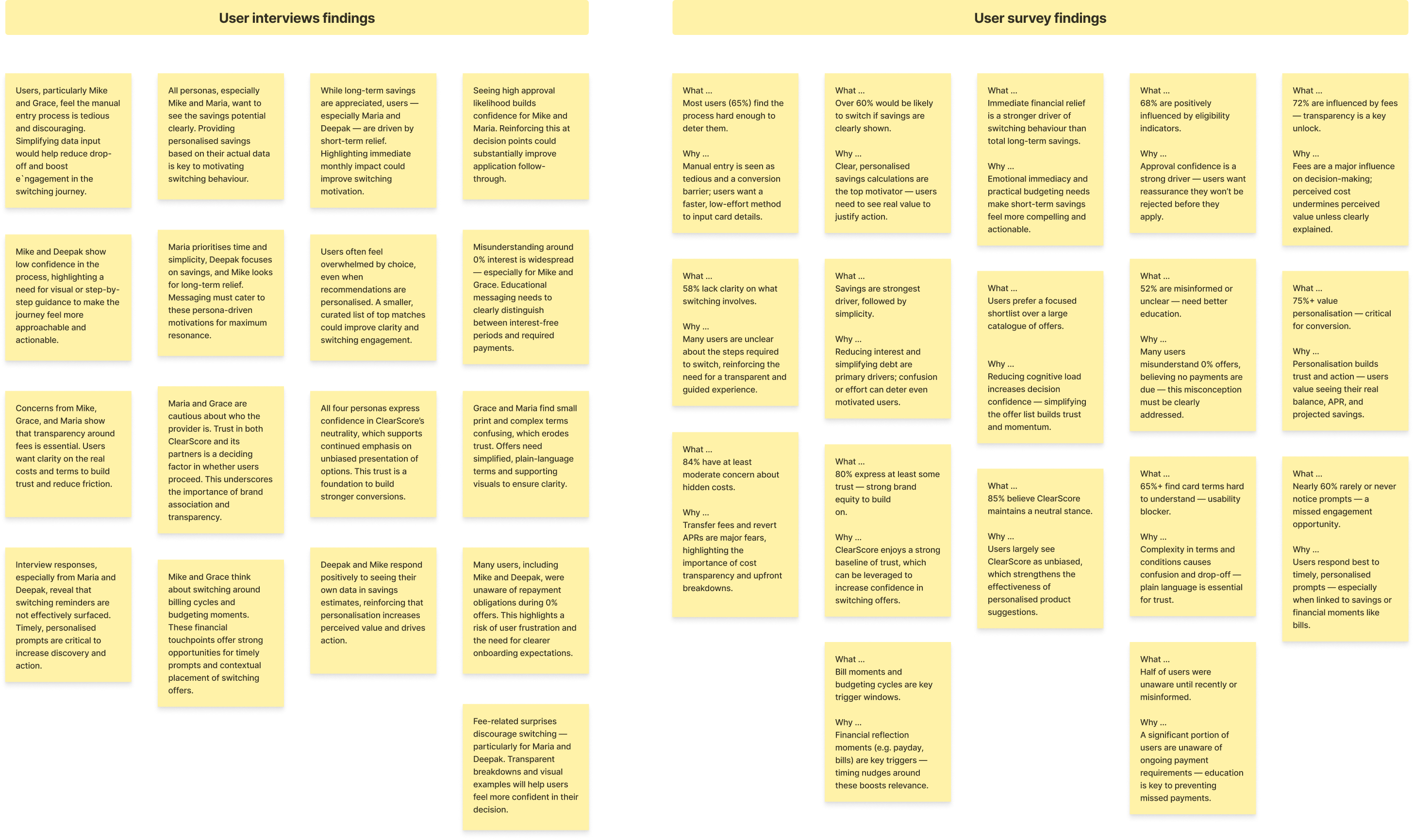

Unstructured Research Findings

Define

Findings Themes

Define

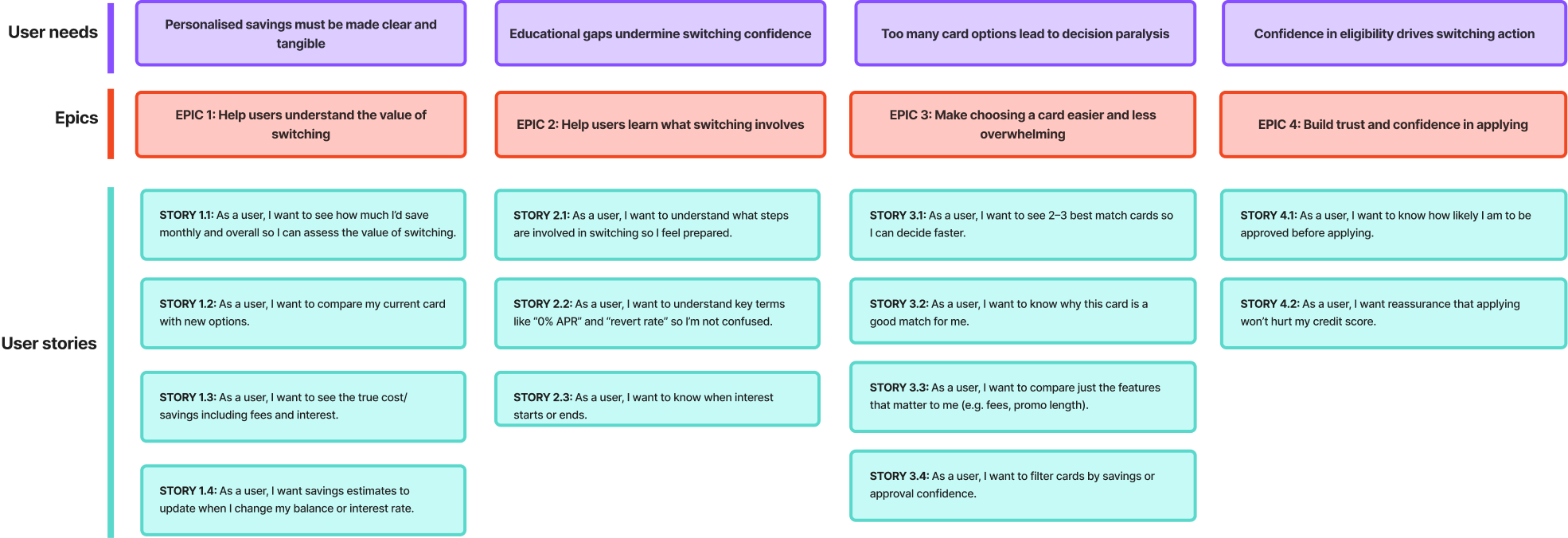

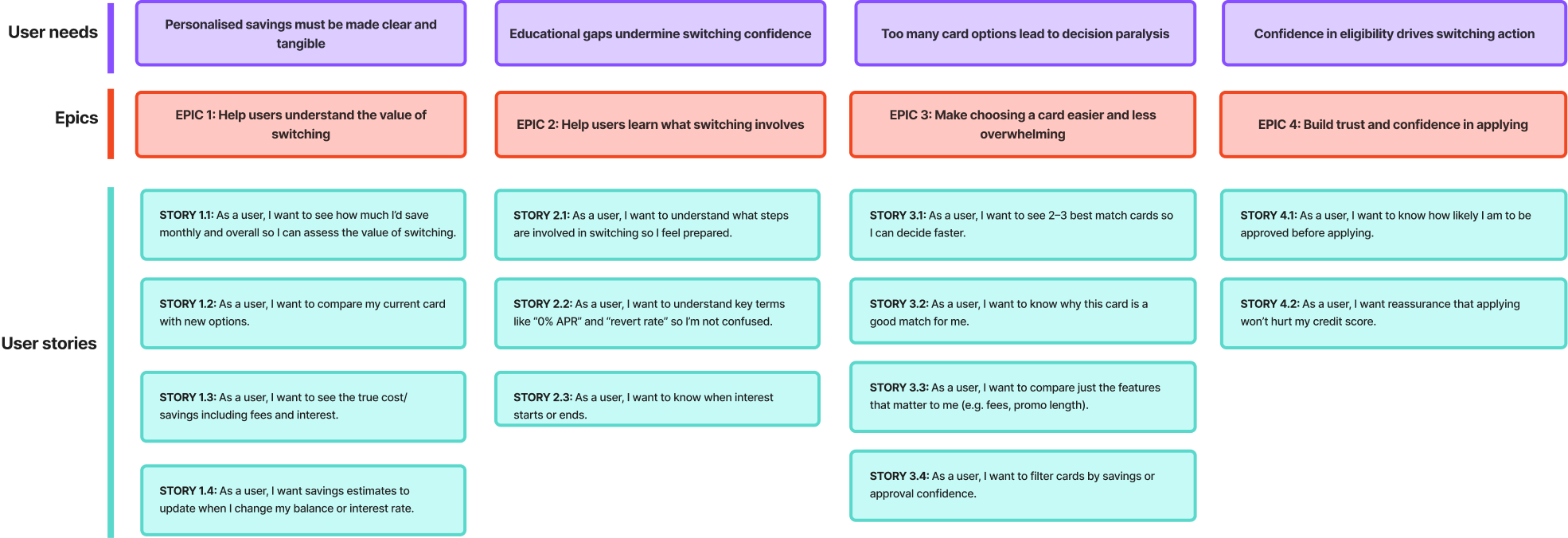

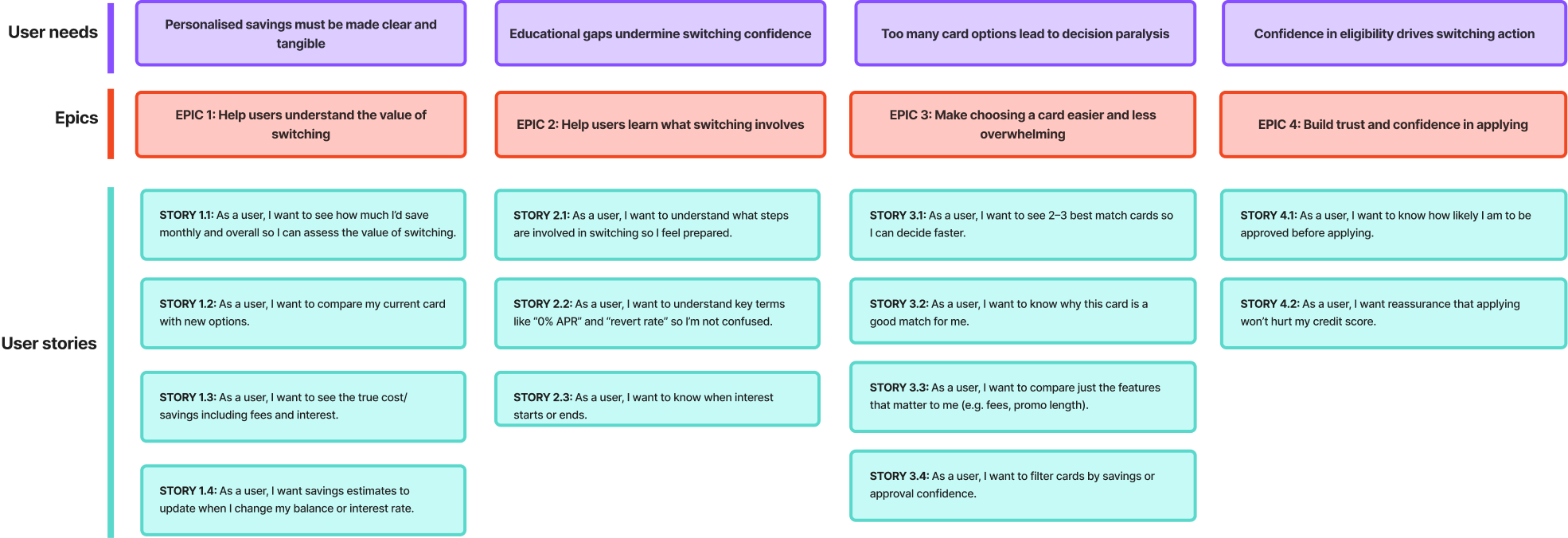

Key Research Insights

Insight 1

Personalised savings must be made clear and tangible

Users are more likely to switch when they clearly see how much they personally will save, presented at the moment they’re comparing options, rather than generic or abstract savings claims.

Insight 2

Educational gaps undermine switching confidence

When users don’t understand switching steps or terminology early in the journey, uncertainty builds and even motivated users hesitate or drop off.

Insight 3

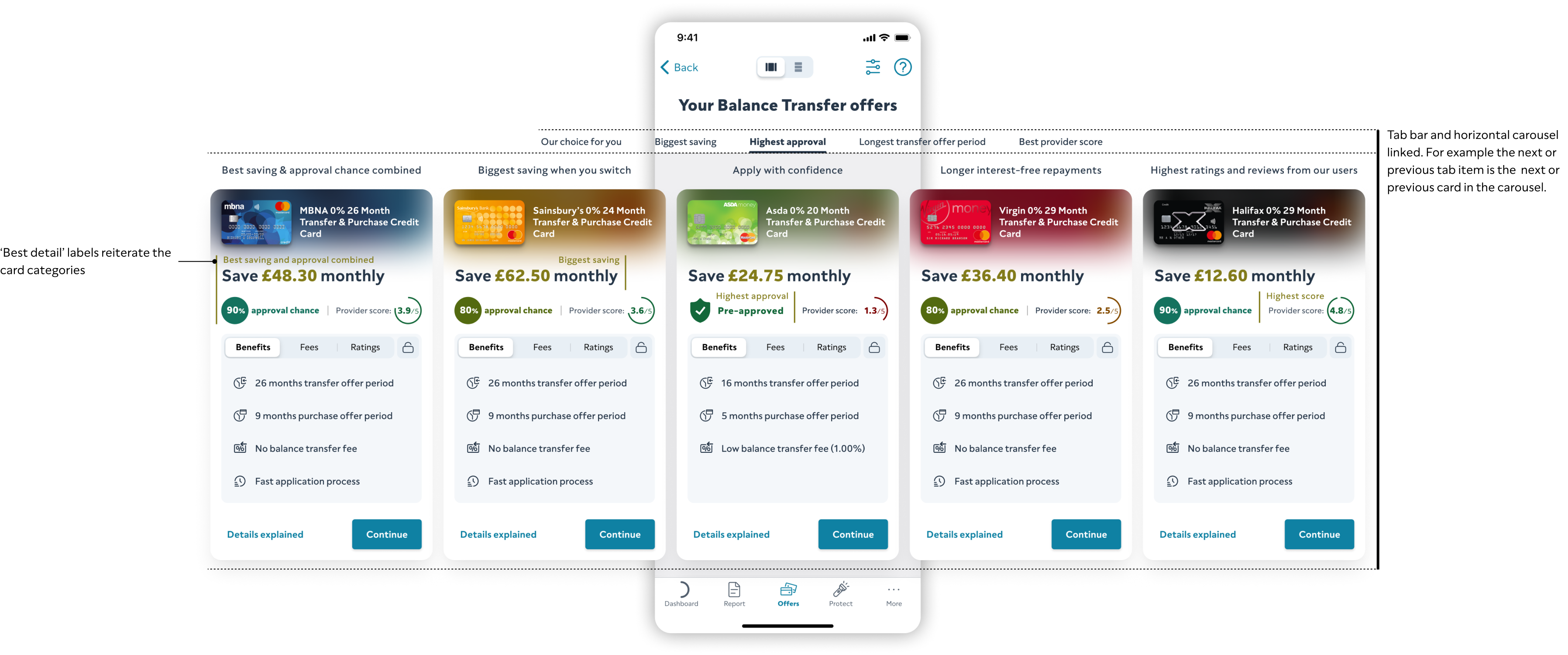

Too many card options lead to decision paralysis

Large lists of similar offers overwhelm users during comparison, making it harder to choose and increasing indecision and abandonment.

Insight 4

Confidence in eligibility drives switching action

Users are more willing to apply when they feel confident they’ll be approved; fear of rejection or credit impact causes them to avoid offers, even when eligible.

‘Researched’ user problem

ClearScore users with credit card debt who are open to switching often feel uncertain and overwhelmed when exploring options in the app.

Unclear savings, a confusing process, and low confidence in approval prevent them from switching, even when it could reduce costs and interest payments.

Design stage 3 OF 4

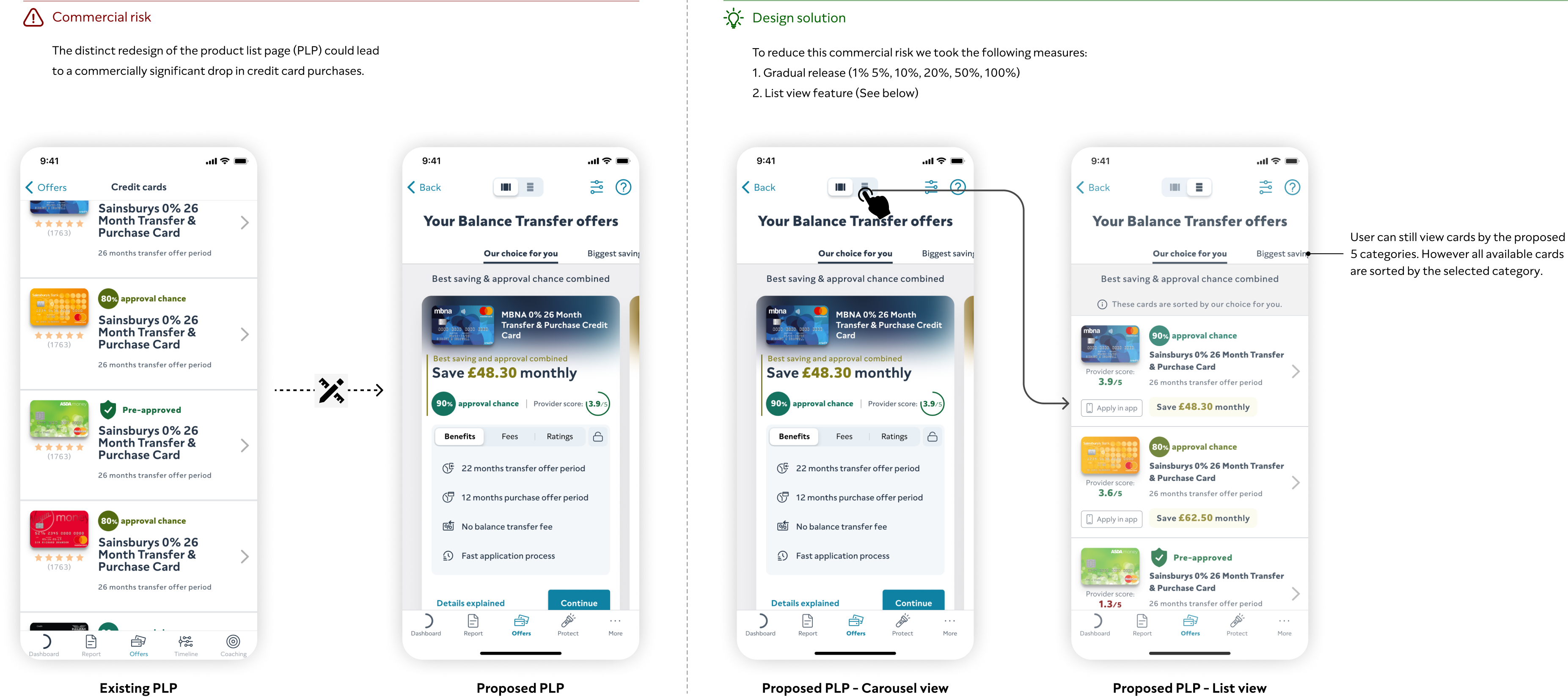

Develop

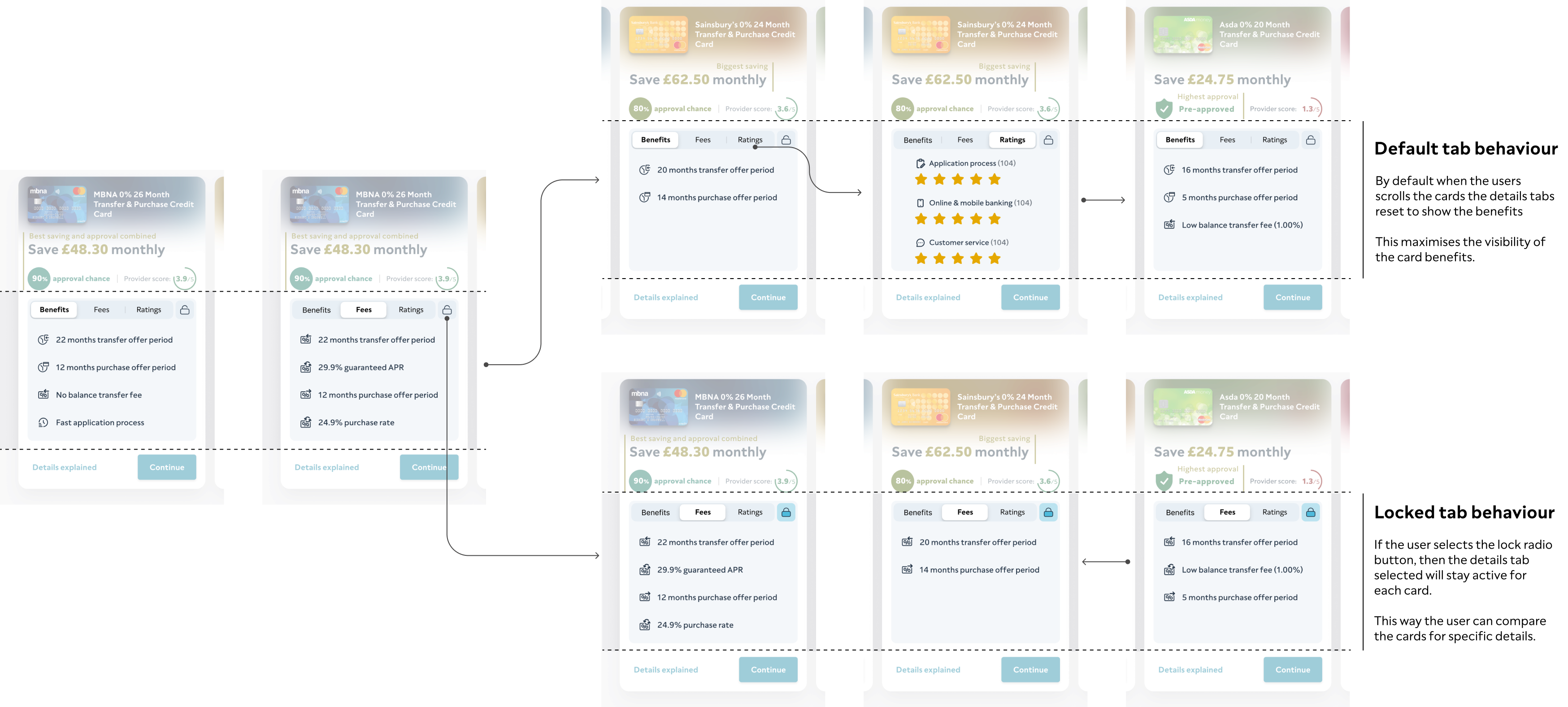

With key insights identified and the problem defined, I started developing solutions – from the user flow through to conceptual UI.

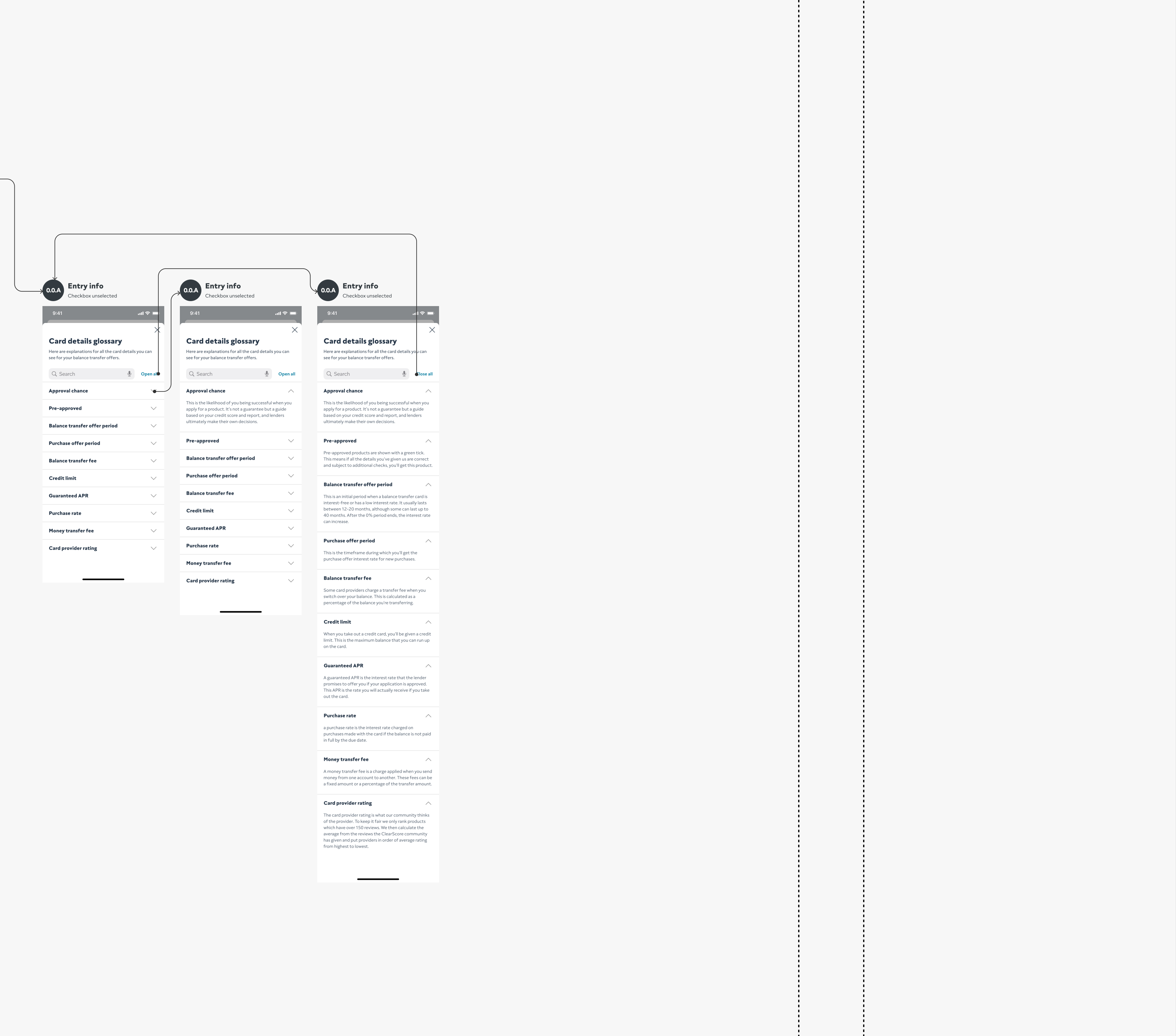

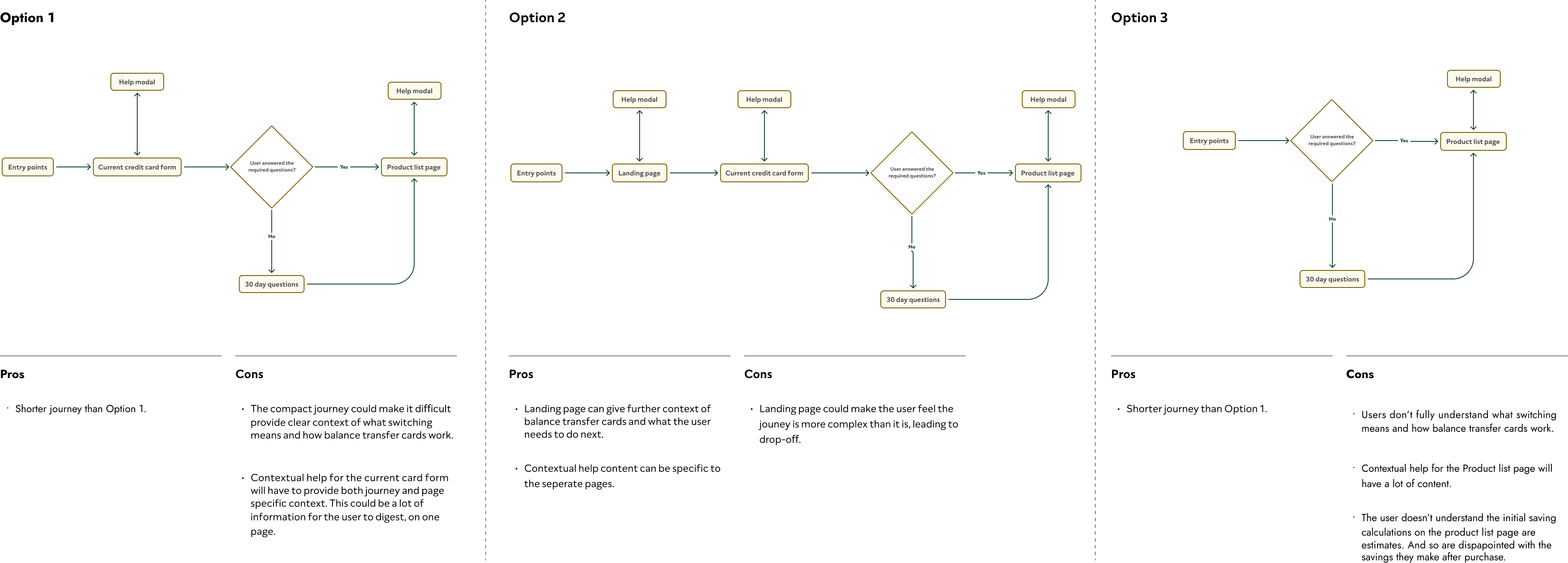

User Needs, Epics & Stories

develop

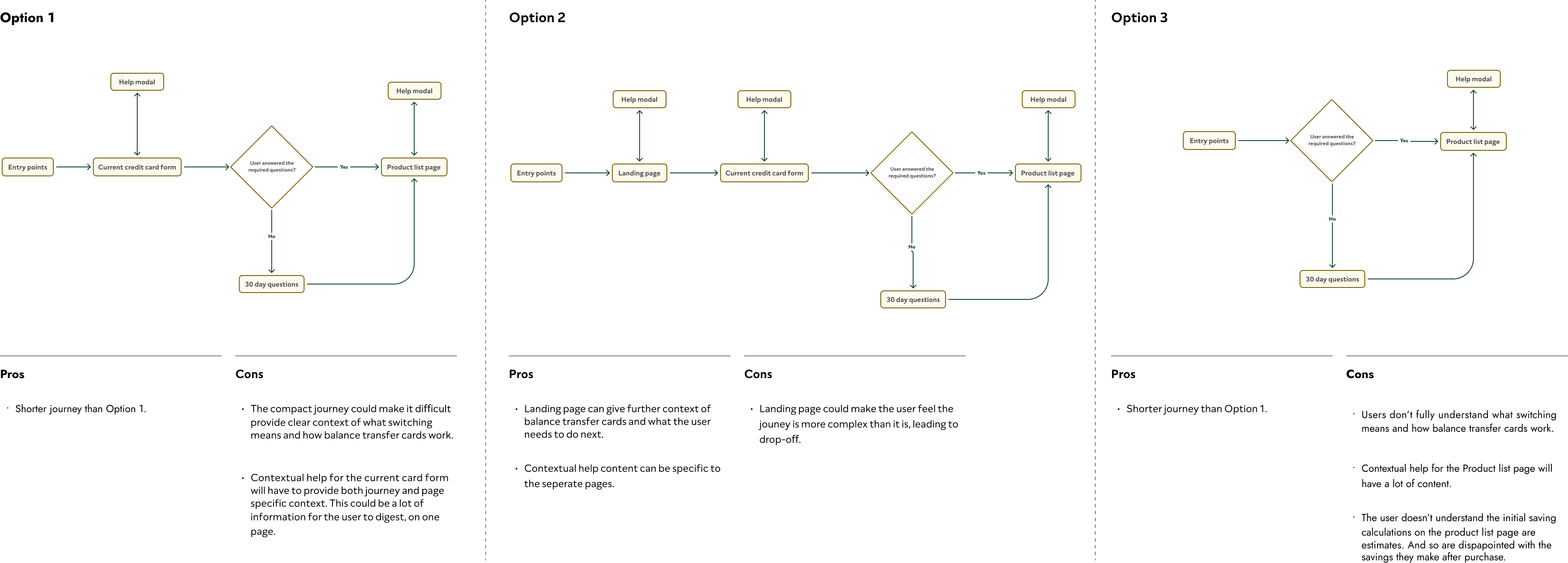

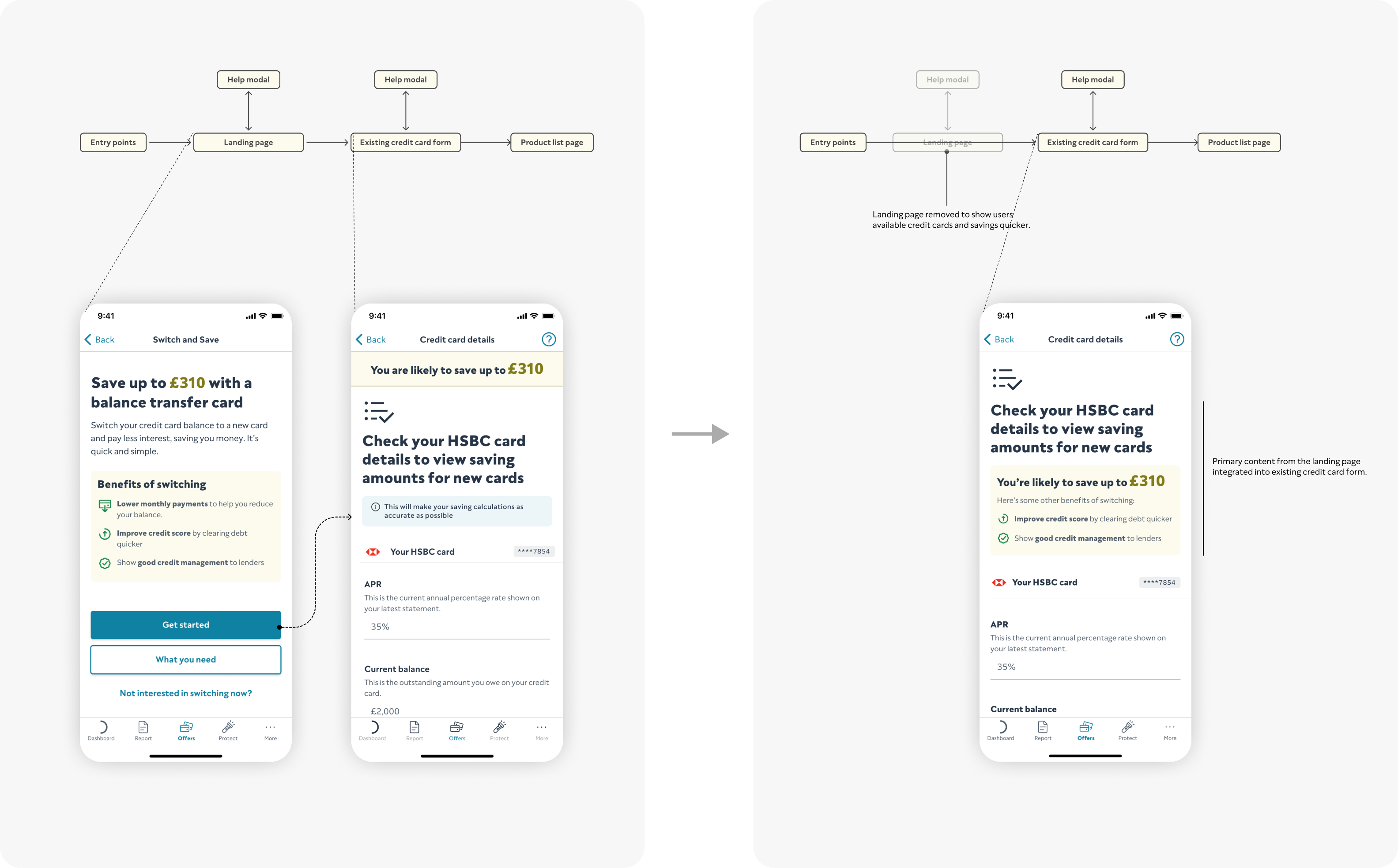

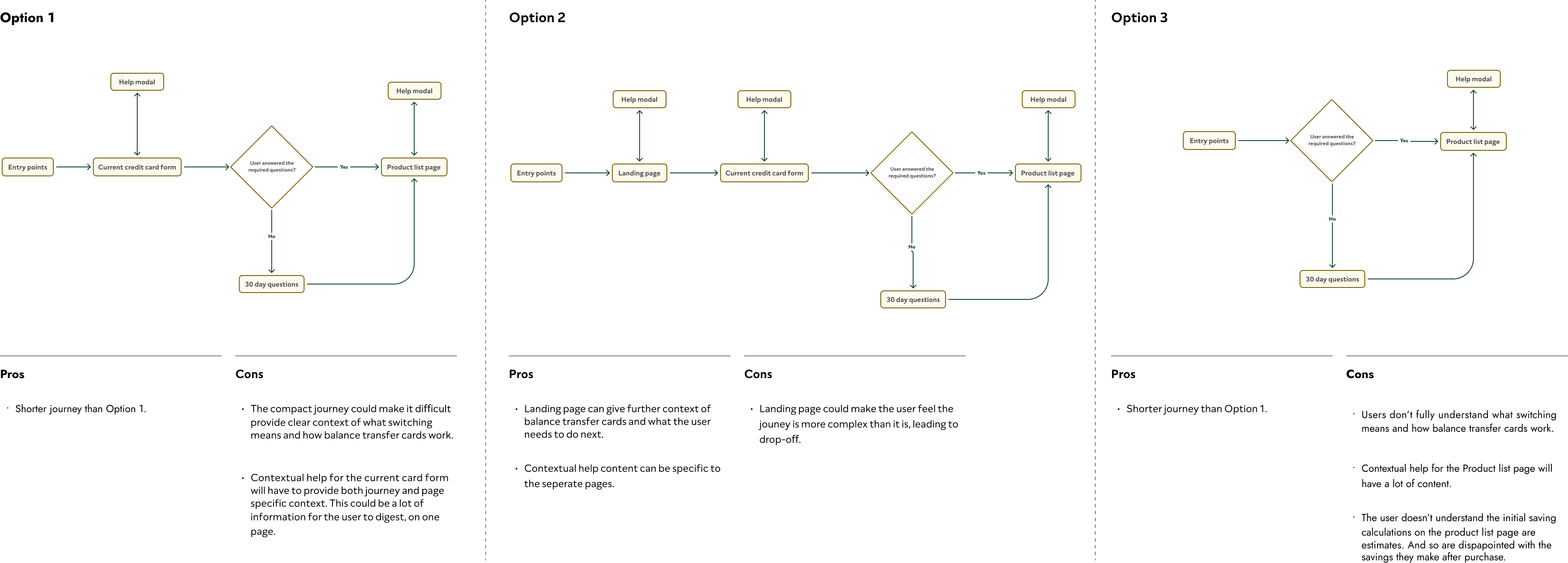

User flow options

develop

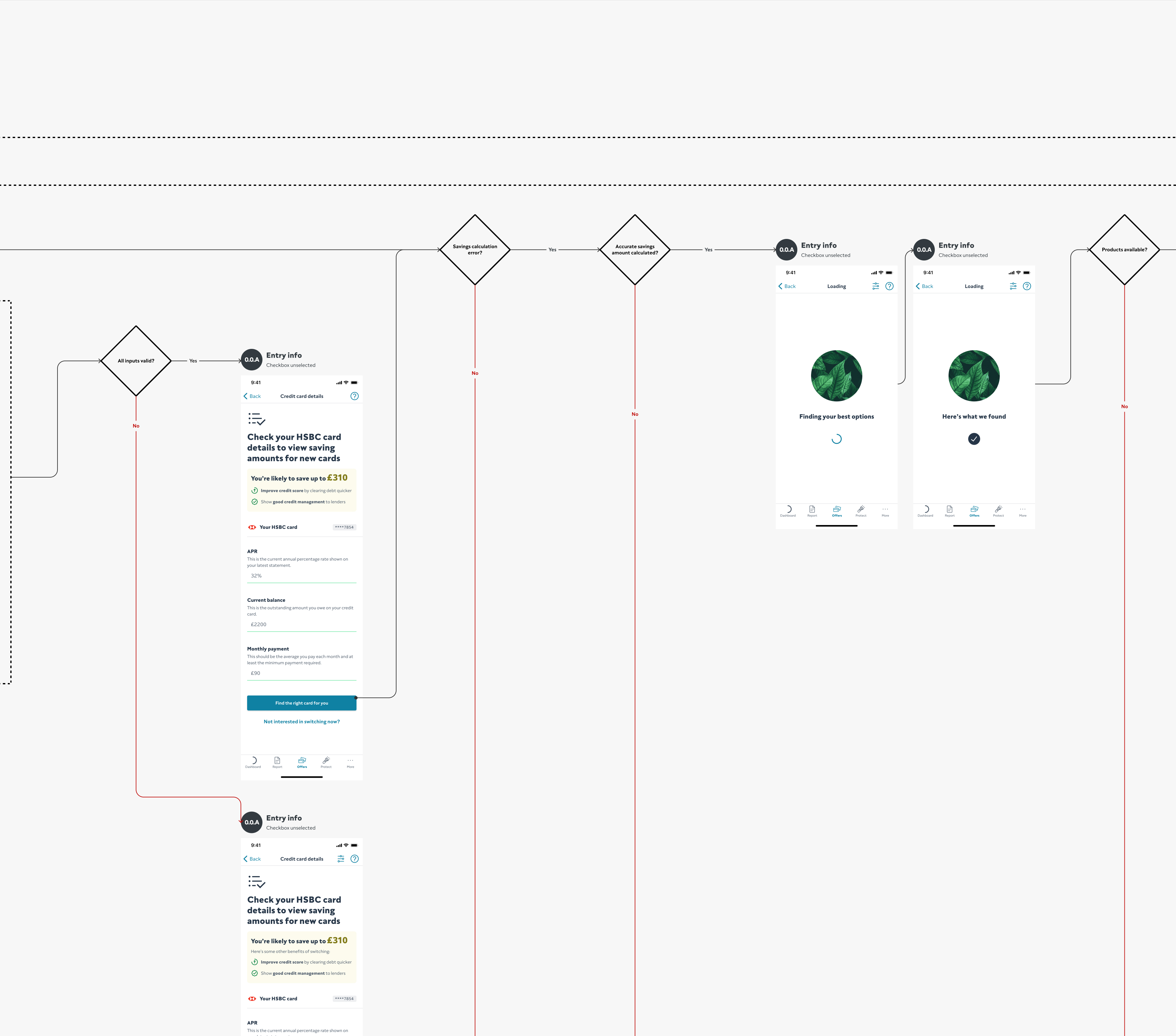

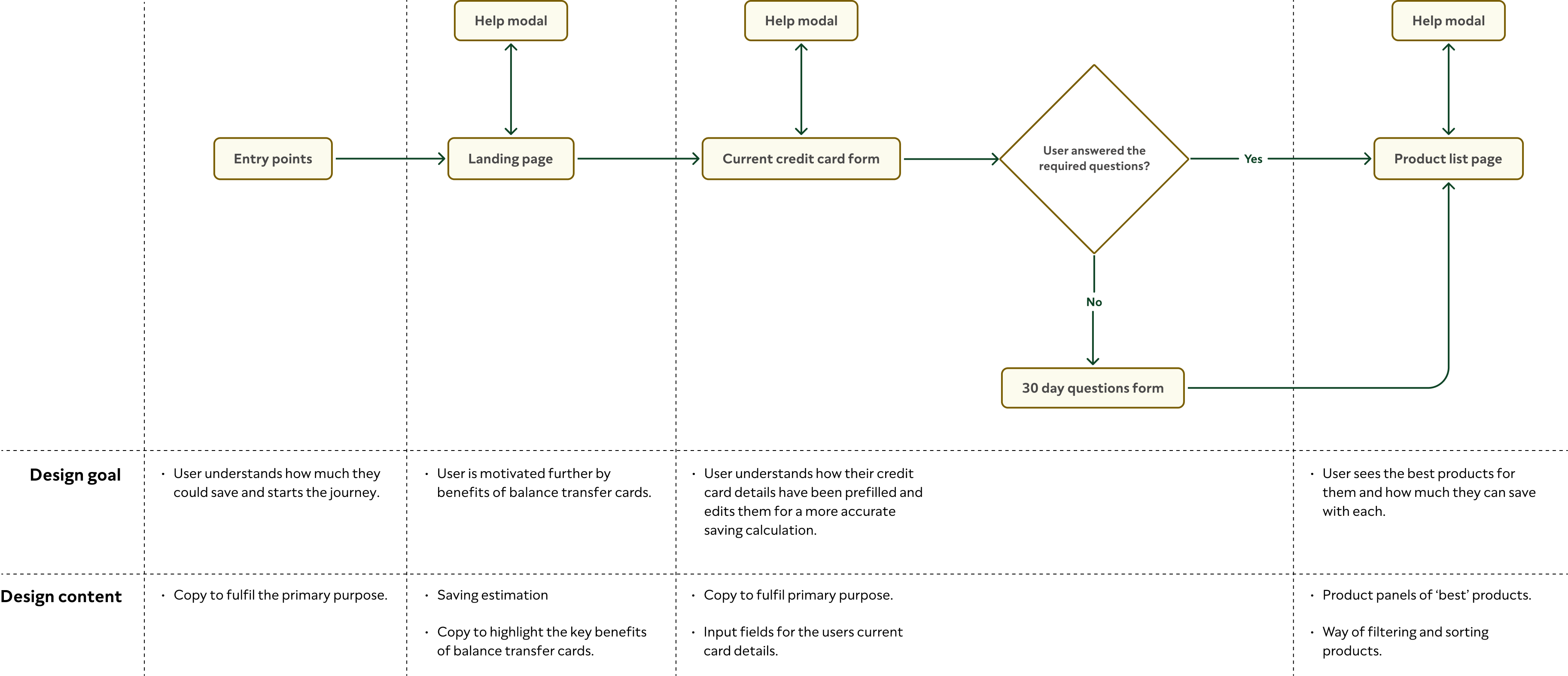

Chosen User Flow

develop

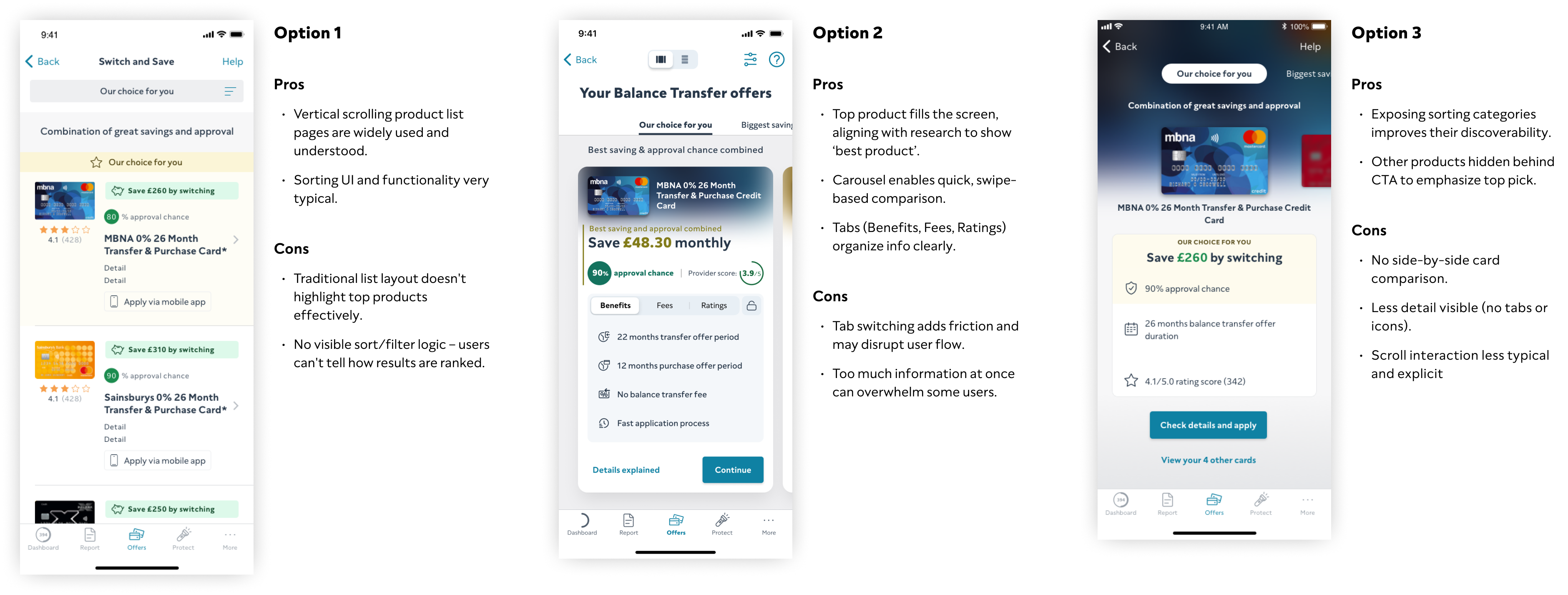

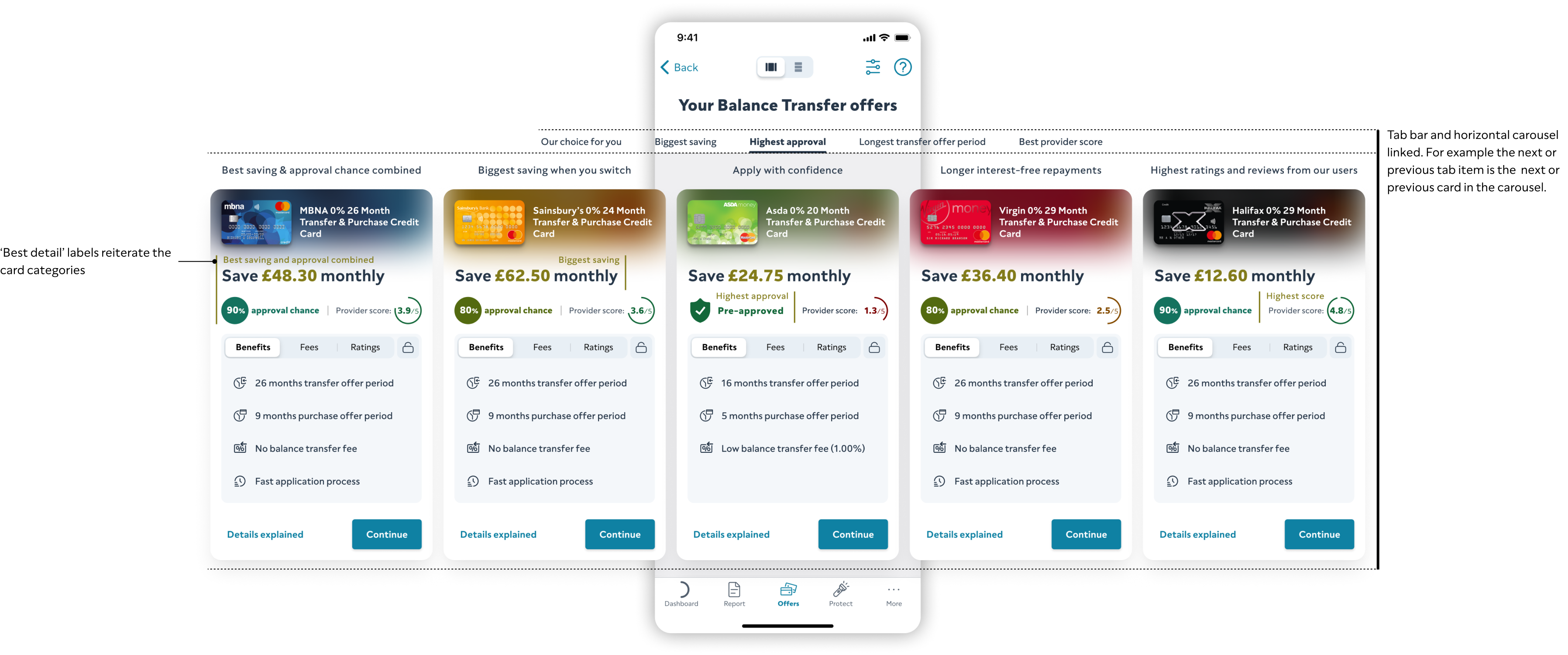

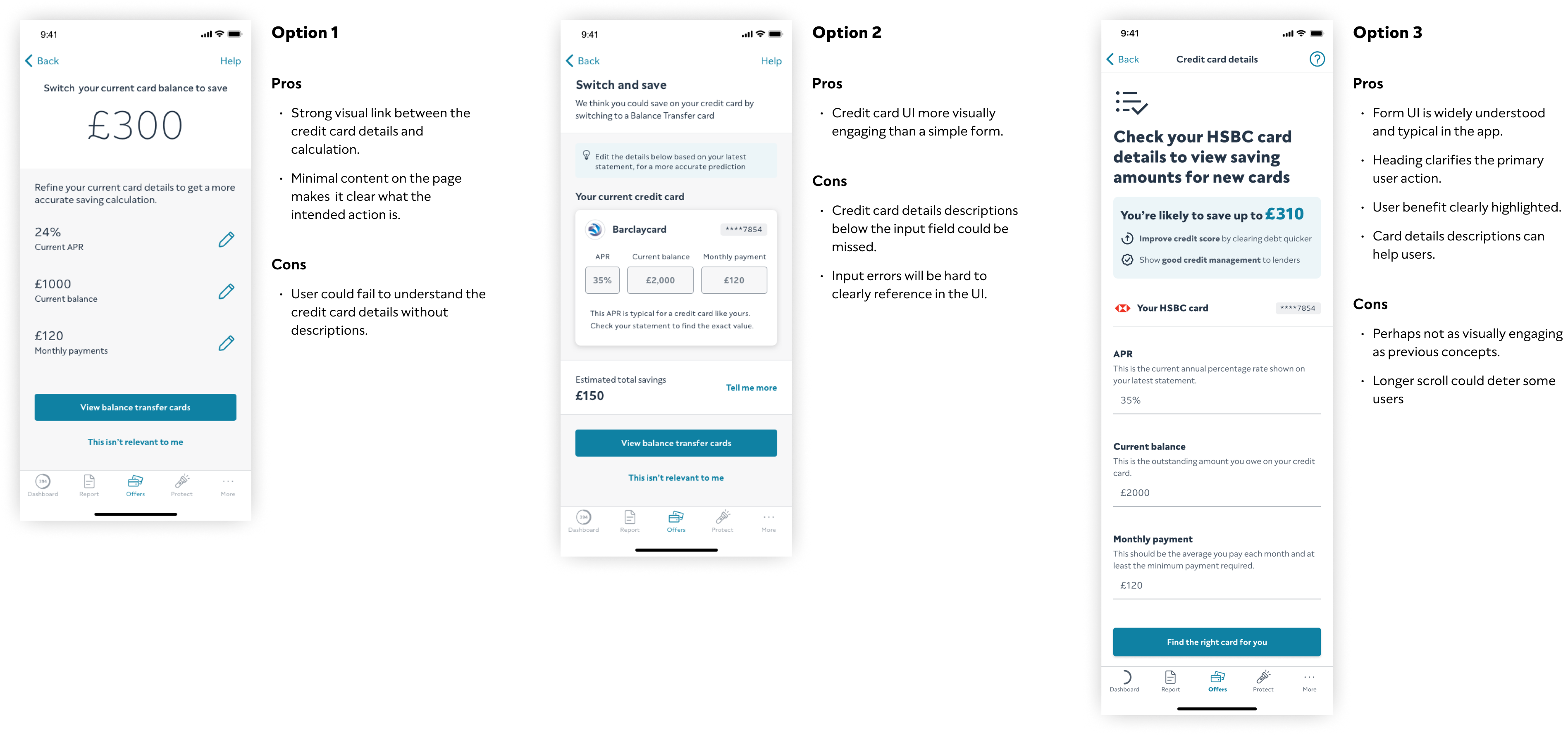

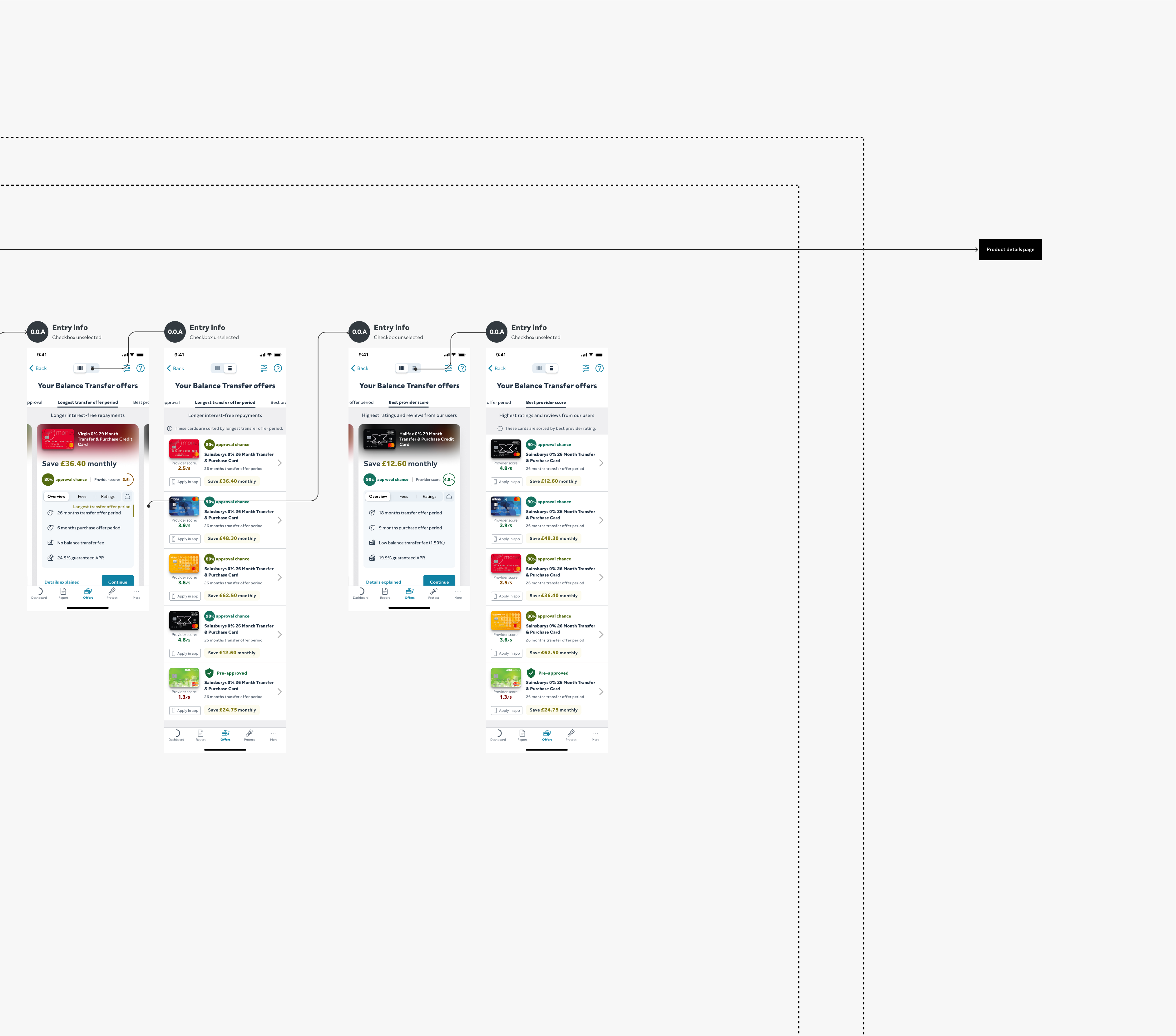

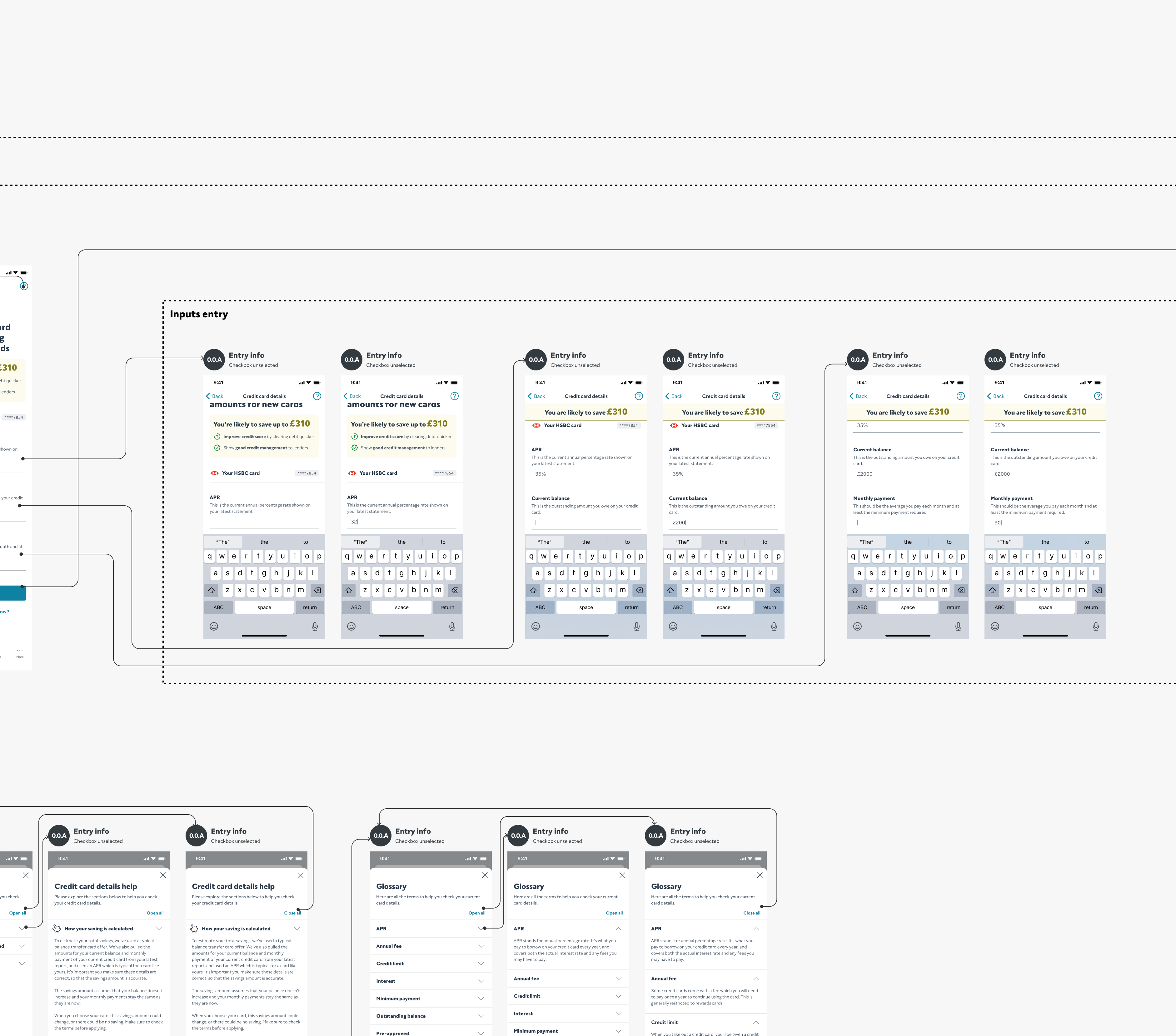

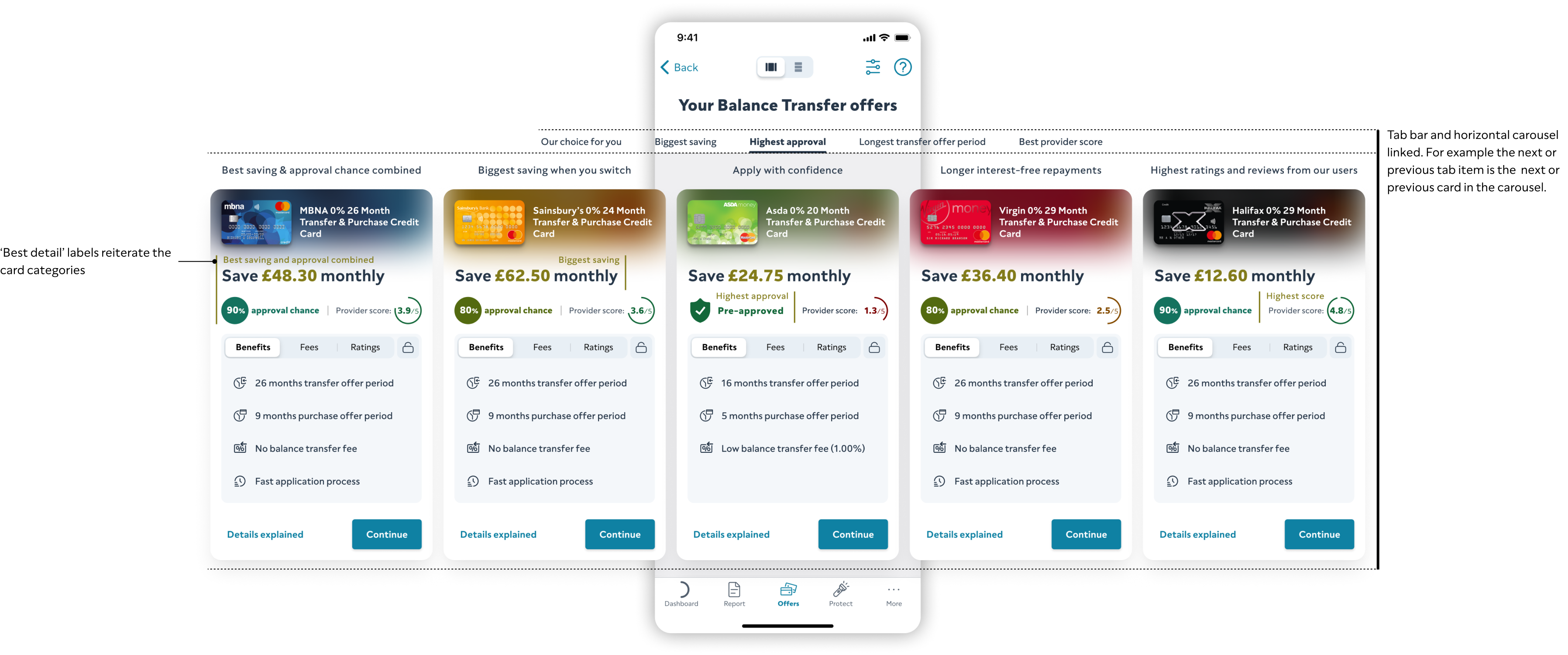

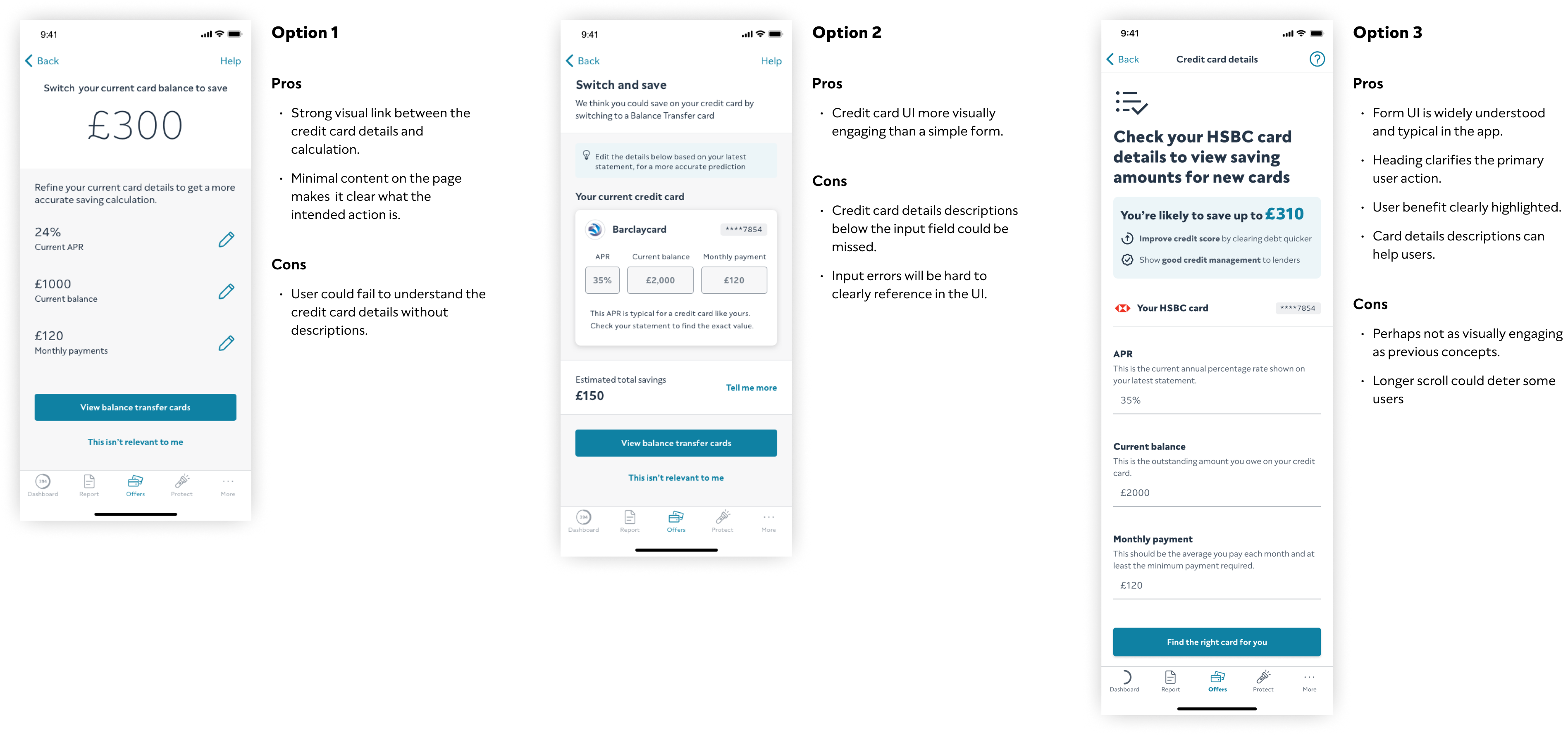

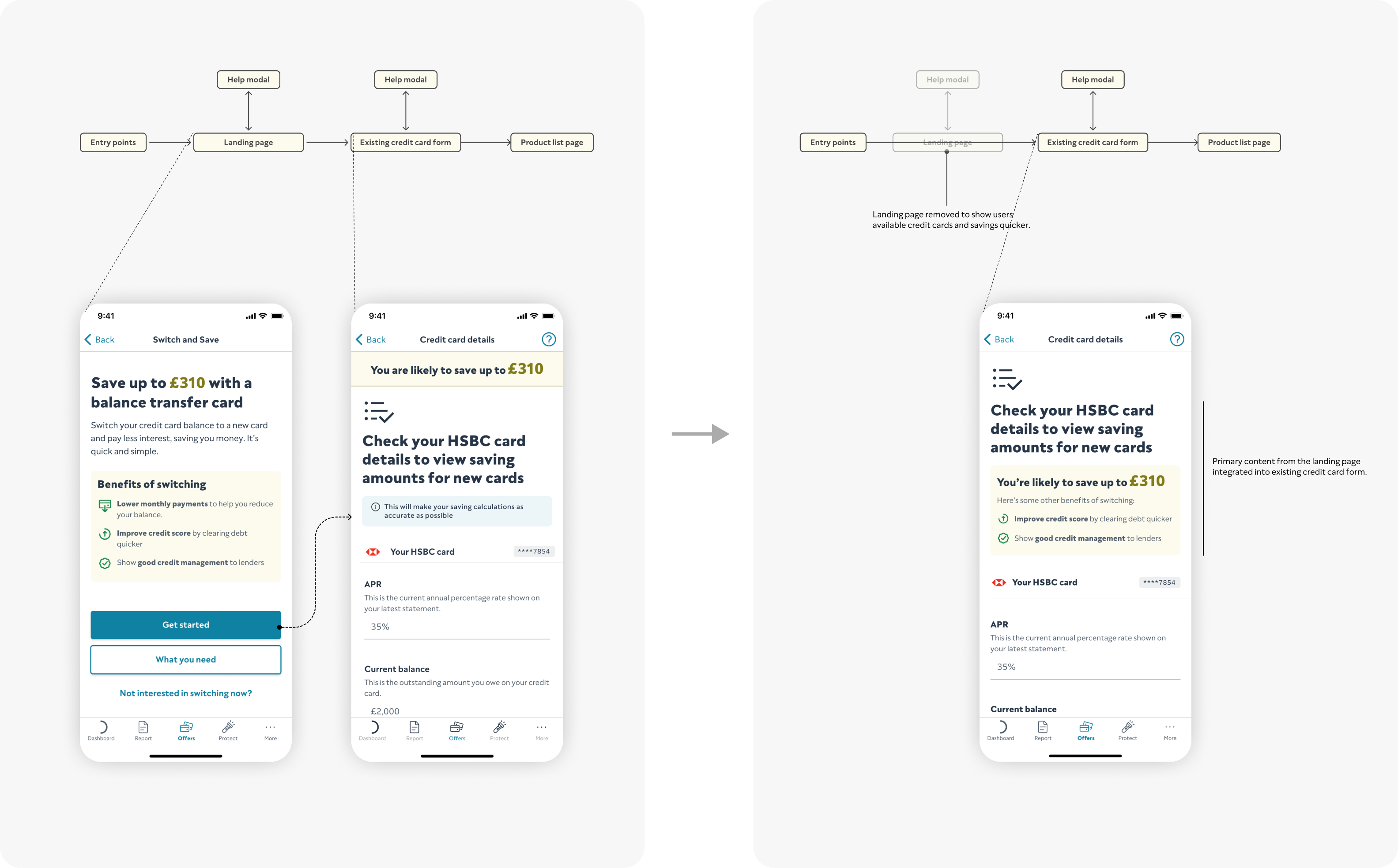

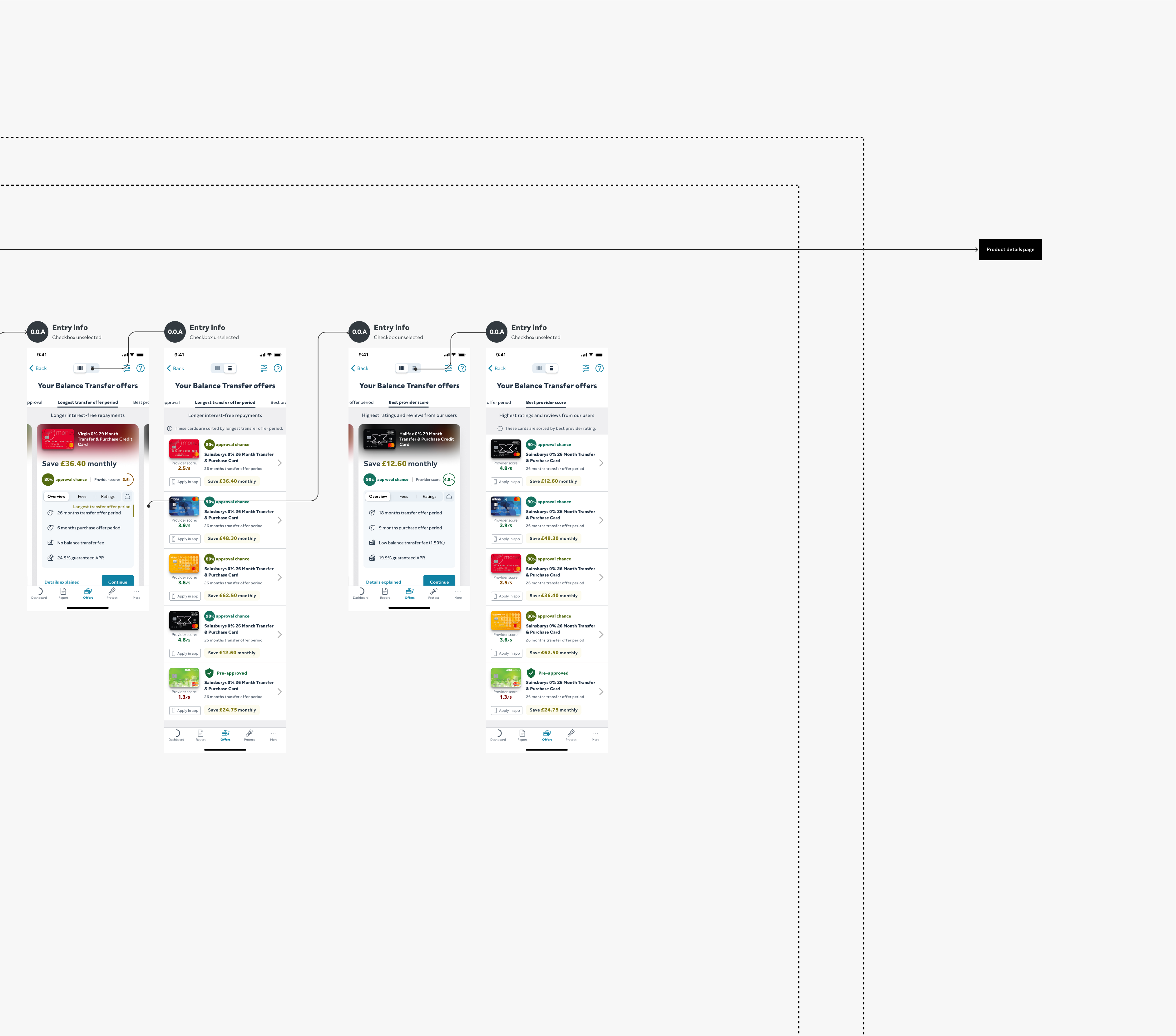

UI options

Capturing users existing credit card details

develop

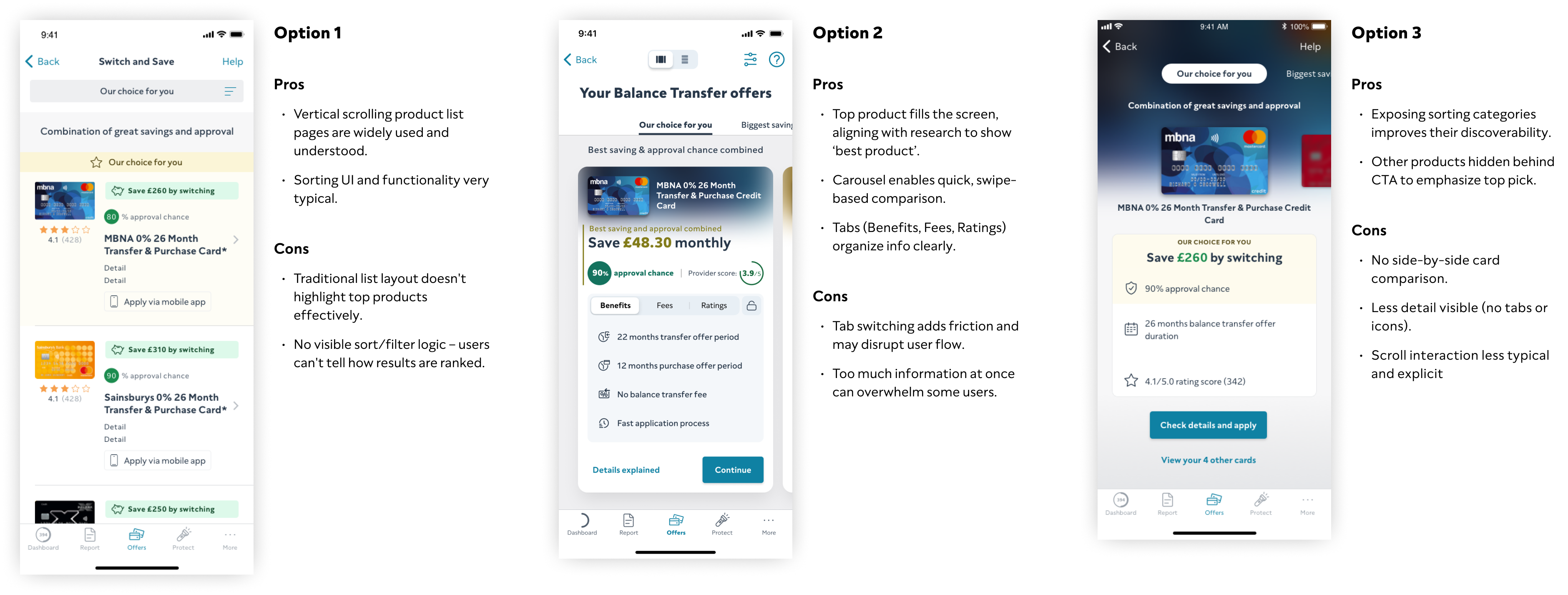

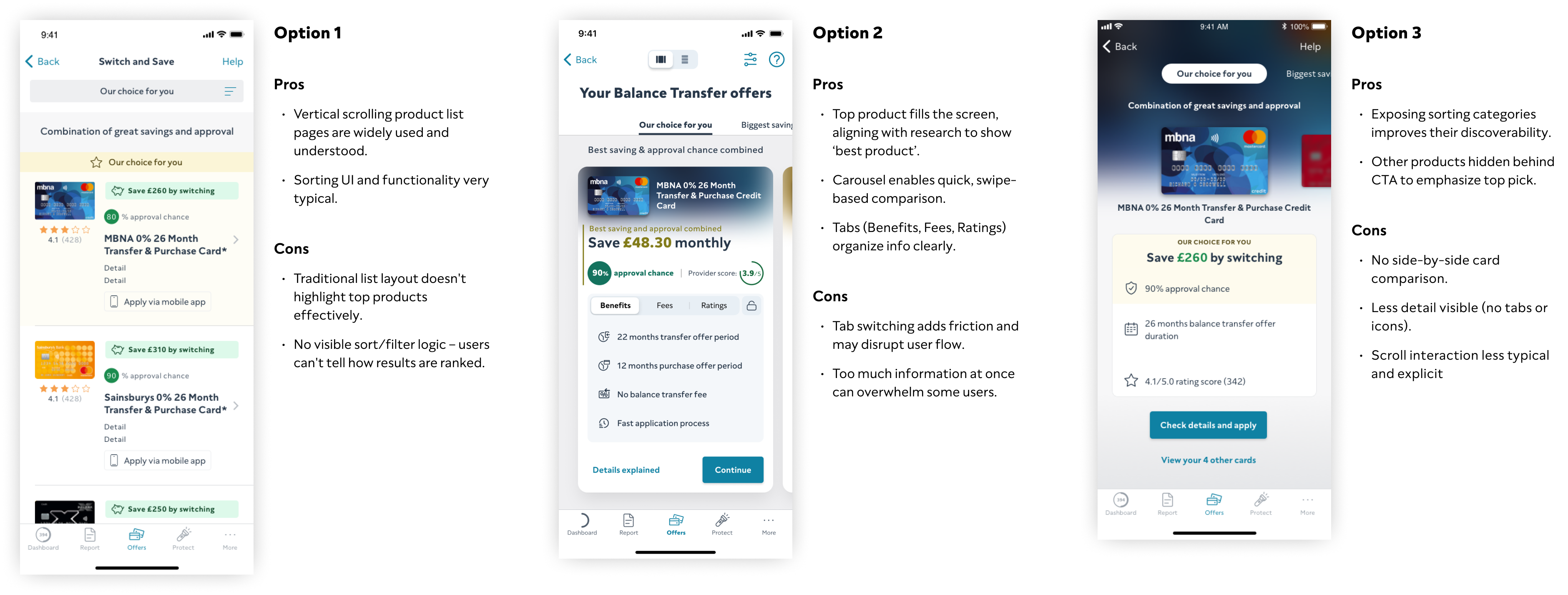

UI options

Displaying users new credit card options

develop

Design stage 4 OF 4

Deliver

Now the chosen solution was brought to life by building, testing, and refining it to ensure it works for our users and the business.

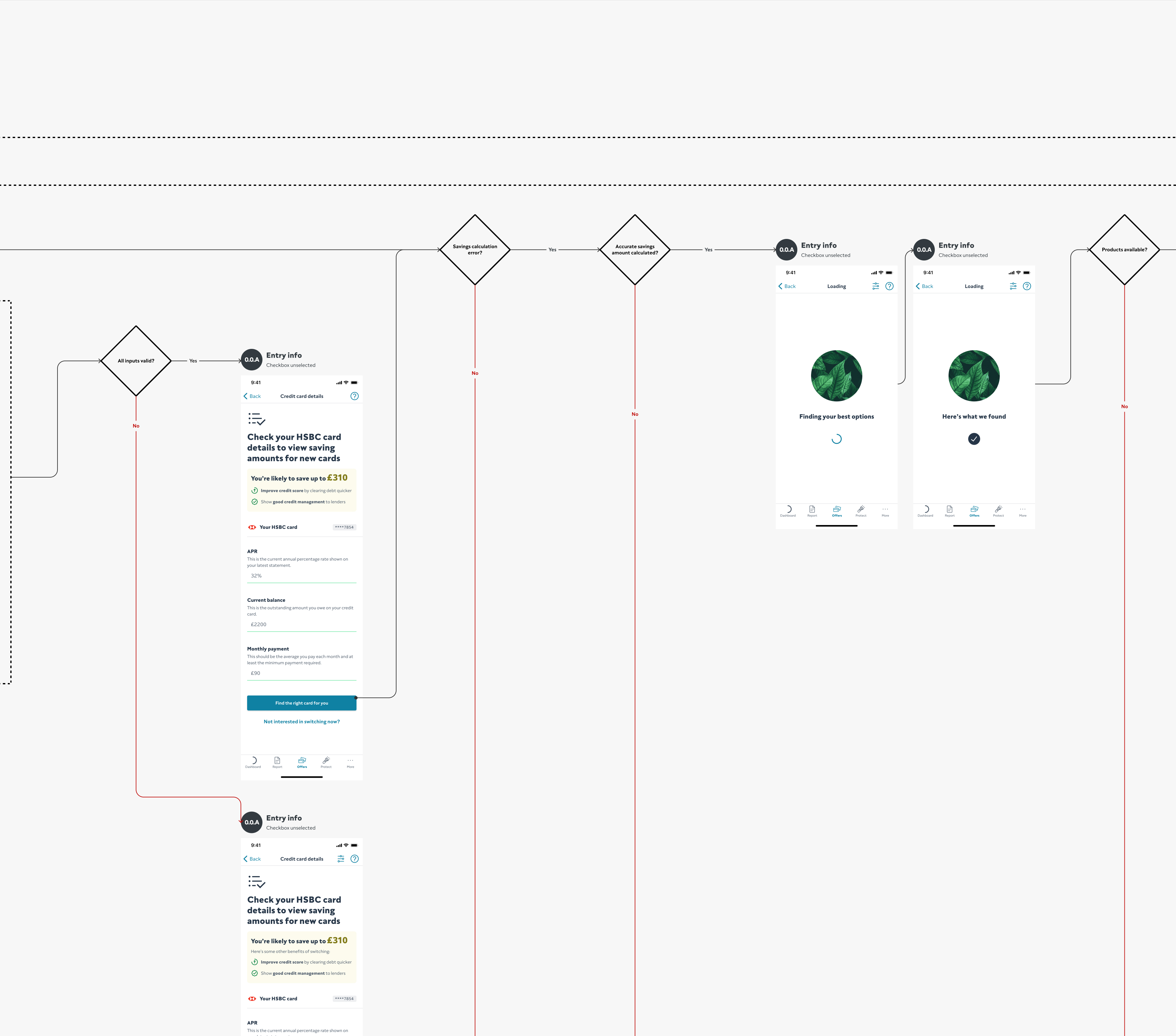

Funnel analytics

First release

deliver

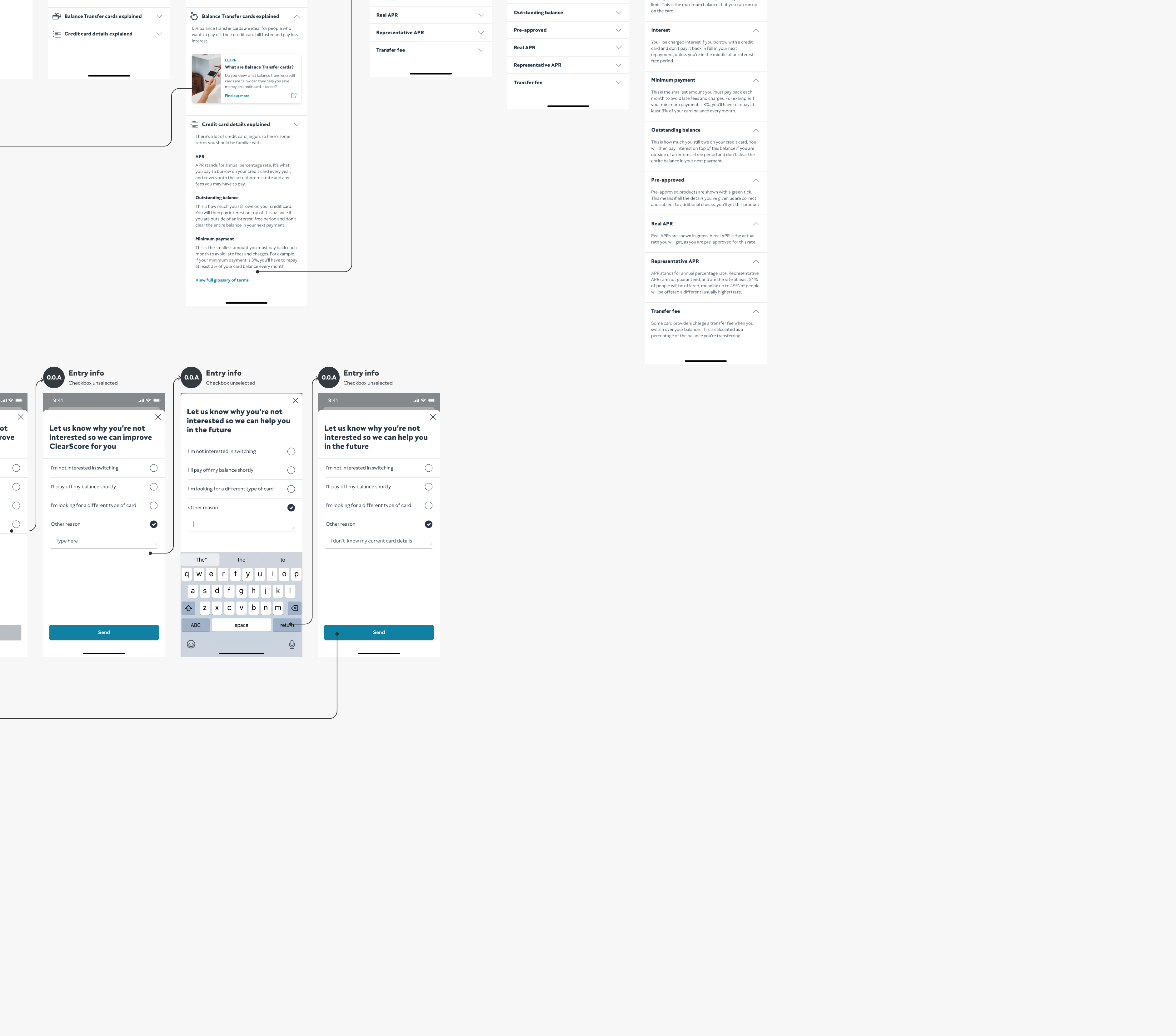

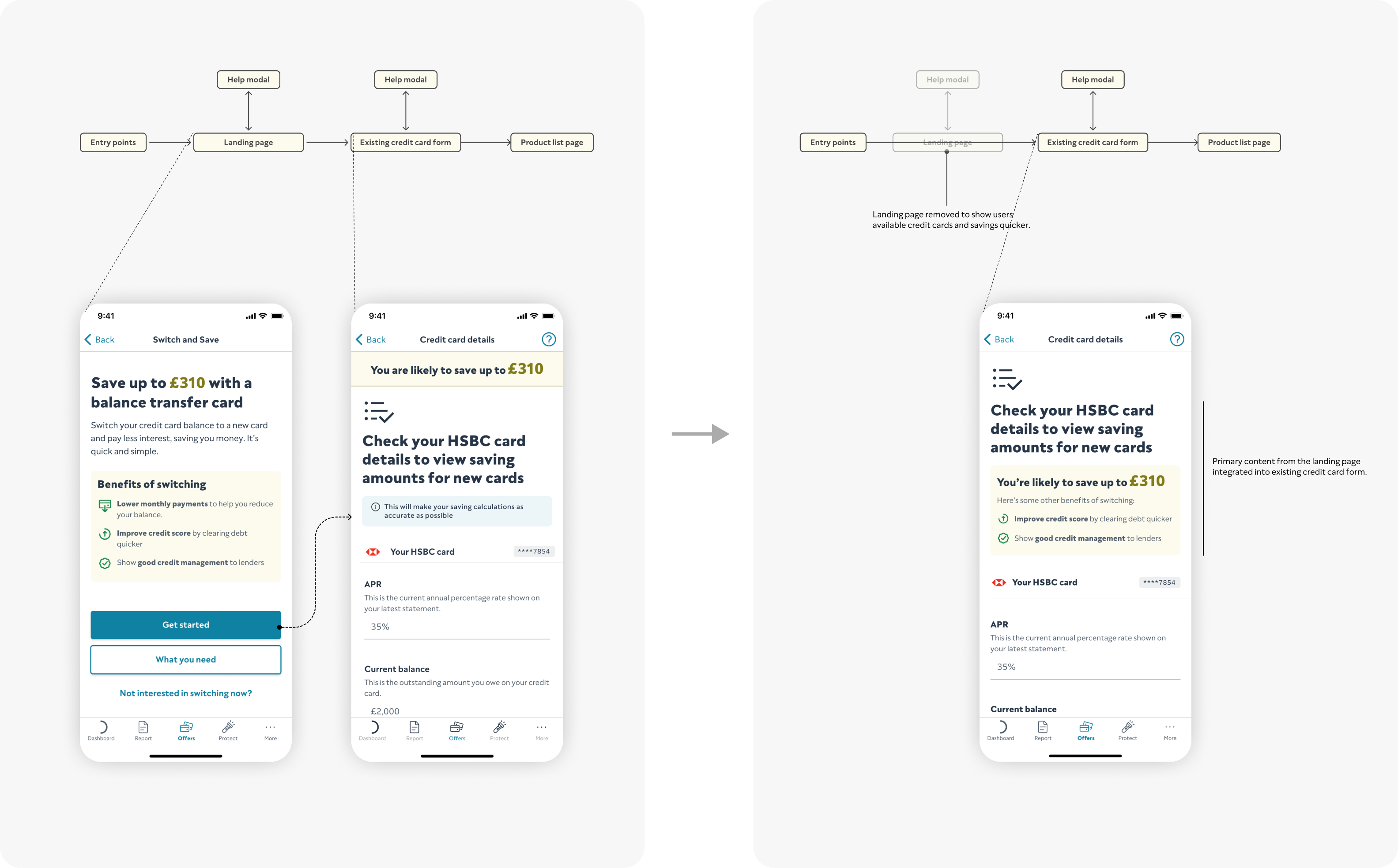

Data Led Design Iteration

deliver

Funnel Analytics

Second release

deliver

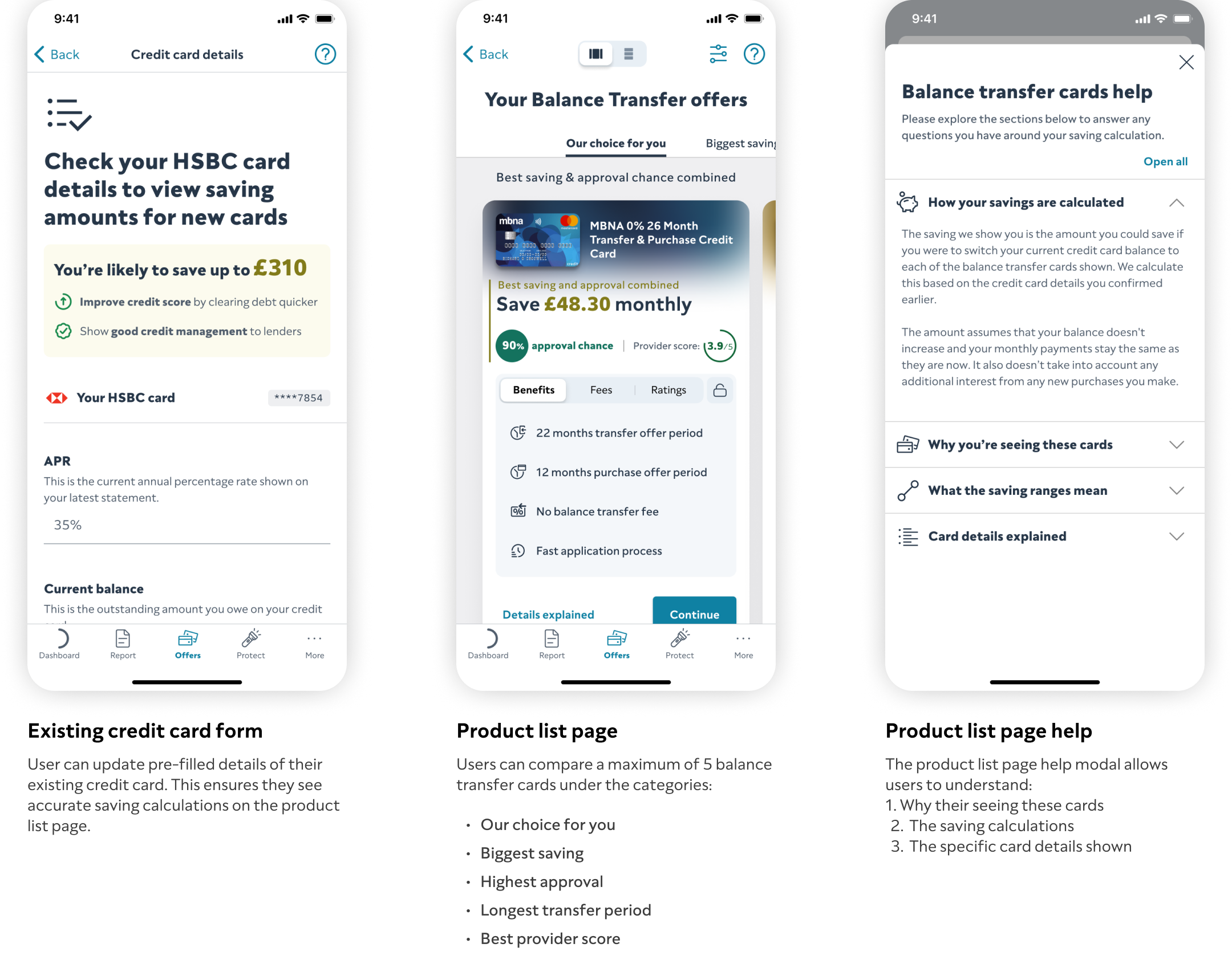

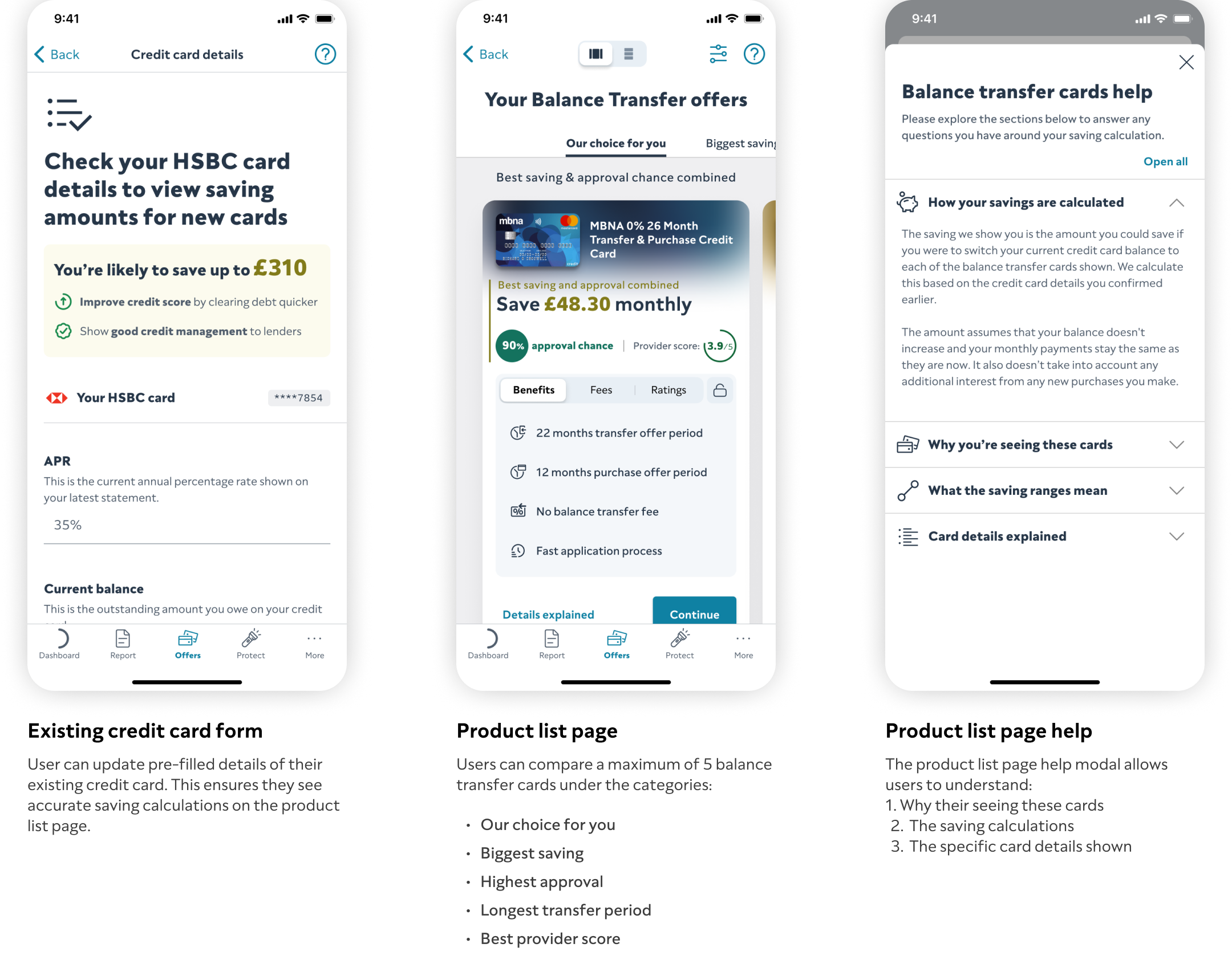

Key Scree

deliver

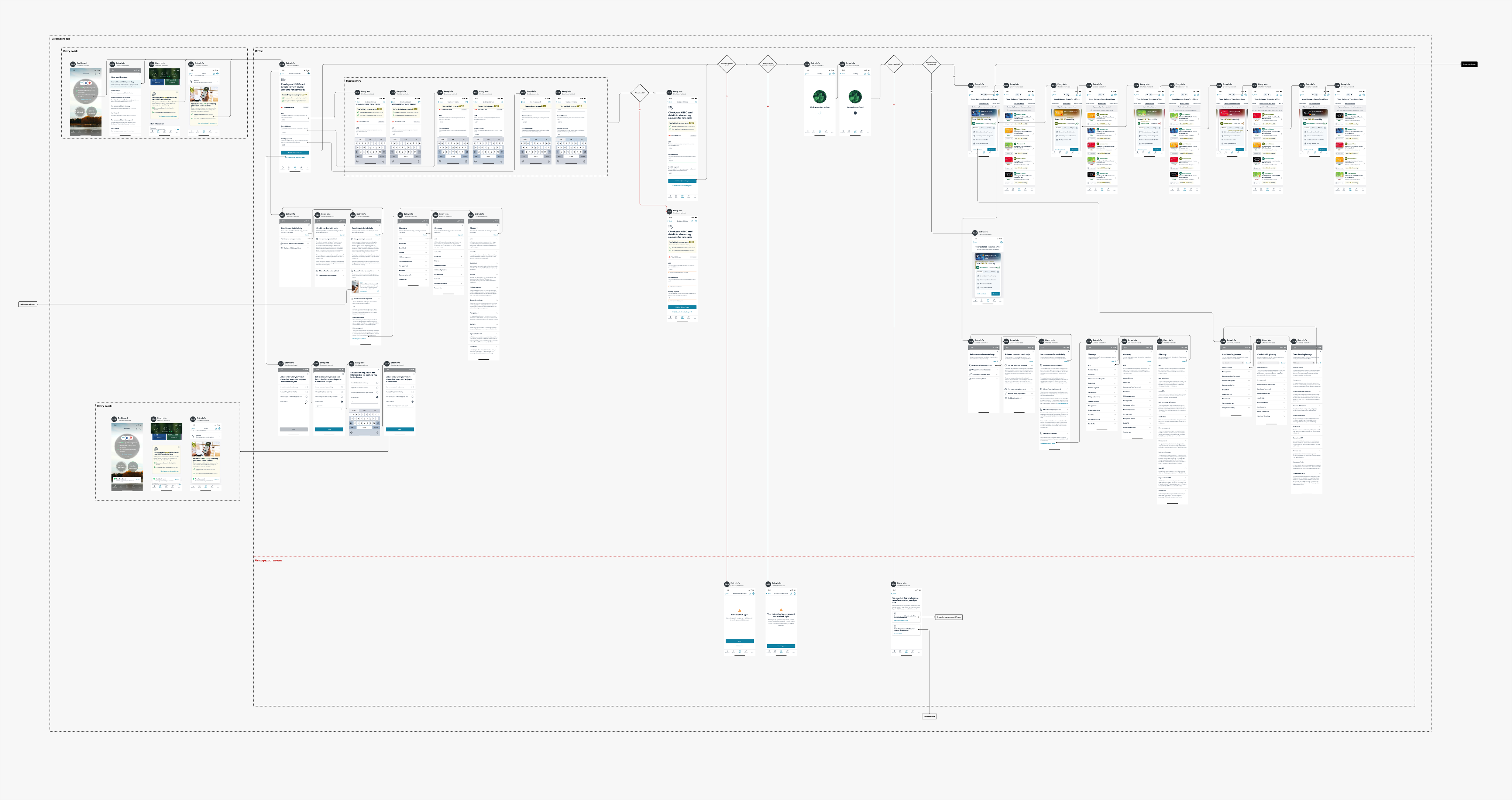

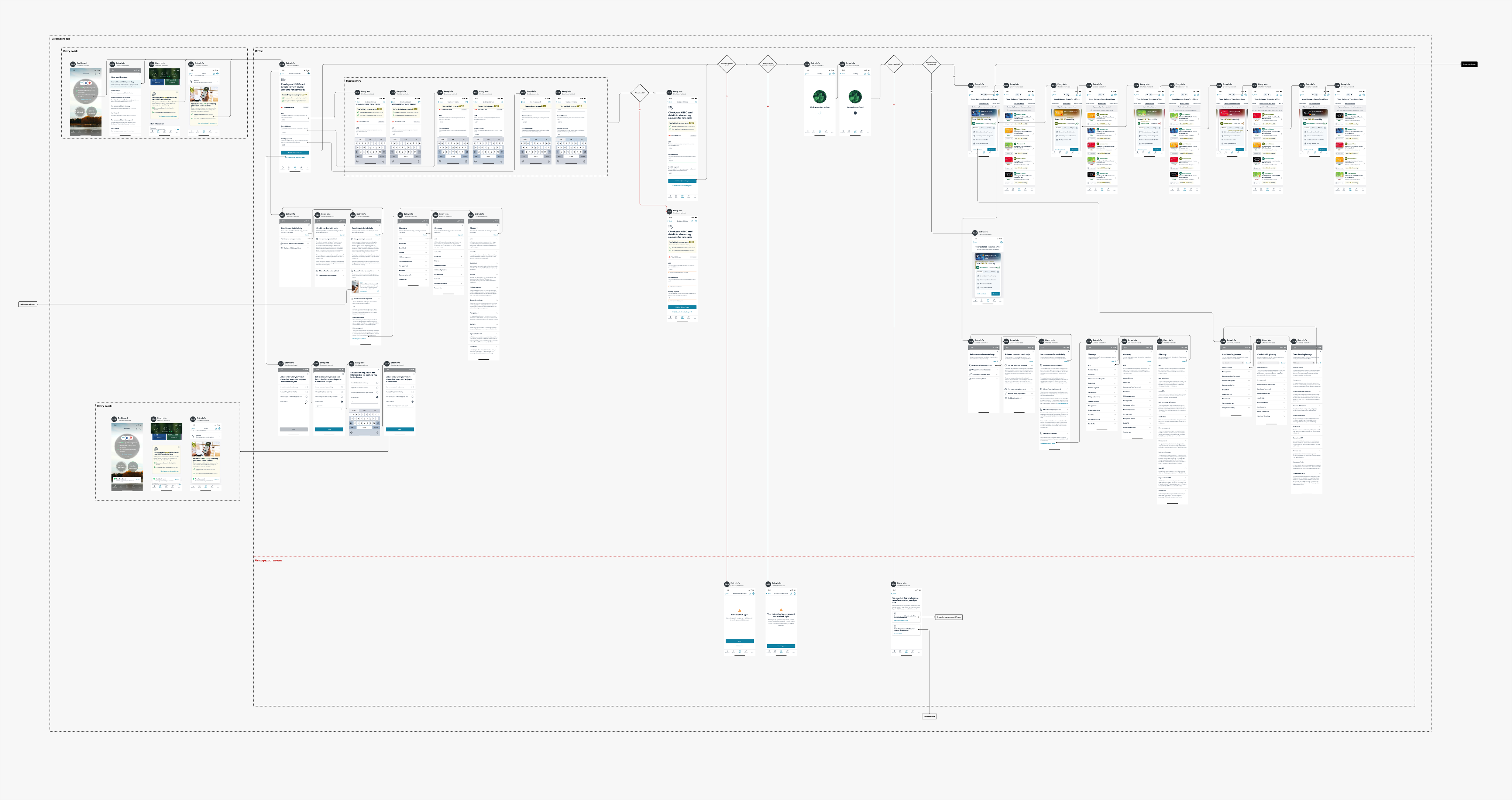

Screen Flow Diagram

deliver

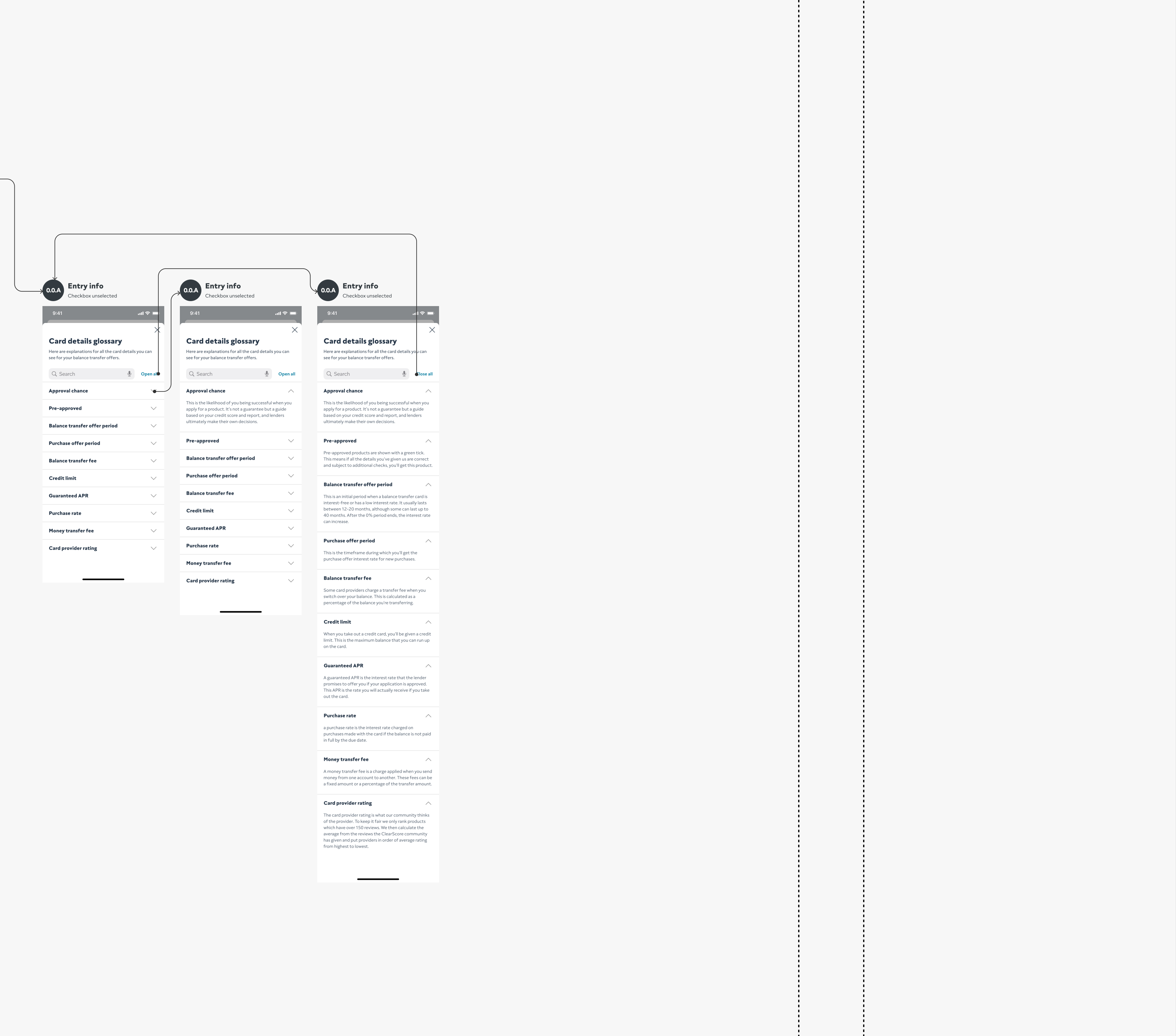

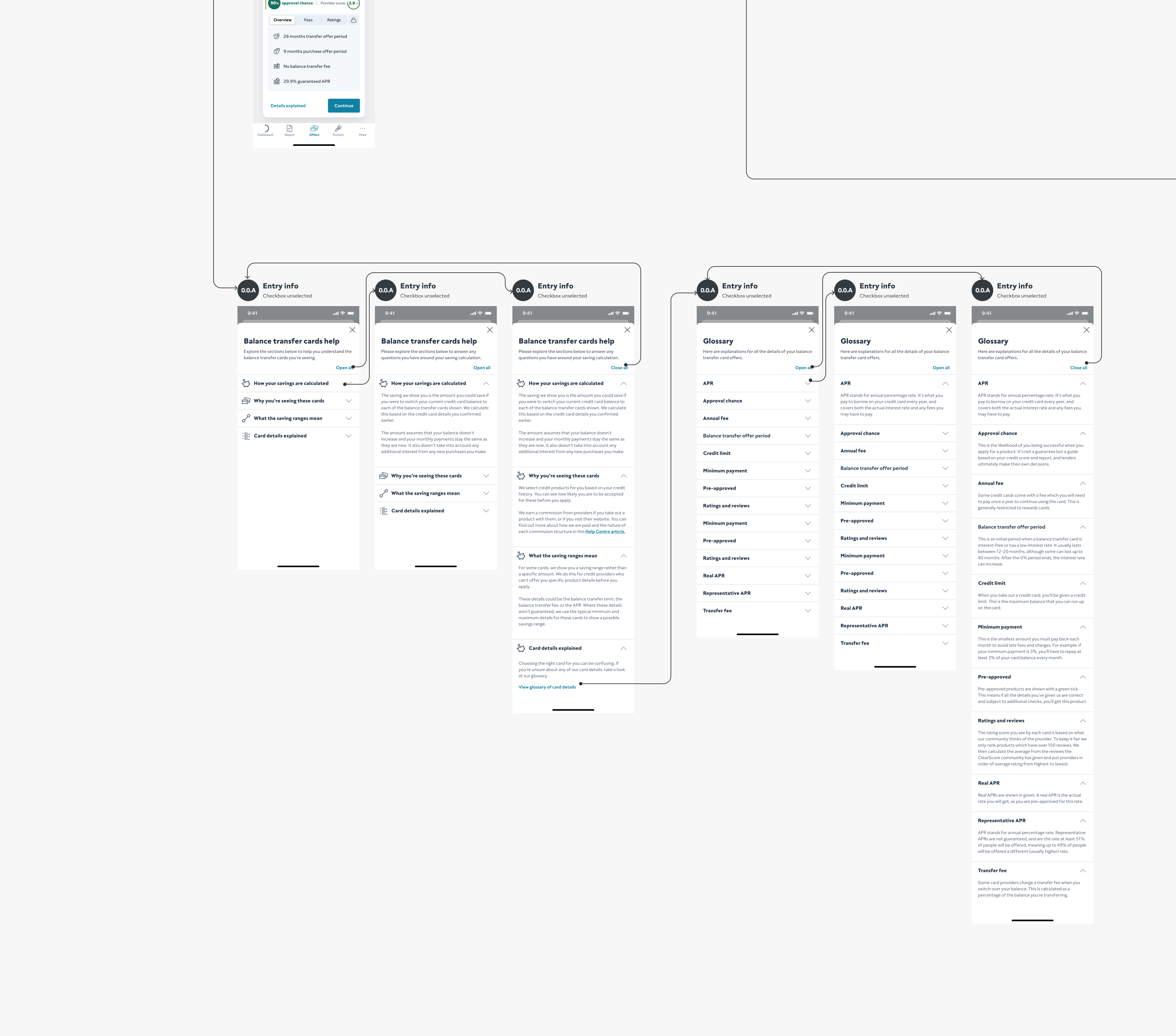

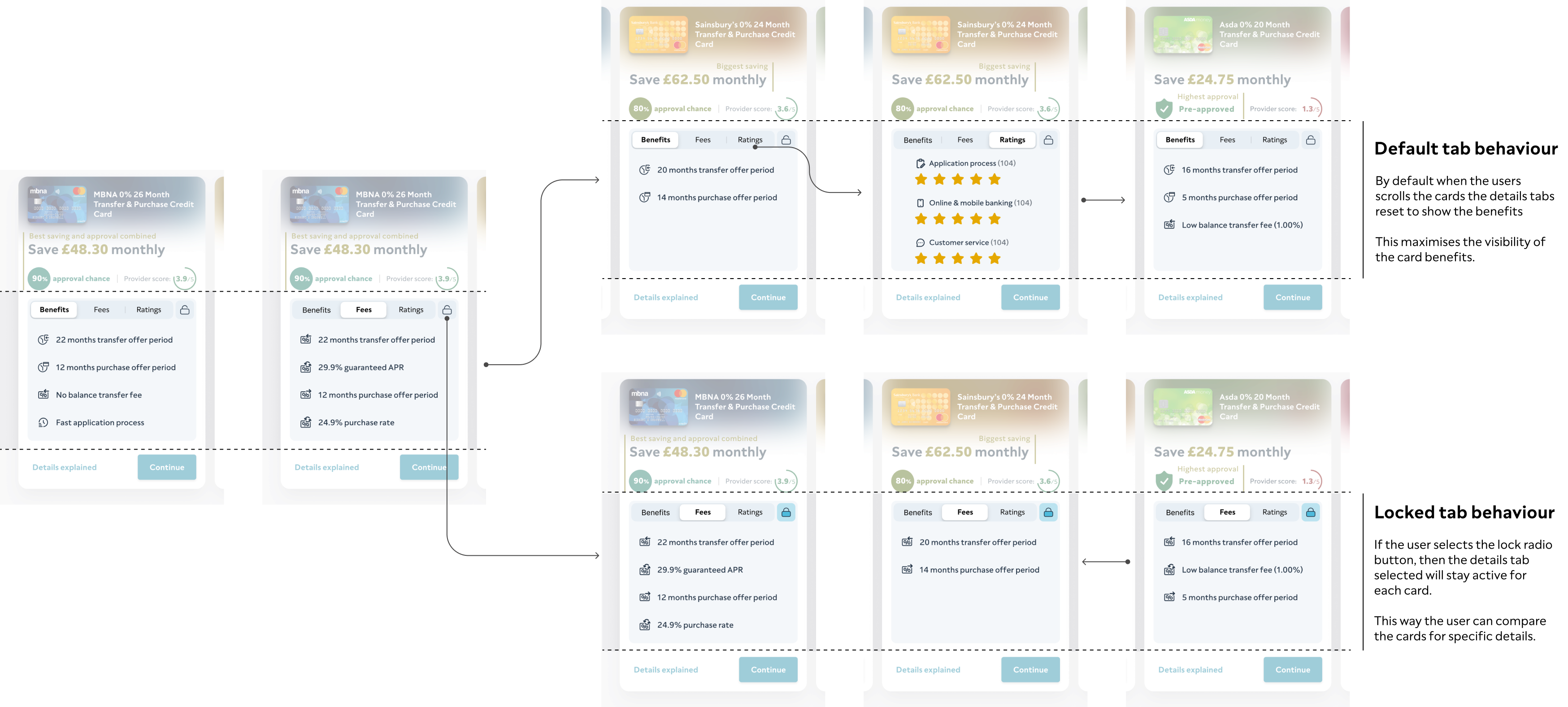

Component Design

Viewing credit cards by categories

deliver

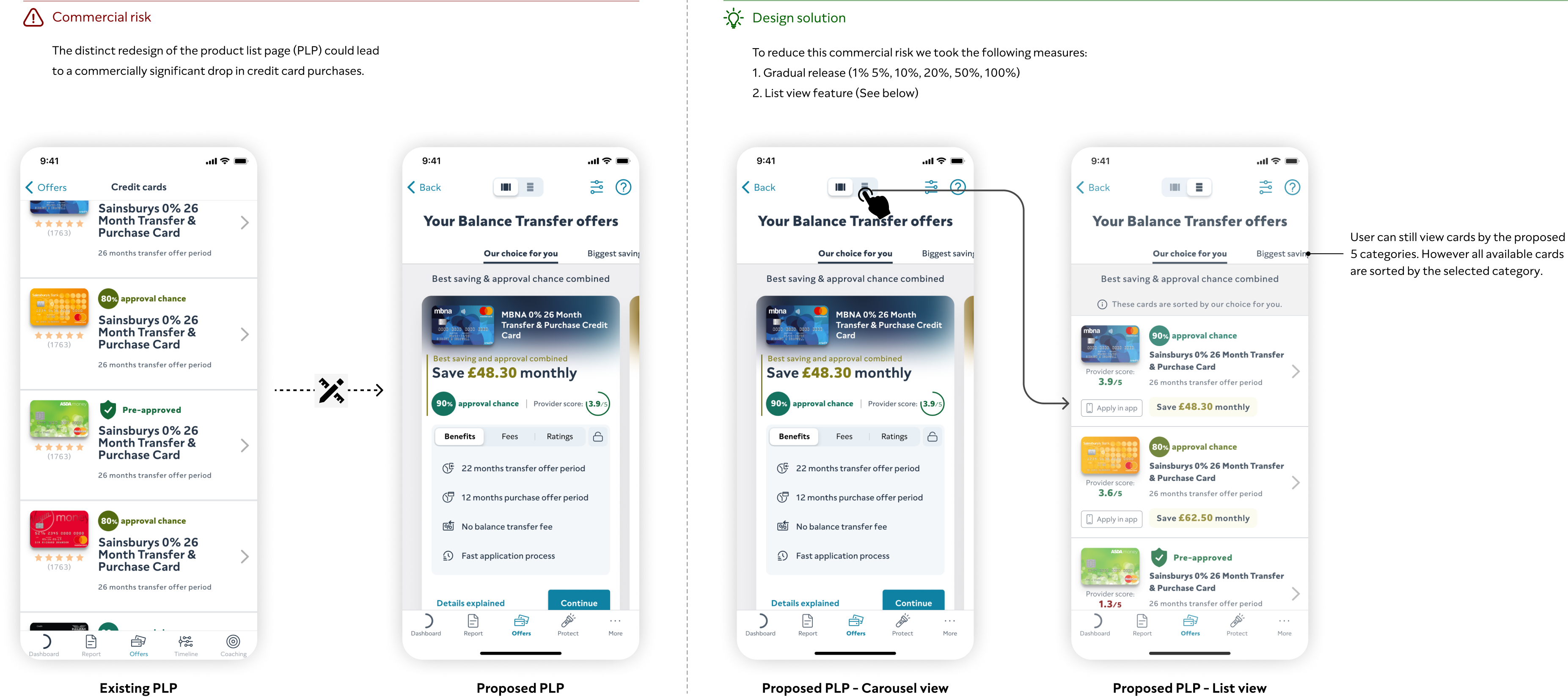

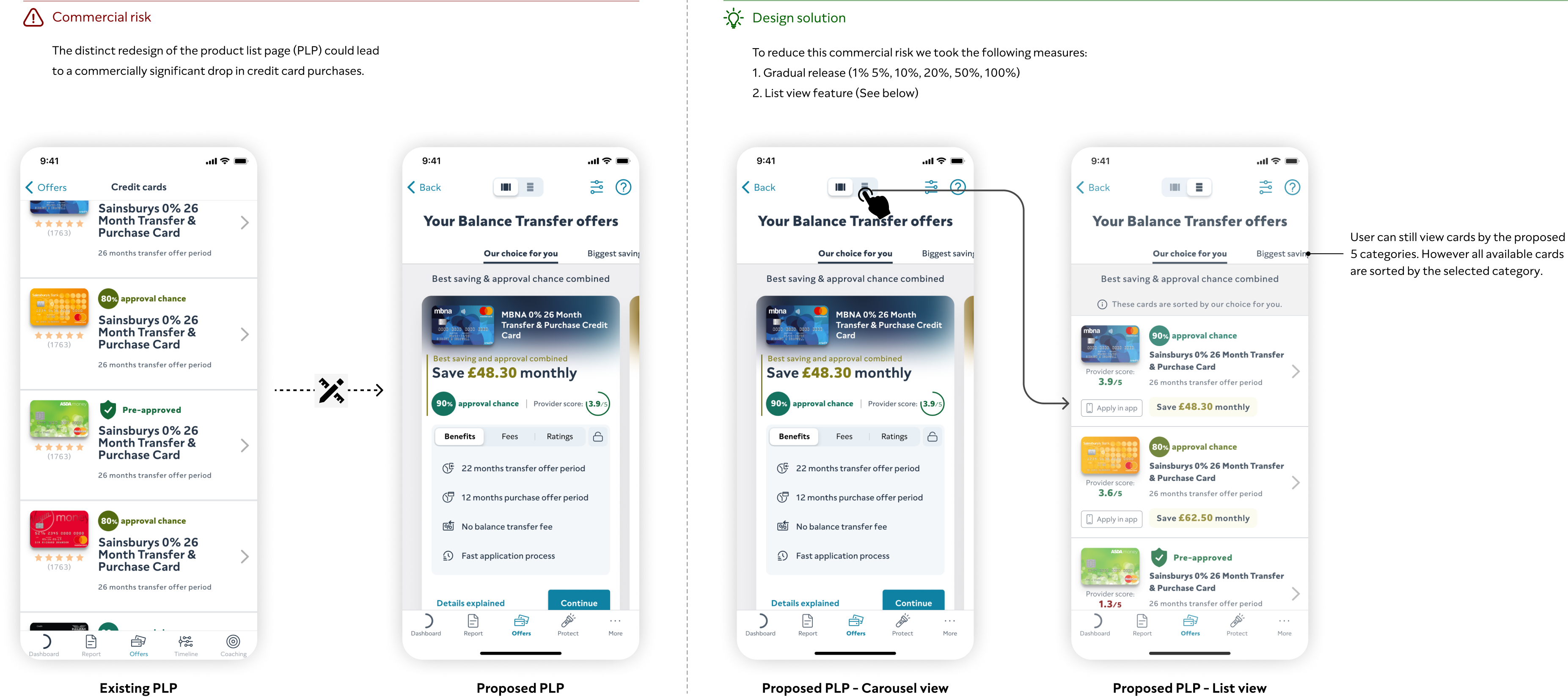

Designing for Commercial Risk

deliver

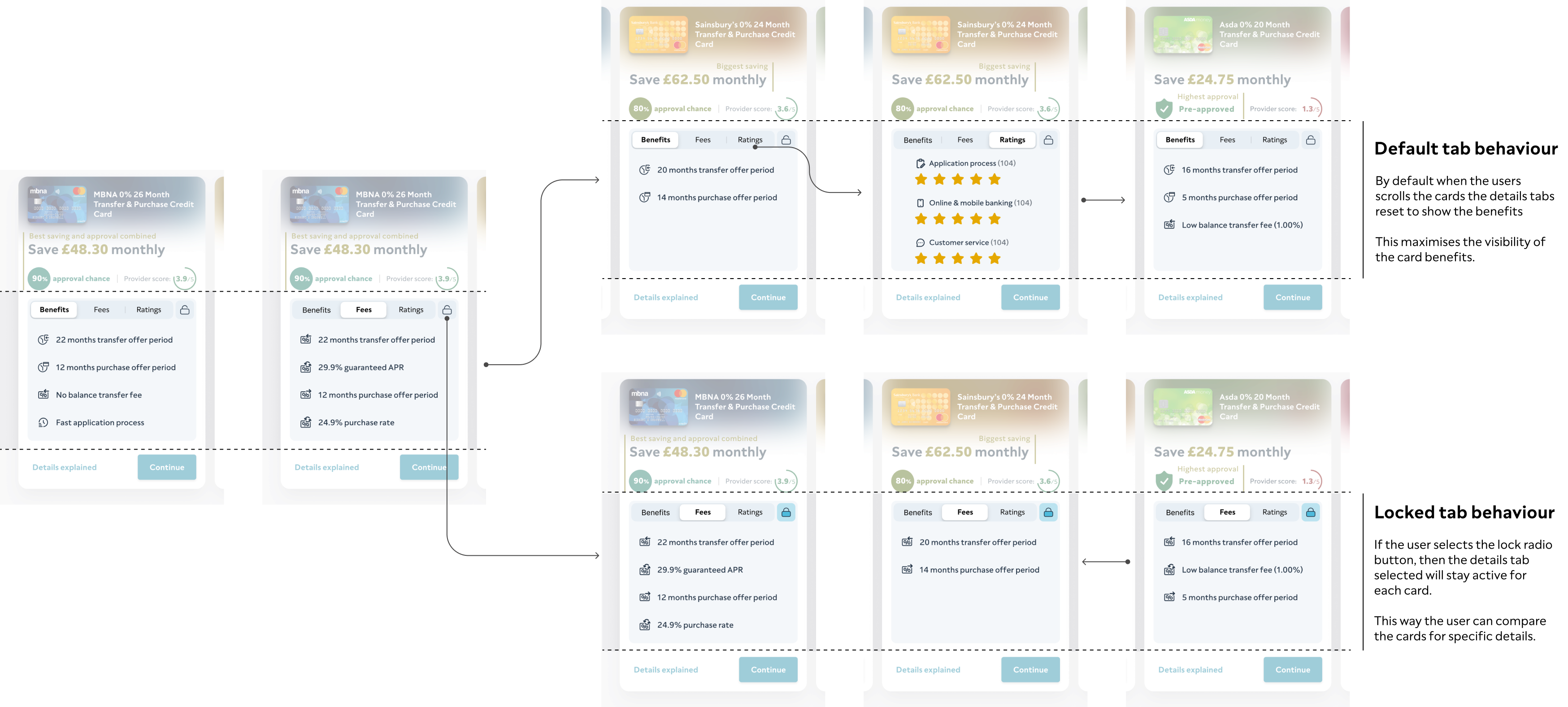

Component Design

Viewing & comparing credit card details

deliver

Prototype

DISCOVER

Success analytics

deliver

Total number of user to apply through switch & save (in first 54 days)

1,471

Average calculated saving per apply click (in first 54 days)

£1,137

Estimated Total saving made for our users

(in first 54 days)

£1,672,527

If you like what you see — Don’t be a stranger! ...

o.hardisty@me.com

Switch

& Save

Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

overhead title

Detail

overhead title

Detail

overhead title

Detail

overhead title

Detail

Context & problem statement

Context

A large majority of users carry over balances on their credit cards, often paying high interests on this debt.

We’ve calculated that we could help save ~£200M across our users if they switched their credit cards to balance transfer cards available in our marketplace.

Users don’t currently know how much they could save with a balance transfer card and so are less motivated to switch.

‘Assumed’ user problem

Users with outstanding credit card balances often pay high interest without realising they could save by switching to balance transfer cards.

This leads to missed savings and low motivation to switch while managing their debt.

Existing relevant insights

- Over 231,000 users could save £576 on average by switching to a balance transfer card.

- Previous optimisations around ‘switching and saving’ have performed well.

- Personalised messaging always outperforms generic messages

Goals & Objectives

User value goals

- Delivering real savings by helping users reduce interest payments.

- Educate users on balance transfer benefits.

- Highlight personalised savings for users.

Business value goals

- Increasing card conversions from the marketplace.

- Boost engagement with balance transfer offers.

Success metrics

Metrics are measured against analytics from the live app.

Success

Ok

Fail

Percentage of users that apply from the new product list page

> 10%

7-10%

< 7%

Percentage of eligible users that start the new journey

> 10%

7-10%

< 7%

Target Audience

Requirements

- Users we predict can save above £100 by switching to a balance transfer card.

- Users with at least a 70% chance of approval for the balance transfer card.

- Users that have revolved a balance for the last 3 months.

- Active & semi-active users (logged in within the last 6 months)

- Users who are not flagged to be on a 0% promotional rate

- Users with credit score above 300.

Personas

ClearScore has 6 personas — 4 of these are a target audience for this project and described below:

Money Maker - Maria

High earner with strong credit, rarely uses ClearScore.

Growth Phase - Grace

Busy working mum, tech-savvy and credit confident.

Mutual Resources - Mike

Older self-employed user, focused on clearing debt, uses ClearScore occasionally.

Deal Seeker - Deepak

Budget-savvy dad, always hunting for savings, uses ClearScore often.

Design Requirements

- Savings Calculation

• Show real-time savings using actual card data (APR, balance, payment).• Only calculate after eligible cards are returned.

- API Integration UX

• Trigger panel search via partner APIs. • Handle delays with smooth loading/progress indicators.

- Pre-condition Logic

• Require Offers flow completion (30-day + credit card). • Integrate into journey as needed.

- In-App Entry Points

• Add entry points from dashboard, cards tab, or credit report. • Target users with card debt or interest.

- Existing credit card input

• Allow editing of card details (APR, balance, payment).

- Results Presentation

• Show savings for top 1, 3, or all eligible cards. • Include APR, terms, eligibility, example. • Link to product pages.

- Unhappy Path

• Fallback if no savings or BT cards. • Suggest next steps or alternatives.

Design stage 1 OF 4

Discover

Our initial problem statement was based on the saving calculation and success of related optimisations. So needed to know users thoughts about switching or why users are not saving on their interest payments.

Assumed Problem Insights

DISCOVER

Research Topics Gathering

DISCOVER

Research Prioritisation

Importance knowledge matrix

DISCOVER

Top Priority Research Delegation

DISCOVER

Research Questions & Goals

DISCOVER

Persona Prioritisation

DISCOVER

Design stage 2 OF 4

Define

We needed to refine the numerous research findings into the most relevant insights and a thorough problem definition to start ideating from.

Unstructured Research Findings

Define

Findings Themes

Define

Key Research Insights

Insight 1

Personalised savings must be made clear and tangible

Users are more likely to switch when they clearly see how much they personally will save, presented at the moment they’re comparing options, rather than generic or abstract savings claims.

Insight 2

Educational gaps undermine switching confidence

When users don’t understand switching steps or terminology early in the journey, uncertainty builds and even motivated users hesitate or drop off.

Insight 3

Too many card options lead to decision paralysis

Large lists of similar offers overwhelm users during comparison, making it harder to choose and increasing indecision and abandonment.

Insight 4

Confidence in eligibility drives switching action

Users are more willing to apply when they feel confident they’ll be approved; fear of rejection or credit impact causes them to avoid offers, even when eligible.

‘Researched’ user problem

ClearScore users with credit card debt who are open to switching often feel uncertain and overwhelmed when exploring options in the app.

Unclear savings, a confusing process, and low confidence in approval prevent them from switching, even when it could reduce costs and interest payments.

Design stage 3 OF 4

Develop

With key insights identified and the problem defined, I started developing solutions – from the user flow through to conceptual UI.

User Needs, Epics & Stories

develop

User flow options

develop

Chosen User Flow

develop

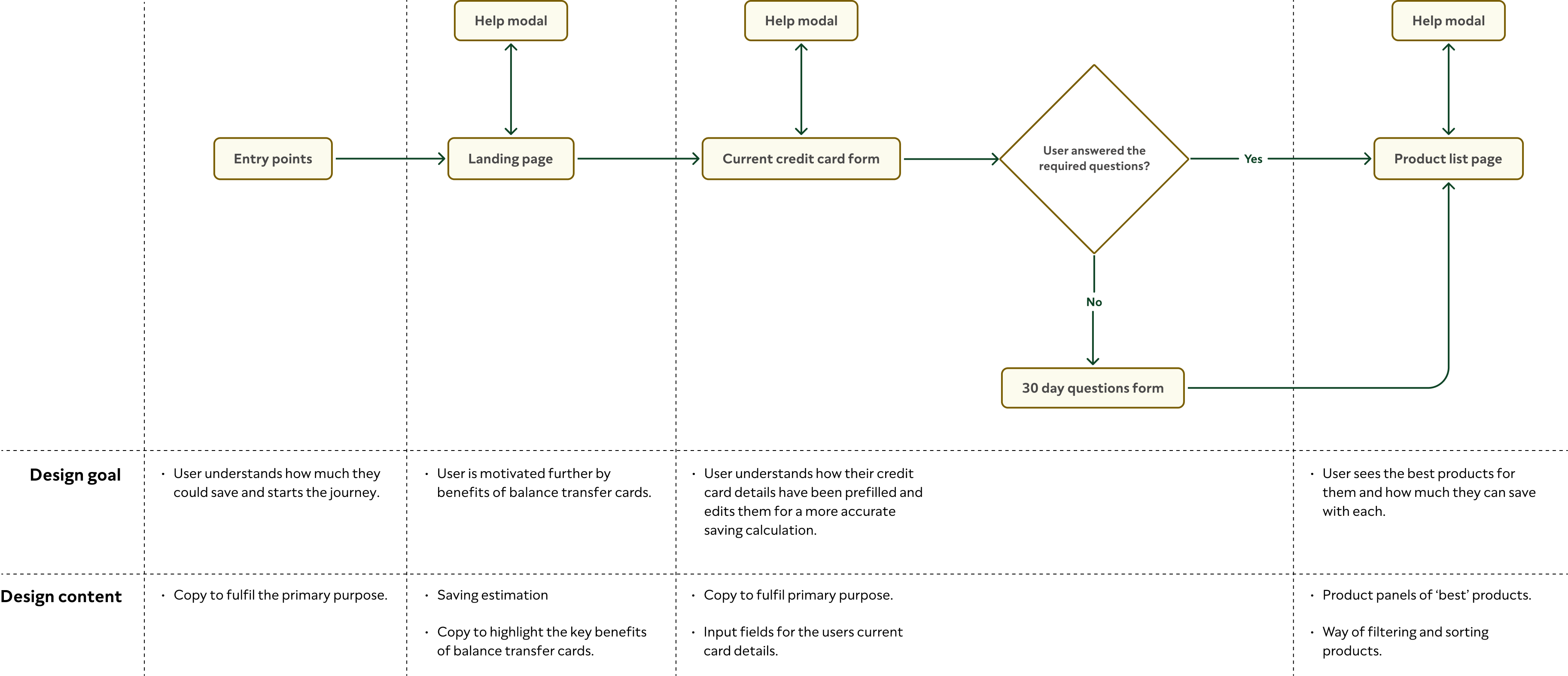

UI options

Capturing users existing credit card details

develop

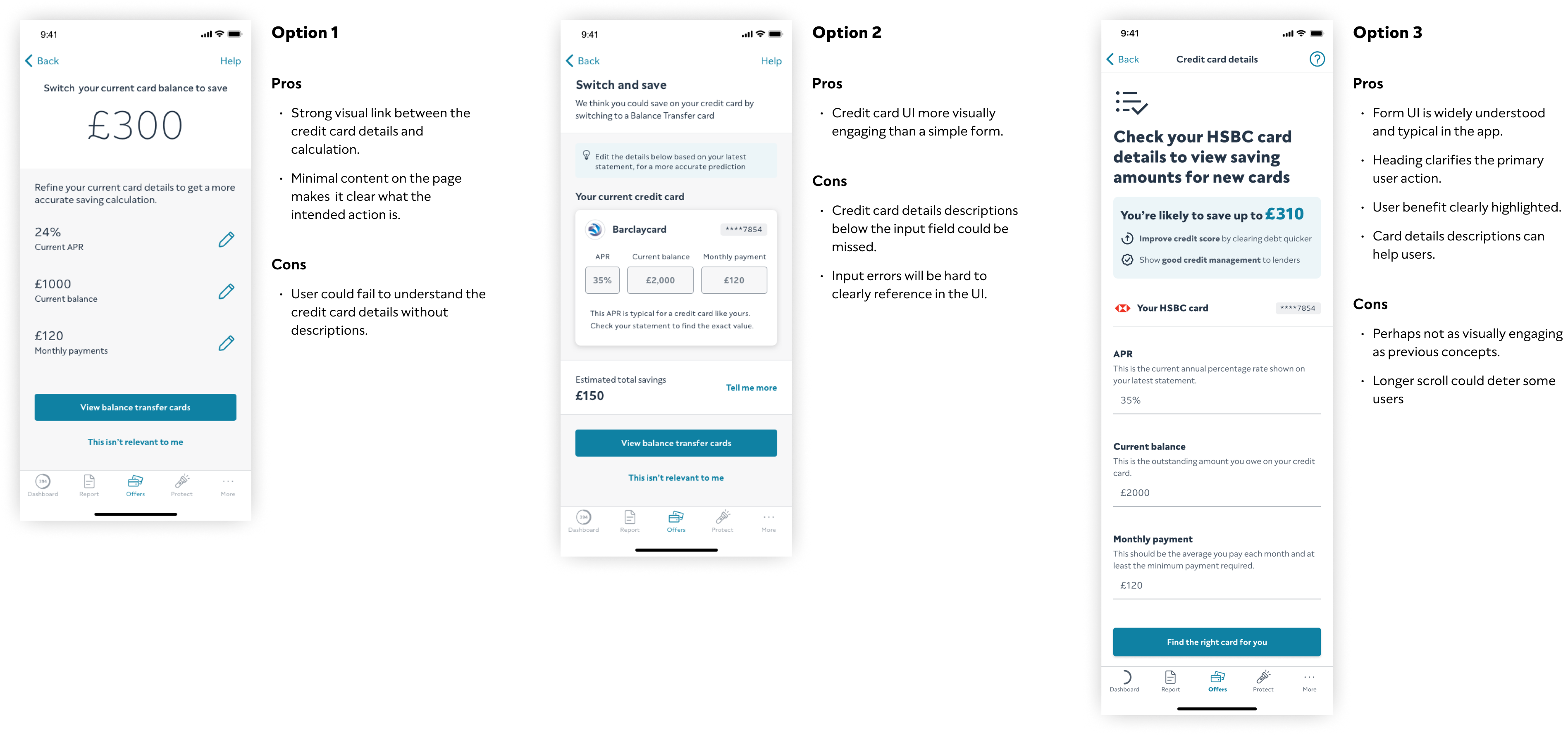

UI options

Displaying users new credit card options

develop

Design stage 4 OF 4

Deliver

Now the chosen solution was brought to life by building, testing, and refining it to ensure it works for our users and the business.

Funnel analytics

First release

deliver

Data Led Design Iteration

deliver

Funnel Analytics

Second release

deliver

Screen Flow Diagram

Hover over the flow to zoom to the start

deliver

Key Screens

deliver

Component Design

Viewing credit cards by categories

deliver

Designing for Commercial Risk

deliver

Component Design

Viewing & comparing credit card details

deliver

Prototype

DISCOVER

Success analytics

deliver

Total number of user to apply through switch & save (in first 54 days)

1,471

Average calculated saving per apply click (in first 54 days)

£1,137

Estimated Total saving made for our users

(in first 54 days)

£1,672,527

If you like what you see — Don’t be a stranger! ...

o.hardisty@me.com